Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

At an activity level of 8, 300 machine-hours in a month, Baudry Corporation's total variable maintenance cost is $220, 448 and its total fixed maintenance cost is $556, 764. What would be the average fixed maintenance cost per unit at an activity level of 8, 600 machine-hours in a month? Assume that this level of activity is within the relevant range.

(Multiple Choice)

4.9/5  (36)

(36)

Dechico Corporation purchased a machine 3 years ago for $456, 000 when it launched product G92L.Unfortunately, this machine has broken down and cannot be repaired.The machine could be replaced by a new model 330 machine costing $474, 000 or by a new model 260 machine costing $418, 000.Management has decided to buy the model 260 machine.It has less capacity than the model 330 machine, but its capacity is sufficient to continue making product G92L.Management also considered, but rejected, the alternative of dropping product G92L and not replacing the old machine.If that were done, the $418, 000 invested in the new machine could instead have been invested in a project that would have returned a total of $496, 000. In making the decision to invest in the model 260 machine, the opportunity cost was:

(Multiple Choice)

4.8/5  (43)

(43)

Abbott Company's manufacturing overhead is 20% of its total conversion costs.If direct labor is $38, 000 and if direct materials are $23, 000, the manufacturing overhead is:

(Multiple Choice)

4.9/5  (45)

(45)

The nursing station on the fourth floor of Central Hospital is responsible for the care of orthopedic surgery patients.The costs of prescription drugs administered by the nursing station to patients should be classified as:

(Multiple Choice)

4.7/5  (41)

(41)

Country Charm Restaurant is open 24 hours a day and always has a fire going in the fireplace in the middle of its dining area.The cost of the firewood for this fire is fixed with respect to the number of meals served at the restaurant.

(True/False)

4.8/5  (43)

(43)

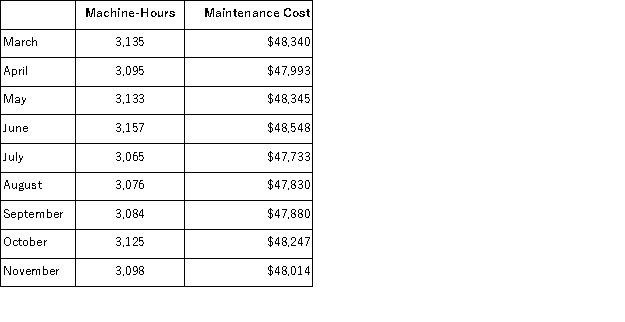

Maintenance costs at a Whetsel Corporation factory are listed below:  Management believes that maintenance cost is a mixed cost that depends on machine-hours.Use the high-low method to estimate the variable and fixed components of this cost.Compute the variable component first and round off to the nearest whole cent.Compute the fixed component second and round off to the nearest whole dollar.These estimates would be closest to:

Management believes that maintenance cost is a mixed cost that depends on machine-hours.Use the high-low method to estimate the variable and fixed components of this cost.Compute the variable component first and round off to the nearest whole cent.Compute the fixed component second and round off to the nearest whole dollar.These estimates would be closest to:

(Multiple Choice)

4.9/5  (46)

(46)

Hadrana Corporation reports that at an activity level of 5, 500 units, its total variable cost is $275, 330 and its total fixed cost is $86, 240. What would be the average fixed cost per unit at an activity level of 5, 600 units? Assume that this level of activity is within the relevant range.

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following costs, if expressed on a per unit basis, would be expected to decrease as the level of production and sales increases?

(Multiple Choice)

4.8/5  (47)

(47)

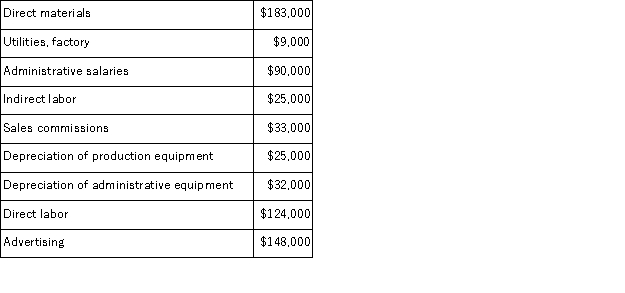

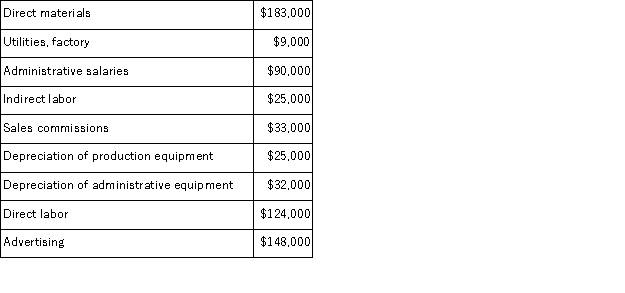

A partial listing of costs incurred at Gilhooly Corporation during September appears below:  The total of the period costs listed above for September is:

The total of the period costs listed above for September is:

(Multiple Choice)

4.8/5  (38)

(38)

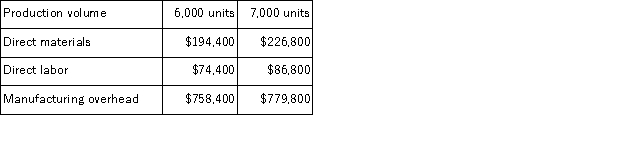

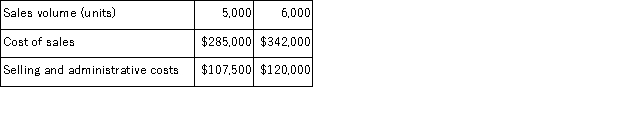

Baker Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

(Multiple Choice)

4.9/5  (37)

(37)

A partial listing of costs incurred at Gilhooly Corporation during September appears below:  The total of the product costs listed above for September is:

The total of the product costs listed above for September is:

(Multiple Choice)

4.8/5  (35)

(35)

Tolden Marketing, Inc. , a merchandising company, reported sales of $2, 861, 800 and cost of goods sold of $1, 492, 400 for December.The company's total variable selling expense was $77, 900;its total fixed selling expense was $70, 600;its total variable administrative expense was $98, 400;and its total fixed administrative expense was $193, 400.The cost of goods sold in this company is a variable cost. The gross margin for December is:

(Multiple Choice)

4.8/5  (46)

(46)

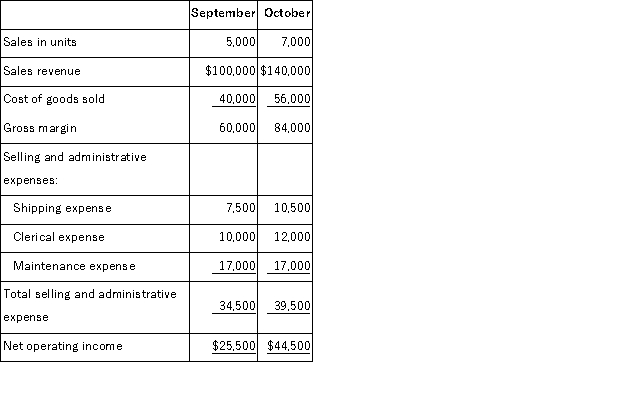

Comparative income statements for Tudor Retailing Company for the last two months are presented below:  If the Tudor Retailing Company uses the high-low method of analysis, the total selling and administrative expense if Tudor Retailing Company sells 6, 500 units during a month would be estimated to be:

If the Tudor Retailing Company uses the high-low method of analysis, the total selling and administrative expense if Tudor Retailing Company sells 6, 500 units during a month would be estimated to be:

(Multiple Choice)

4.9/5  (35)

(35)

At a sales volume of 30, 000 units, Carne Company's total fixed costs are $30, 000 and total variable costs are $45, 000.The relevant range is 20, 000 to 40, 000 units. If Carne Company were to sell 40, 000 units, the total expected cost per unit would be:

(Multiple Choice)

5.0/5  (41)

(41)

The contribution margin is the amount remaining from sales revenues after variable expenses have been deducted.

(True/False)

4.8/5  (34)

(34)

Harris Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $84.40 per unit.  The best estimate of the total variable cost per unit is:

The best estimate of the total variable cost per unit is:

(Multiple Choice)

4.8/5  (28)

(28)

Ence Sales, Inc. , a merchandising company, reported sales of 6, 400 units in April at a selling price of $684 per unit.Cost of goods sold, which is a variable cost, was $455 per unit.Variable selling expenses were $30 per unit and variable administrative expenses were $40 per unit.The total fixed selling expenses were $156, 800 and the total administrative expenses were $260, 400. The gross margin for April was:

(Multiple Choice)

4.8/5  (42)

(42)

Showing 161 - 180 of 186

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)