Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

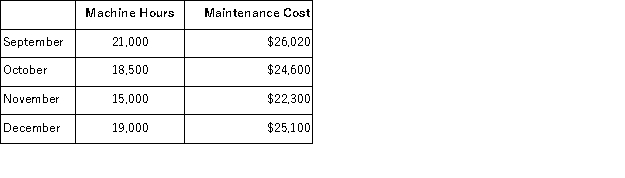

Comco, Inc.has accumulated the following data for the cost of maintenance on its machinery for the last four months:  Assume that the relevant range includes all of the activity levels mentioned in this problem. Assuming Comco uses the high-low method of analysis, if machine hours are budgeted to be 20, 000 hours then the budgeted total maintenance cost would be expected to be:

Assume that the relevant range includes all of the activity levels mentioned in this problem. Assuming Comco uses the high-low method of analysis, if machine hours are budgeted to be 20, 000 hours then the budgeted total maintenance cost would be expected to be:

(Multiple Choice)

4.9/5  (39)

(39)

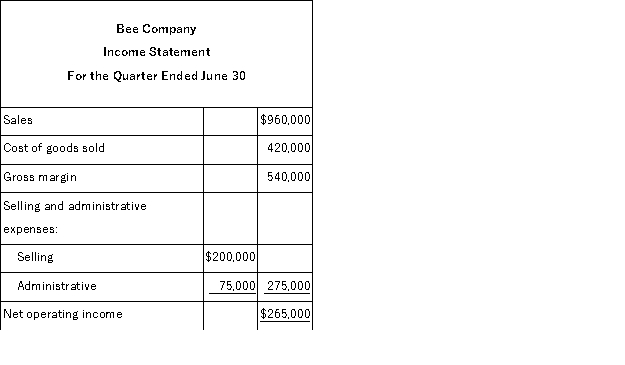

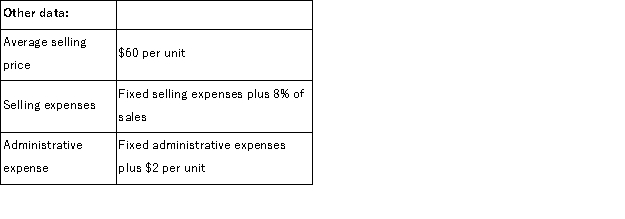

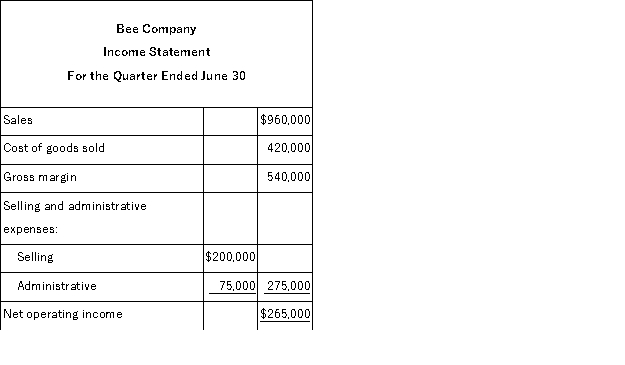

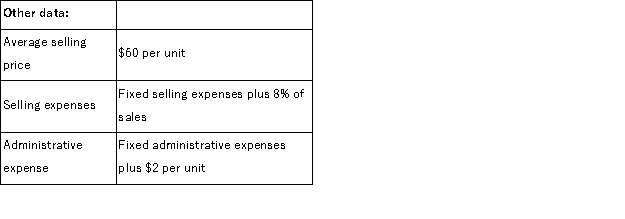

Bee Company is a honey wholesaler.An income statement and other data for the second quarter of the year are given below:

If 24, 000 units are sold during the third quarter and this activity is within the relevant range, Bee Company's expected contribution margin would be:

If 24, 000 units are sold during the third quarter and this activity is within the relevant range, Bee Company's expected contribution margin would be:

(Multiple Choice)

4.8/5  (41)

(41)

A contribution format income statement for a merchandising company organizes costs into two categories-cost of goods sold and selling and administrative expenses.

(True/False)

4.7/5  (40)

(40)

At an activity level of 8, 300 machine-hours in a month, Baudry Corporation's total variable maintenance cost is $220, 448 and its total fixed maintenance cost is $556, 764. What would be the total variable maintenance cost at an activity level of 8, 600 machine-hours in a month? Assume that this level of activity is within the relevant range.

(Multiple Choice)

4.8/5  (38)

(38)

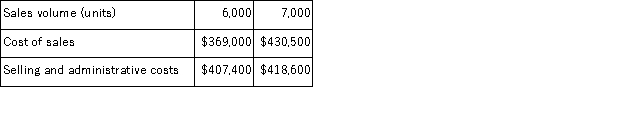

Gambino Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $138.80 per unit.  The best estimate of the total monthly fixed cost is:

The best estimate of the total monthly fixed cost is:

(Multiple Choice)

4.8/5  (45)

(45)

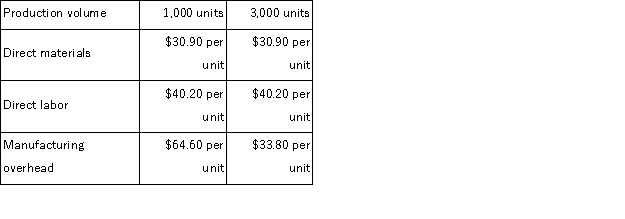

Baker Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

(Multiple Choice)

4.7/5  (40)

(40)

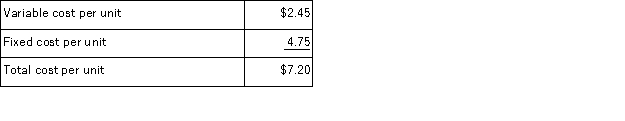

Shaw Supply Company sells a single product and has the following average costs at a sales level of 15, 000 units:  Required:

Determine the following amounts at a sales level of 18, 000 units:

a.Total variable cost

b.Total fixed cost

c.Variable cost per unit

d.Fixed cost per unit

e.Total cost per unit

Required:

Determine the following amounts at a sales level of 18, 000 units:

a.Total variable cost

b.Total fixed cost

c.Variable cost per unit

d.Fixed cost per unit

e.Total cost per unit

(Essay)

4.8/5  (33)

(33)

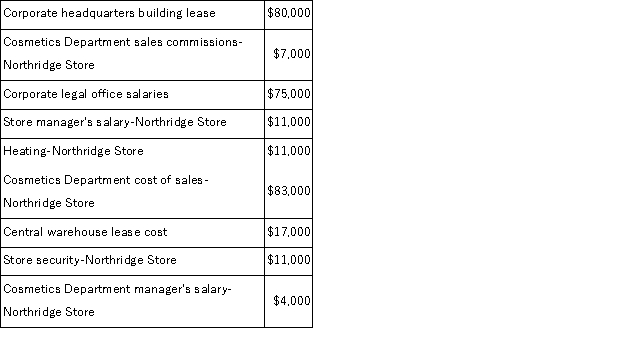

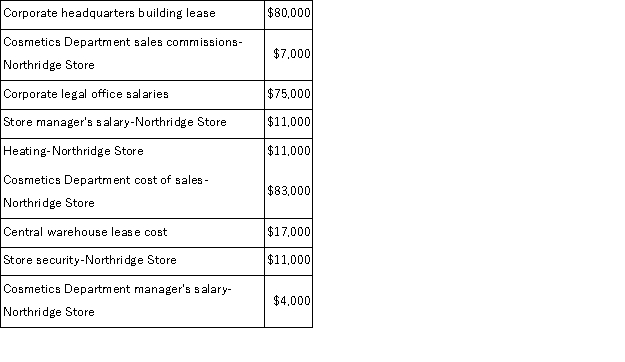

The following cost data pertain to the operations of Rademaker Department Stores, Inc. , for the month of March.  The Northridge Store is just one of many stores owned and operated by the company.The Cosmetics Department is one of many departments at the Northridge Store.The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

The Northridge Store is just one of many stores owned and operated by the company.The Cosmetics Department is one of many departments at the Northridge Store.The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

(Multiple Choice)

4.7/5  (36)

(36)

Given the cost formula Y = $18, 000 + $6X, total cost at an activity level of 9, 000 units would be:

(Multiple Choice)

4.9/5  (35)

(35)

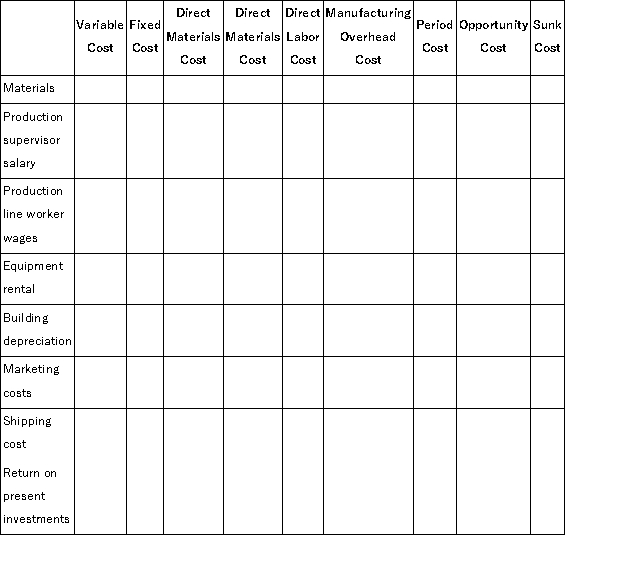

The Plastechnics Company began operations several years ago.The company's product requires materials that cost $25 per unit.The company employs a production supervisor whose salary is $2, 000 per month.Production line workers are paid $15 per hour to manufacture and assemble the product.The company rents the equipment needed to produce the product at a rental cost of $1, 500 per month.The building is depreciated on the straight-line basis at $9, 000 per year.

The company spends $40, 000 per year to market the product.Shipping costs for each unit are $20 per unit.

The company plans to liquidate several investments in order to expand production.These investments currently earn a return of $8, 000 per year.

Required:

Complete the answer sheet below by placing an "X" under each heading that identifies the cost involved.The "Xs" can be placed under more than one heading for a single cost, e.g. , a cost might be a sunk cost, an overhead cost, and a product cost.

(Essay)

4.7/5  (30)

(30)

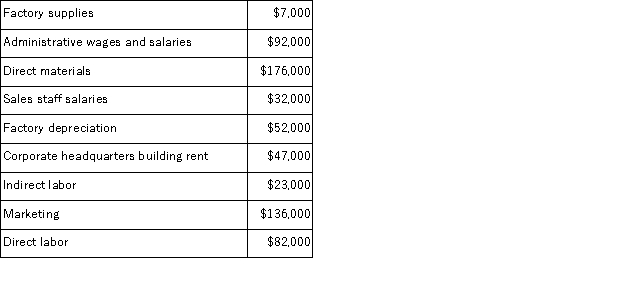

A partial listing of costs incurred during December at Rooks Corporation appears below:  The total of the product costs listed above for December is:

The total of the product costs listed above for December is:

(Multiple Choice)

4.8/5  (33)

(33)

Dechico Corporation purchased a machine 3 years ago for $456, 000 when it launched product G92L.Unfortunately, this machine has broken down and cannot be repaired.The machine could be replaced by a new model 330 machine costing $474, 000 or by a new model 260 machine costing $418, 000.Management has decided to buy the model 260 machine.It has less capacity than the model 330 machine, but its capacity is sufficient to continue making product G92L.Management also considered, but rejected, the alternative of dropping product G92L and not replacing the old machine.If that were done, the $418, 000 invested in the new machine could instead have been invested in a project that would have returned a total of $496, 000. In making the decision to buy the model 260 machine rather than the model 330 machine, the sunk cost was:

(Multiple Choice)

4.9/5  (37)

(37)

The following cost data pertain to the operations of Rademaker Department Stores, Inc. , for the month of March.  The Northridge Store is just one of many stores owned and operated by the company.The Cosmetics Department is one of many departments at the Northridge Store.The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

The Northridge Store is just one of many stores owned and operated by the company.The Cosmetics Department is one of many departments at the Northridge Store.The central warehouse serves all of the company's stores. What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

(Multiple Choice)

4.8/5  (31)

(31)

Kodama Corporation staffs a helpline to answer questions from customers.The costs of operating the helpline are variable with respect to the number of calls in a month.At a volume of 30, 000 calls in a month, the costs of operating the helpline total $369, 000. To the nearest whole dollar, what should be the total cost of operating the helpline costs at a volume of 33, 800 calls in a month? (Assume that this call volume is within the relevant range. )

(Multiple Choice)

4.9/5  (36)

(36)

The property taxes on a factory building would be an example of:

(Multiple Choice)

4.7/5  (44)

(44)

Bee Company is a honey wholesaler.An income statement and other data for the second quarter of the year are given below:

Bee Company's net operating income for the second quarter using the contribution approach is:

Bee Company's net operating income for the second quarter using the contribution approach is:

(Multiple Choice)

4.8/5  (34)

(34)

Showing 61 - 80 of 186

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)