Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

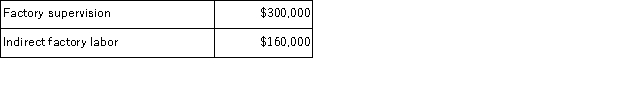

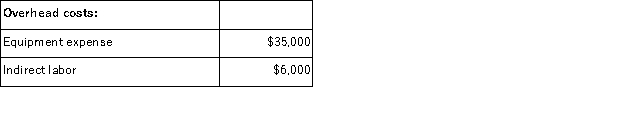

The following data have been provided by Graise Corporation from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much factory supervision and indirect factory labor cost would NOT be assigned to products using the activity-based costing system?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much factory supervision and indirect factory labor cost would NOT be assigned to products using the activity-based costing system?

(Multiple Choice)

4.9/5  (38)

(38)

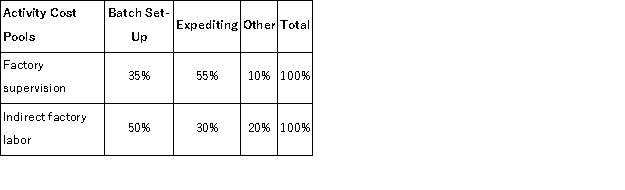

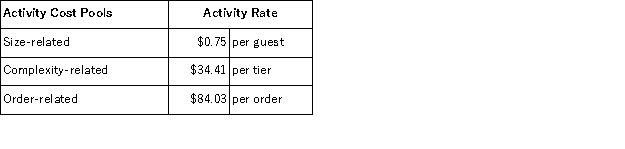

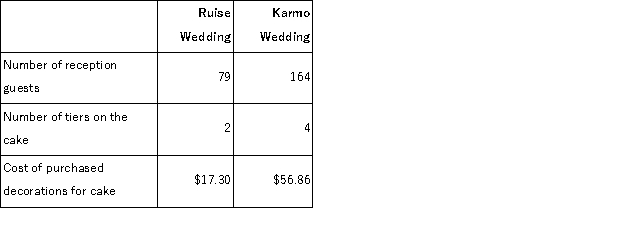

Carsten Wedding Fantasy Corporation makes very elaborate wedding cakes to order.The owner of the company has provided the following data concerning the activity rates in its activity-based costing system:  The measure of activity for the size-related activity cost pool is the number of planned guests at the wedding reception.The greater the number of guests, the larger the cake.The measure of complexity is the number of tiers in the cake.The activity measure for the order-related cost pool is the number of orders.(Each wedding involves one order. )The activity rates include the costs of raw ingredients such as flour, sugar, eggs, and shortening.The activity rates do not include the costs of purchased decorations such as miniature statues and wedding bells, which are accounted for separately. Data concerning two recent orders appear below:

The measure of activity for the size-related activity cost pool is the number of planned guests at the wedding reception.The greater the number of guests, the larger the cake.The measure of complexity is the number of tiers in the cake.The activity measure for the order-related cost pool is the number of orders.(Each wedding involves one order. )The activity rates include the costs of raw ingredients such as flour, sugar, eggs, and shortening.The activity rates do not include the costs of purchased decorations such as miniature statues and wedding bells, which are accounted for separately. Data concerning two recent orders appear below:  Assuming that the company charges $485.85 for the Karmo wedding cake, what would be the overall margin on the order?

Assuming that the company charges $485.85 for the Karmo wedding cake, what would be the overall margin on the order?

(Multiple Choice)

4.7/5  (37)

(37)

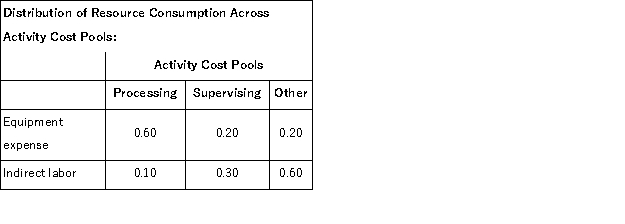

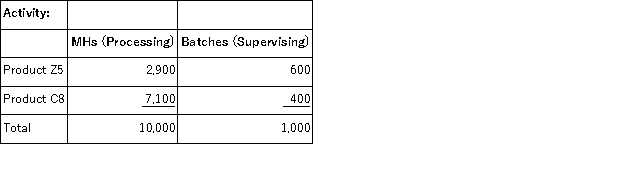

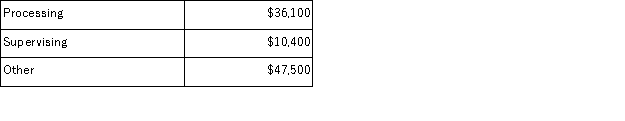

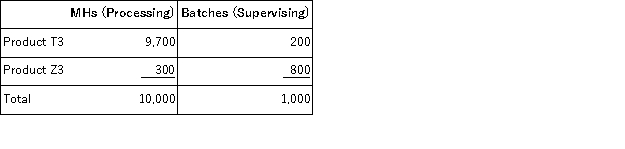

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

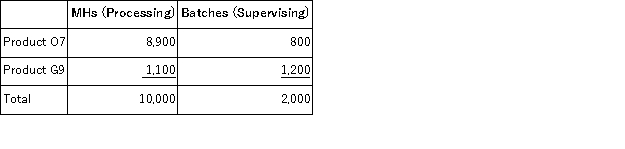

In the second stage, Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  What is the overhead cost assigned to Product Z5 under activity-based costing?

What is the overhead cost assigned to Product Z5 under activity-based costing?

(Multiple Choice)

4.8/5  (39)

(39)

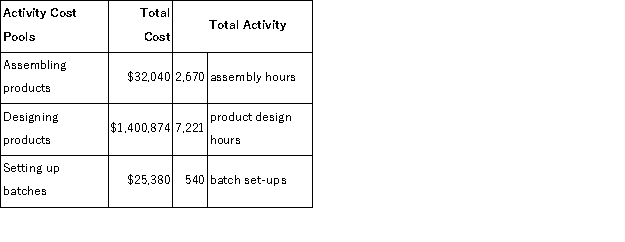

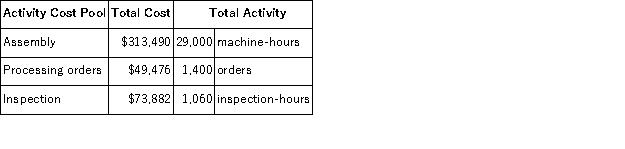

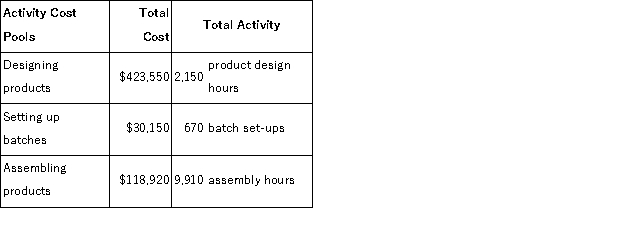

Data concerning three of Falkenstein Corporation's activity cost pools appear below:  Required:

Compute the activity rates for each of the three cost pools.Show your work!

Required:

Compute the activity rates for each of the three cost pools.Show your work!

(Essay)

4.8/5  (39)

(39)

In activity-based costing, nonmanufacturing costs are not assigned to products.

(True/False)

4.7/5  (35)

(35)

The costs of idle capacity should be assigned to products in activity-based costing.

(True/False)

4.8/5  (33)

(33)

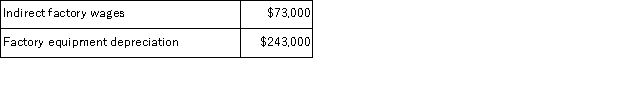

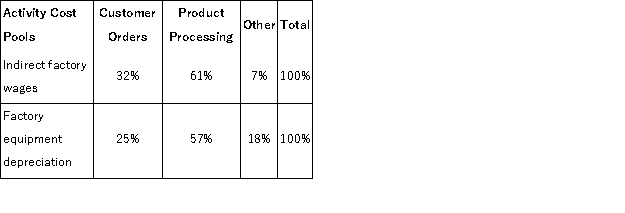

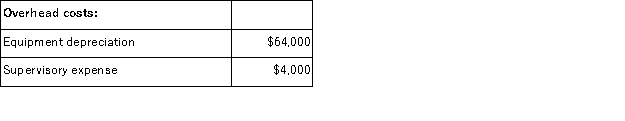

Schulenburg Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.Show your work!

b.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.Show your work!

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.Show your work!

b.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.Show your work!

(Essay)

4.9/5  (39)

(39)

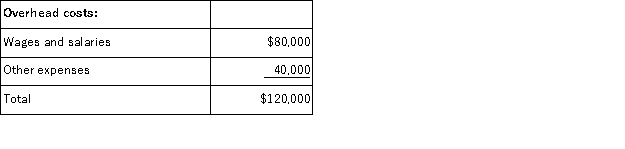

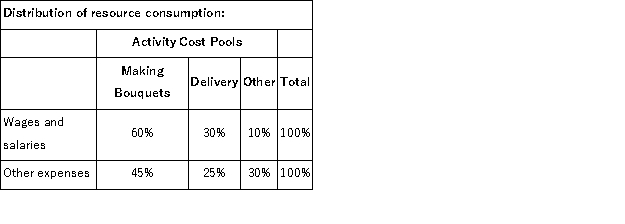

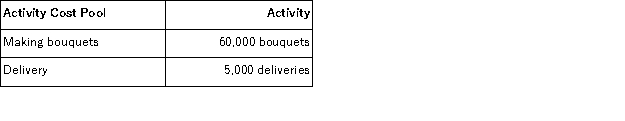

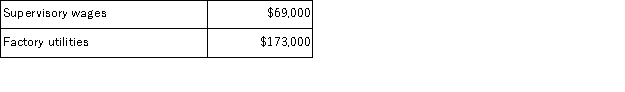

Forse Florist specializes in large floral bouquets for hotels and other commercial spaces.The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:  What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round to the nearest whole cent. )

What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round to the nearest whole cent. )

(Multiple Choice)

4.8/5  (35)

(35)

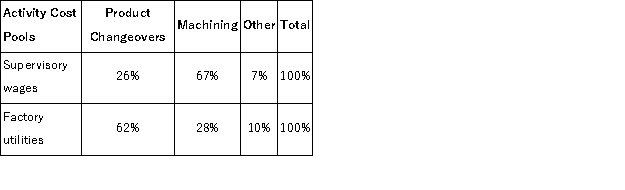

The following data have been provided by Kilmartin Corporation from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Machining activity cost pool.Show your work!

b.Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.Show your work!

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Machining activity cost pool.Show your work!

b.Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.Show your work!

(Essay)

4.9/5  (40)

(40)

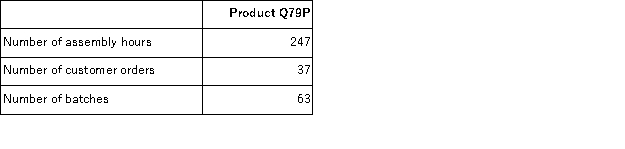

Bera Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

(Multiple Choice)

4.8/5  (46)

(46)

The practice of assigning the costs of idle capacity to products results in more stable unit product costs.

(True/False)

4.8/5  (40)

(40)

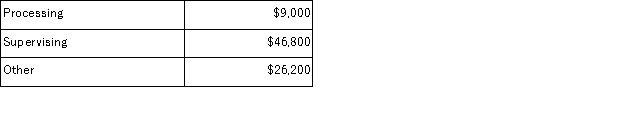

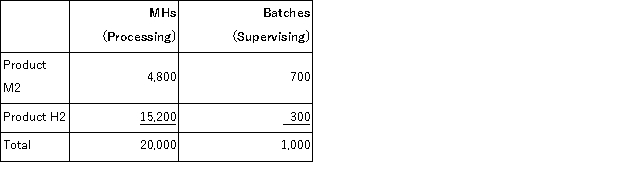

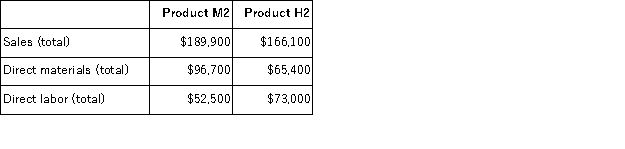

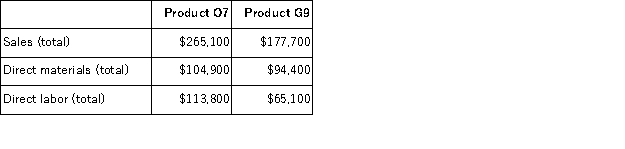

Zumbrunnen Corporation uses activity-based costing to compute product margins.Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other.The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:

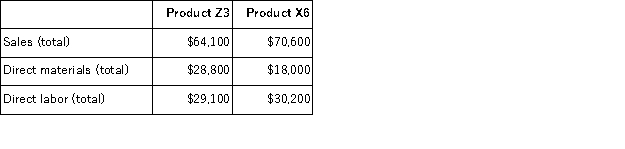

Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

Belsky Corporation has provided the following data from its activity-based costing system:  The company makes 490 units of product Q19S a year, requiring a total of 1, 080 machine-hours, 60 orders, and 20 inspection-hours per year.The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:

The company makes 490 units of product Q19S a year, requiring a total of 1, 080 machine-hours, 60 orders, and 20 inspection-hours per year.The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:

(Multiple Choice)

4.7/5  (34)

(34)

Koutz Corporation uses activity-based costing to compute product margins.Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other.The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:

Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (29)

(29)

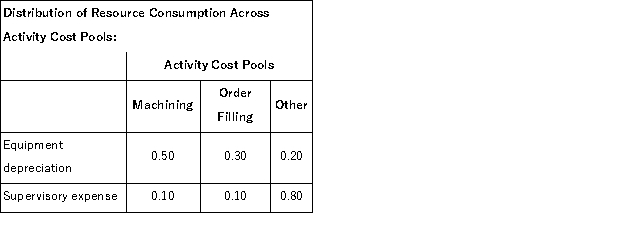

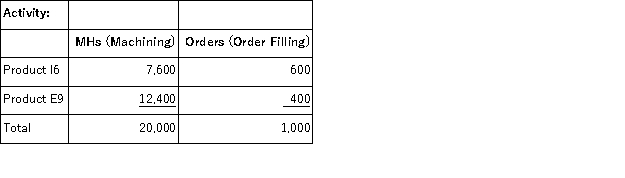

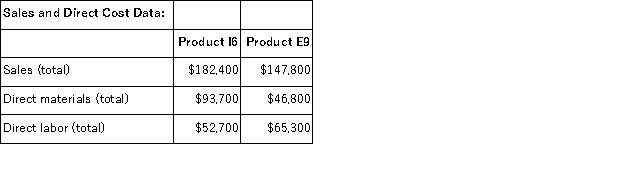

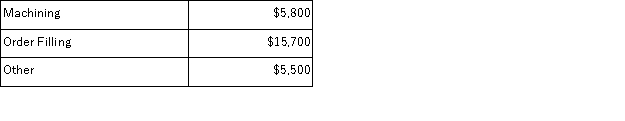

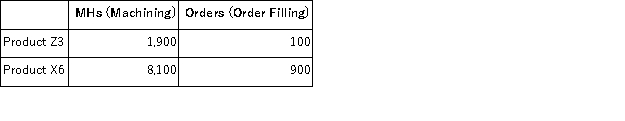

Vontungeln Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

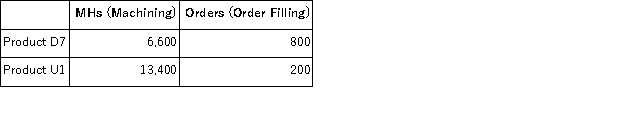

In the second stage, Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.

In the second stage, Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.  What is the overhead cost assigned to Product I6 under activity-based costing?

What is the overhead cost assigned to Product I6 under activity-based costing?

(Multiple Choice)

4.9/5  (43)

(43)

The labor time required to assemble a product is an example of a(n):

(Multiple Choice)

4.8/5  (34)

(34)

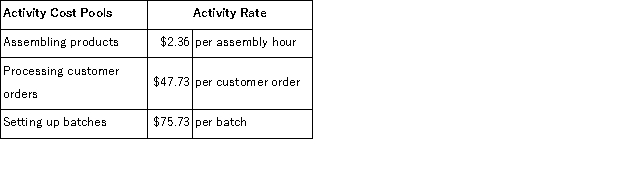

Malan Corporation has provided the following data from its activity-based costing accounting system:  Required:

Compute the activity rates for each of the three cost pools.Show your work!

Required:

Compute the activity rates for each of the three cost pools.Show your work!

(Essay)

4.9/5  (29)

(29)

Glassey Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20, 000;Supervising, $33, 500;and Other, $16, 500.Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  What is the overhead cost assigned to Product T3 under activity-based costing?

What is the overhead cost assigned to Product T3 under activity-based costing?

(Multiple Choice)

4.8/5  (34)

(34)

Munar Corporation uses activity-based costing to compute product margins.Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other.The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:

Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.  The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

Schwering Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $20, 800;Order Filling, $30, 400;and Other, $48, 800.Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (39)

(39)

Showing 41 - 60 of 145

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)