Exam 21: The Statement of Cash Flows Revisited

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

Which of the following is not classified as an operating activity?

(Multiple Choice)

4.8/5  (38)

(38)

Melanie Corporation declared cash dividends of $13,500 during the current year. The beginning and ending balances in dividends payable were $450 and $750, respectively. What was the amount of cash paid for dividends?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following is always reported as an outflow of cash?

(Multiple Choice)

4.9/5  (41)

(41)

If bond interest expense is $800,000, bond interest payable increased by $8,000 and bond discount decreased by $2,000, cash paid for bond interest is:

(Multiple Choice)

4.8/5  (38)

(38)

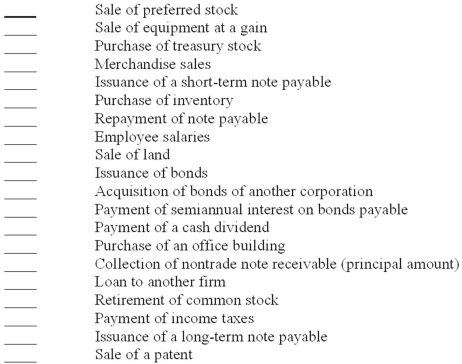

Listed below are several transactions that typically produce either an increase or a decrease in cash. Indicate by letter whether the cash effect of each transaction is reported on a statement of cash flows as an operating (O), investing (I), or financing (F) activity.

Transactions

(Essay)

4.8/5  (37)

(37)

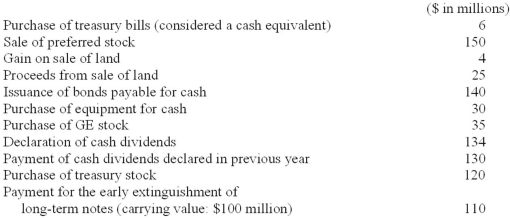

In preparation for developing its statement of cash flows for the year just ended, D-Rose Distributors collected the following information:  Required:

1. In D-Rose's statement of cash flows, what were net cash inflows (or outflows) from investing activities?

2. In D-Rose's statement of cash flows, what were net cash inflows (or outflows) from financing activities?

Required:

1. In D-Rose's statement of cash flows, what were net cash inflows (or outflows) from investing activities?

2. In D-Rose's statement of cash flows, what were net cash inflows (or outflows) from financing activities?

(Essay)

4.8/5  (37)

(37)

Why are "cash equivalents" included as part of cash in the statement of cash flows?

(Essay)

4.8/5  (34)

(34)

A statement of cash flows and its related disclosure note typically do not report:

(Multiple Choice)

4.9/5  (39)

(39)

Charlene Company sold a printer with a cost of $68,000 and accumulated depreciation of $23,000 for $20,000 cash. This transaction would be reported as:

(Multiple Choice)

4.8/5  (37)

(37)

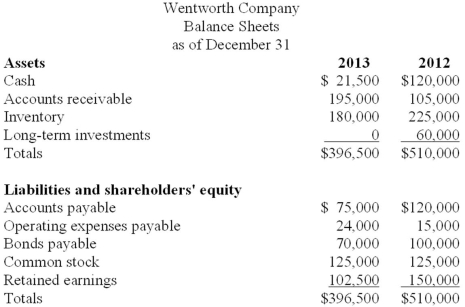

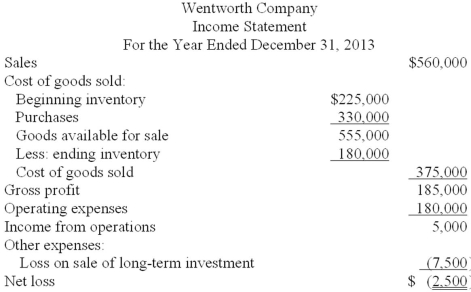

The following are comparative balance sheets and an income statement for Wentworth Company.

Cash dividends of $45,000 were paid in 2013.

Required:

Prepare a statement of cash flows for 2013 using the direct method.

Cash dividends of $45,000 were paid in 2013.

Required:

Prepare a statement of cash flows for 2013 using the direct method.

(Essay)

4.9/5  (38)

(38)

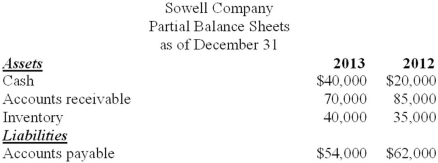

Partial balance sheets and additional information are listed below for Sowell Company.  Additional information for 2013:

Net income was $88,000.

Depreciation expense was $19,000.

Required:

Prepare the operating activities section of the statement of cash flows for 2013 using the indirect method.

Additional information for 2013:

Net income was $88,000.

Depreciation expense was $19,000.

Required:

Prepare the operating activities section of the statement of cash flows for 2013 using the indirect method.

(Essay)

4.8/5  (39)

(39)

How is the amortization of patents reported in a statement of cash flows that is prepared using the direct method?

(Multiple Choice)

4.9/5  (33)

(33)

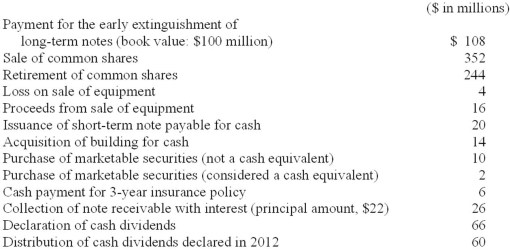

In preparation for developing its statement of cash flows for the year ended December 31, 2013, Millennium Solutions, Inc., collected the following information:  Required:

1. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2013?

2. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2013?

Required:

1. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2013?

2. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2013?

(Essay)

4.9/5  (36)

(36)

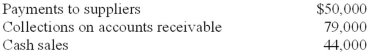

Lite Travel Company's accounting records include the following information:  What is the amount of net cash provided by operating activities indicated by the amounts provided?

What is the amount of net cash provided by operating activities indicated by the amounts provided?

(Multiple Choice)

4.9/5  (36)

(36)

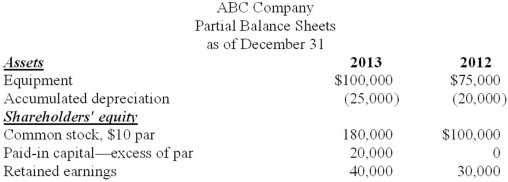

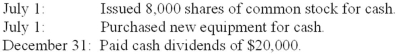

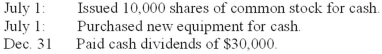

Partial balance sheets for ABC Company and additional information are provided below.  Additional information for 2013:

Additional information for 2013:  Required:

Prepare the financing activities section of the statement of cash flows for 2013.

Required:

Prepare the financing activities section of the statement of cash flows for 2013.

(Essay)

4.9/5  (37)

(37)

In determining cash flows from operating activities (indirect method), adjustments to net income should not include:

(Multiple Choice)

4.7/5  (25)

(25)

Sneed Corporation reported balances in the following accounts for the current year:  Income tax expense was $230 for the year. What was the amount paid for taxes?

Income tax expense was $230 for the year. What was the amount paid for taxes?

(Multiple Choice)

4.9/5  (39)

(39)

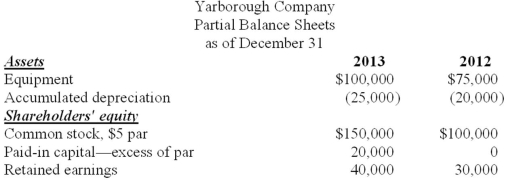

Partial balance sheets for Yarborough Company and additional information are found below.  Additional information for 2013:

Additional information for 2013:  Required:

Prepare the investing activities section of the statement of cash flows for 2013.

Required:

Prepare the investing activities section of the statement of cash flows for 2013.

(Essay)

4.8/5  (30)

(30)

Transactions that involve merely purchases or sales of cash equivalents generally are not reported on a statement of cash flows. Describe an exception to this generalization. What is the essential characteristic of the transaction that qualifies as an exception?

(Essay)

4.9/5  (33)

(33)

Showing 121 - 140 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)