Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

A transaction driver provides a measure of the amount of time required to perform an activity.

(True/False)

4.8/5  (33)

(33)

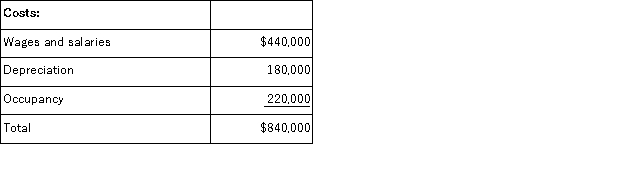

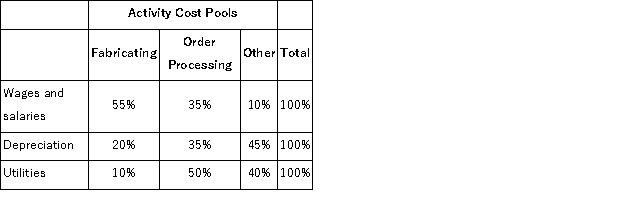

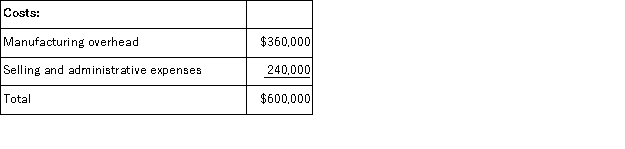

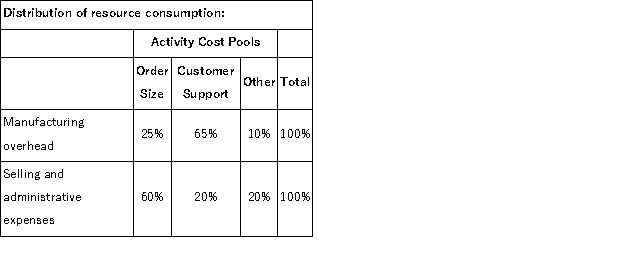

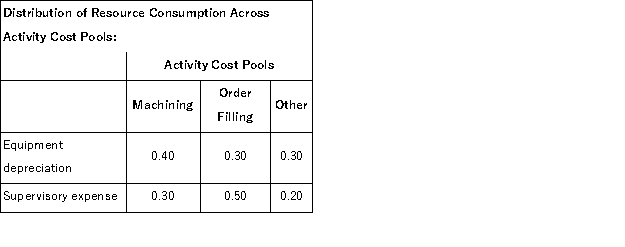

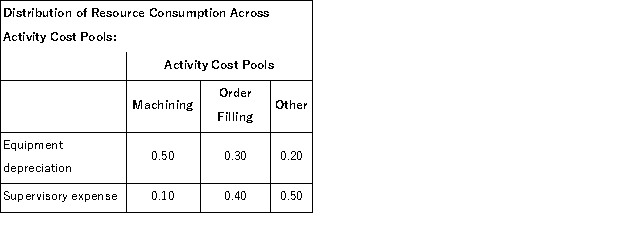

Futter Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

(Multiple Choice)

4.8/5  (41)

(41)

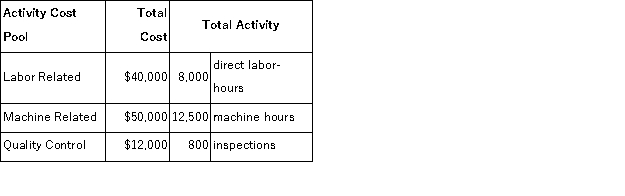

Swagg Jewelry Corporation manufactures custom jewelry.In the past, Swagg has been using a traditional overhead allocation system based solely on direct labor-hours.Sensing that this system was distorting costs and selling prices, Swagg has decided to switch to an activity-based costing system using three activity cost pools.Information on these activity cost pools are as follows:  Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Required:

a.What is the cost of the job under the activity-based costing system?

b.Relative to the activity-based costing system, would Job #309 have been overcosted or undercosted under the traditional system and by how much?

Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Required:

a.What is the cost of the job under the activity-based costing system?

b.Relative to the activity-based costing system, would Job #309 have been overcosted or undercosted under the traditional system and by how much?

(Essay)

4.8/5  (32)

(32)

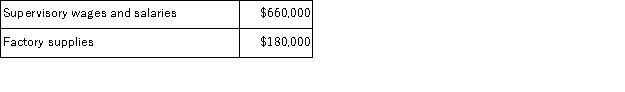

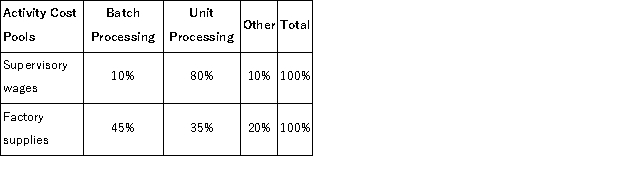

Conely Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much supervisory wages and salaries and factory supplies cost would be assigned to the Batch Processing activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much supervisory wages and salaries and factory supplies cost would be assigned to the Batch Processing activity cost pool?

(Multiple Choice)

4.9/5  (39)

(39)

Dideda Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

How much cost, in total, should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

How much cost, in total, should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

(Multiple Choice)

4.9/5  (40)

(40)

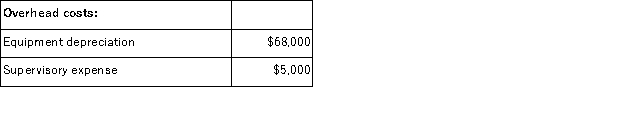

Keske Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other.In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

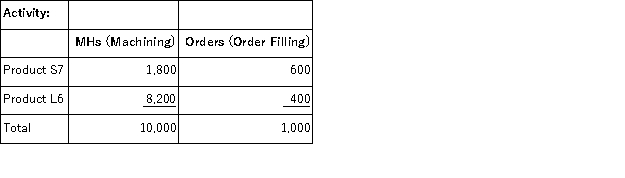

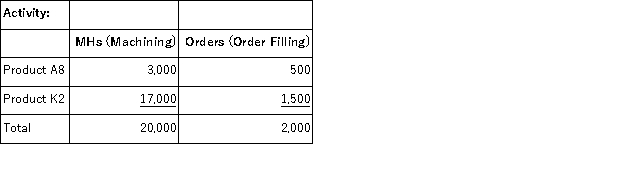

Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

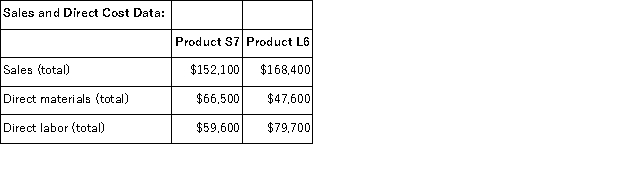

Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.  What is the product margin for Product L6 under activity-based costing?

What is the product margin for Product L6 under activity-based costing?

(Multiple Choice)

4.8/5  (42)

(42)

If substantial batch-level or product-level costs exist, then overhead allocation based on a measure of volume such as direct labor-hours alone:

(Multiple Choice)

4.9/5  (40)

(40)

The costs of activities that are classified as unit-level should be fixed respect to the number of units produced.

(True/False)

5.0/5  (35)

(35)

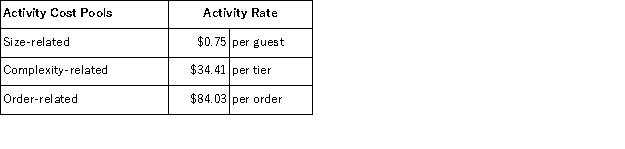

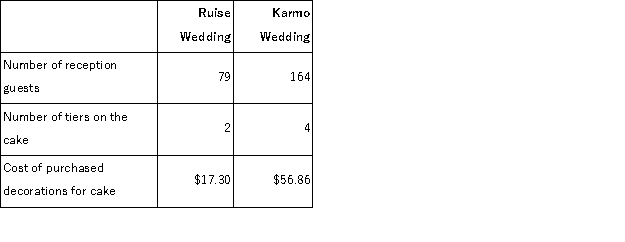

Carsten Wedding Fantasy Corporation makes very elaborate wedding cakes to order.The owner of the company has provided the following data concerning the activity rates in its activity-based costing system:  The measure of activity for the size-related activity cost pool is the number of planned guests at the wedding reception.The greater the number of guests, the larger the cake.The measure of complexity is the number of tiers in the cake.The activity measure for the order-related cost pool is the number of orders.(Each wedding involves one order. )The activity rates include the costs of raw ingredients such as flour, sugar, eggs, and shortening.The activity rates do not include the costs of purchased decorations such as miniature statues and wedding bells, which are accounted for separately. Data concerning two recent orders appear below:

The measure of activity for the size-related activity cost pool is the number of planned guests at the wedding reception.The greater the number of guests, the larger the cake.The measure of complexity is the number of tiers in the cake.The activity measure for the order-related cost pool is the number of orders.(Each wedding involves one order. )The activity rates include the costs of raw ingredients such as flour, sugar, eggs, and shortening.The activity rates do not include the costs of purchased decorations such as miniature statues and wedding bells, which are accounted for separately. Data concerning two recent orders appear below:  Suppose that the company decides that the present activity-based costing system is too complex and that all costs (except for the costs of purchased decorations)should be allocated on the basis of the number of guests.In that event, what would you expect to happen to the costs of cakes?

Suppose that the company decides that the present activity-based costing system is too complex and that all costs (except for the costs of purchased decorations)should be allocated on the basis of the number of guests.In that event, what would you expect to happen to the costs of cakes?

(Multiple Choice)

5.0/5  (41)

(41)

Which terms would make the following sentence true? Manufacturing companies that benefit the most from activity-based costing are those where overhead costs are a _________ percentage of total product cost and where there is ___________ diversity among the various products that they produce.

(Multiple Choice)

4.7/5  (37)

(37)

In general, duration drivers are more accurate measures of the consumption of resources than transaction drivers.

(True/False)

4.8/5  (46)

(46)

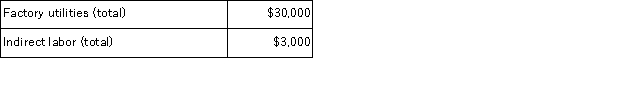

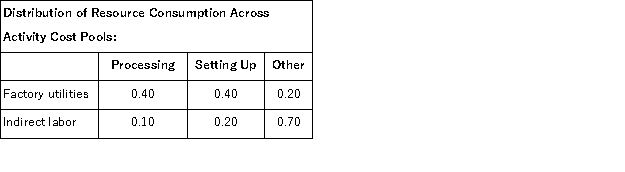

Lovette Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other.The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Data concerning the company's costs and activity-based costing system appear below:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Required:

Assign overhead costs to activity cost pools using activity-based costing.

(Essay)

4.9/5  (41)

(41)

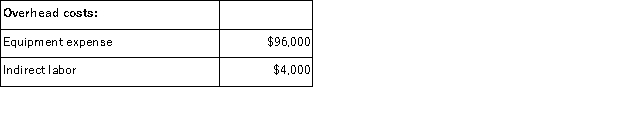

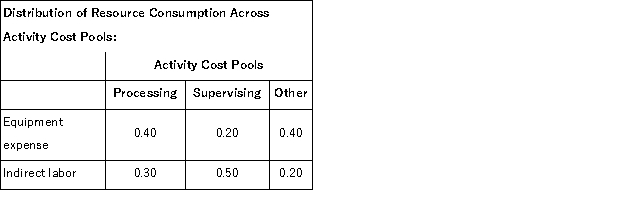

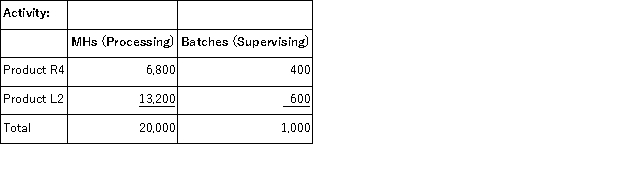

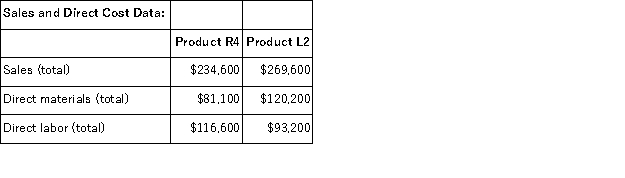

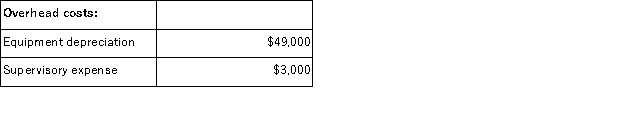

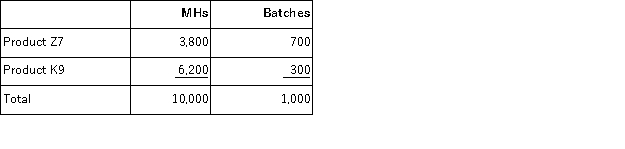

Lake Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other.In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs)and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.  What is the overhead cost assigned to Product L2 under activity-based costing?

What is the overhead cost assigned to Product L2 under activity-based costing?

(Multiple Choice)

4.7/5  (44)

(44)

In traditional costing, some manufacturing costs may be excluded from product costs.

(True/False)

4.7/5  (35)

(35)

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

In the second stage, Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs)and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  What is the overhead cost assigned to Product A8 under activity-based costing?

What is the overhead cost assigned to Product A8 under activity-based costing?

(Multiple Choice)

4.8/5  (42)

(42)

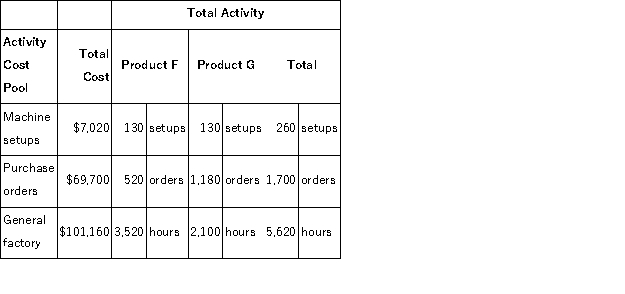

Dace Company manufactures two products, Product F and Product

G.The company expects to produce and sell 3, 200 units of Product F and 2, 100 units of Product G during the current year.Data relating to the company's three activity cost pools are given below for the current year:

Required:

Using the activity-based costing approach, determine the overhead cost per unit for each product.

Required:

Using the activity-based costing approach, determine the overhead cost per unit for each product.

(Essay)

4.9/5  (39)

(39)

Activity-based costing involves a two-stage allocation in which overhead costs are first assigned to departments and then to jobs.

(True/False)

4.9/5  (40)

(40)

Deraney Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other.The company's overhead costs have already been allocated to the cost pools and total $5, 800 for the Machining cost pool, $4, 700 for the Setting Up cost pool, and $7, 500 for the Other cost pool.Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products appear below:  Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

(Essay)

4.9/5  (35)

(35)

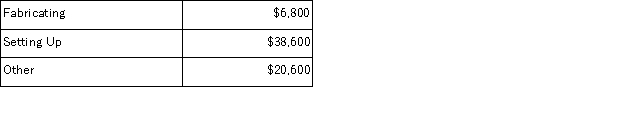

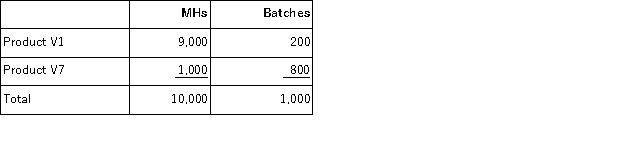

Foradori Corporation's activity-based costing system has three activity cost pools-Fabricating, Setting Up, and Other.The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

(Essay)

4.8/5  (36)

(36)

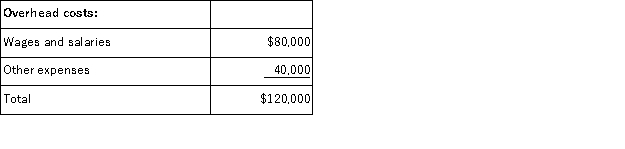

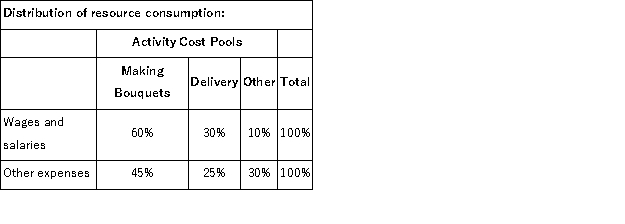

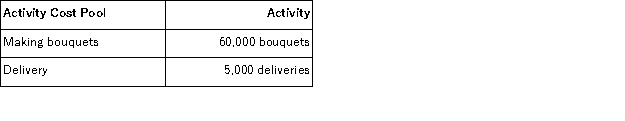

Forse Florist specializes in large floral bouquets for hotels and other commercial spaces.The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:  What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round to the nearest whole cent. )

What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round to the nearest whole cent. )

(Multiple Choice)

4.9/5  (35)

(35)

Showing 101 - 120 of 145

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)