Exam 2: Review of the Accounting Process

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

Based on the information presented above, prepare the 12/31/13 Balance Sheet for Krafty Foods.

(Essay)

4.9/5  (36)

(36)

What is the difference between permanent accounts and temporary accounts, and why does an accounting system have both types of accounts?

(Essay)

4.9/5  (35)

(35)

Describe the difference between external events and internal events, and give two examples of each.

(Essay)

4.9/5  (38)

(38)

Examples of external transactions include all of the following except:

(Multiple Choice)

4.9/5  (36)

(36)

After an unadjusted trial balance is prepared, the next step in the accounting processing cycle is the preparation of financial statements.

(True/False)

4.8/5  (46)

(46)

Cal Farms reported supplies expense of $2,000,000 this year. The supplies account decreased by $200,000 during the year to an ending balance of $400,000. What was the cost of supplies the Cal Farms purchased during the year?

(Multiple Choice)

4.9/5  (44)

(44)

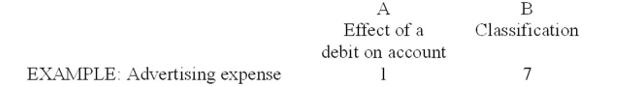

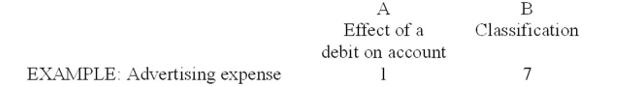

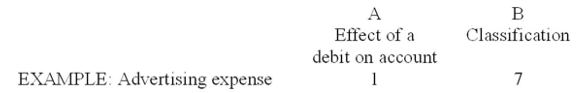

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Capital stock

-Capital stock

(Essay)

4.9/5  (37)

(37)

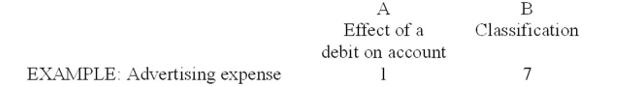

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Unearned revenues

-Unearned revenues

(Essay)

4.9/5  (44)

(44)

When the amount of interest receivable decreases during an accounting period:

(Multiple Choice)

4.8/5  (46)

(46)

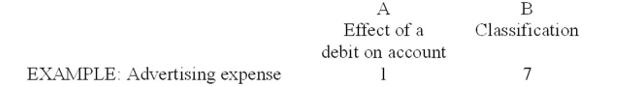

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Property taxes payable

-Property taxes payable

(Essay)

4.8/5  (36)

(36)

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Cost of goods sold

-Cost of goods sold

(Essay)

4.8/5  (35)

(35)

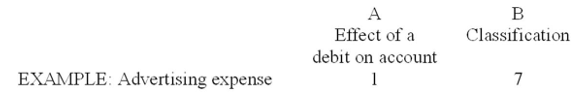

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Supplies expense

-Supplies expense

(Essay)

4.8/5  (35)

(35)

The employees of Neat Clothes work Monday through Friday. Every other Friday the company issues payroll checks totaling $32,000. The current pay period ends on Friday, July 3. Neat Clothes is now preparing quarterly financial statements for the three months ended June 30. What is the adjusting entry to record accrued salaries at the end of June?

(Multiple Choice)

4.8/5  (40)

(40)

When a tenant makes an end-of-period adjusting entry credit to the "Prepaid rent" account:

(Multiple Choice)

4.8/5  (45)

(45)

Somerset Leasing received $12,000 for 24 months rent in advance. How should Somerset record this transaction?

(Multiple Choice)

4.9/5  (42)

(42)

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Short-term notes payable

-Short-term notes payable

(Essay)

4.8/5  (30)

(30)

A future economic benefit owned or controlled by an entity is:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 81 - 100 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)