Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

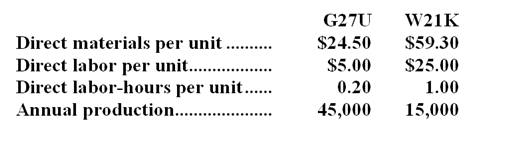

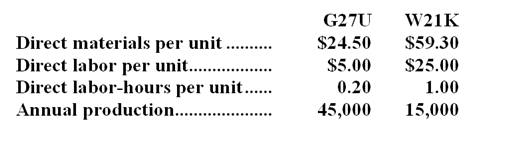

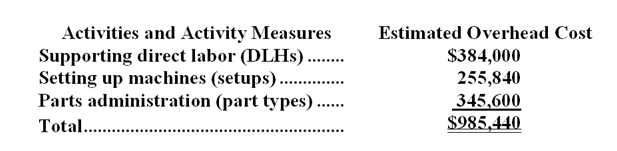

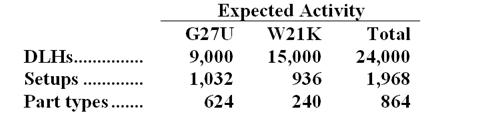

Shininger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, G27U and W21K, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

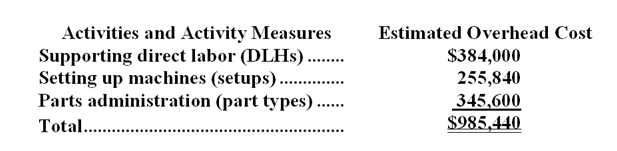

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product W21K under the activity-based costing system is closest to:

-The manufacturing overhead that would be applied to a unit of product W21K under the activity-based costing system is closest to:

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

D

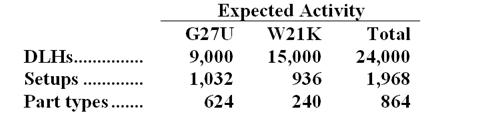

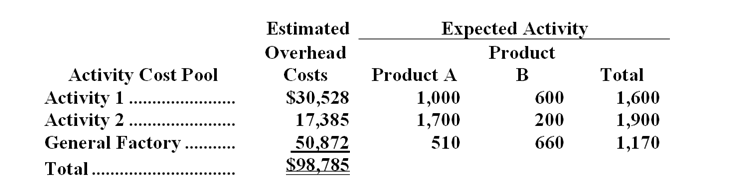

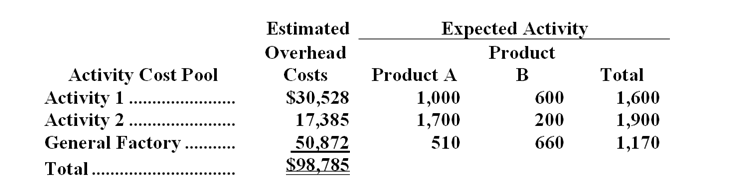

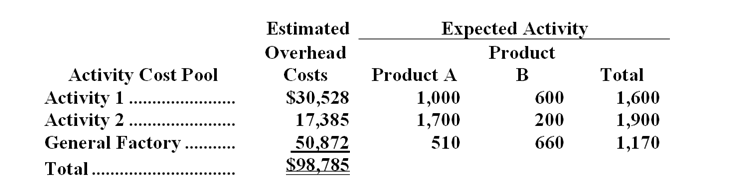

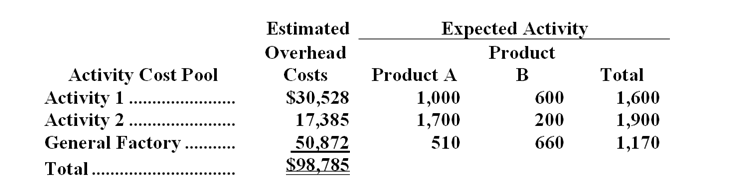

Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate (i.e. ,activity rate)for Activity 2 under the activity-based costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate (i.e. ,activity rate)for Activity 2 under the activity-based costing system is closest to:

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

A

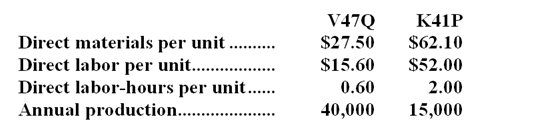

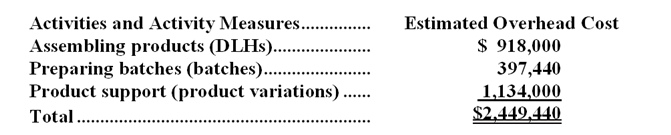

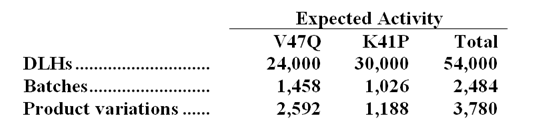

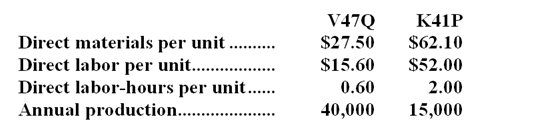

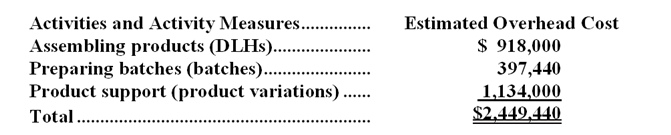

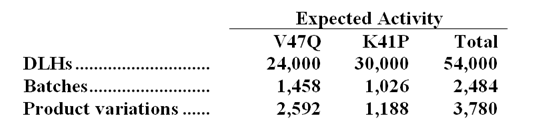

Solum Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, V47Q and K41P, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product V47Q under the company's traditional costing system is closest to:

-The unit product cost of product V47Q under the company's traditional costing system is closest to:

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

B

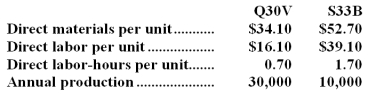

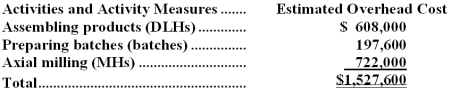

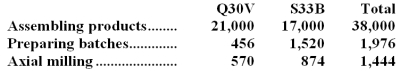

Wetz Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,Q30V and S33B,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,527,600 and the company's estimated total direct labor-hours for the year is 38,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,527,600 and the company's estimated total direct labor-hours for the year is 38,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

(Essay)

4.9/5  (36)

(36)

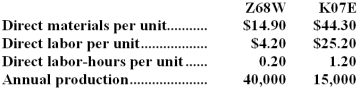

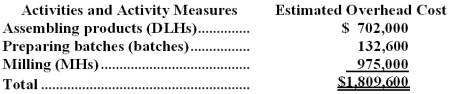

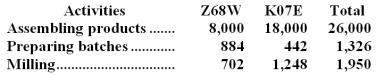

Bustle Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,Z68W and K07E,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,809,600 and the company's estimated total direct labor-hours for the year is 26,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,809,600 and the company's estimated total direct labor-hours for the year is 26,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

(Essay)

4.8/5  (39)

(39)

Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the activity-based costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the activity-based costing system is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

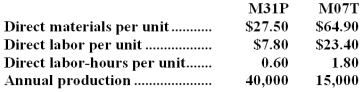

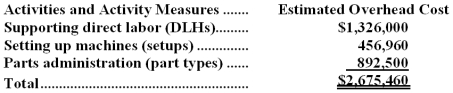

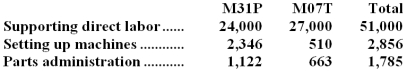

Stoughton Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,M31P and M07T,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,675,460 and the company's estimated total direct labor-hours for the year is 51,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,675,460 and the company's estimated total direct labor-hours for the year is 51,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

(Essay)

4.8/5  (40)

(40)

Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the traditional costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the traditional costing system is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

Shininger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, G27U and W21K, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product G27U under the company's traditional costing system is closest to:

-The manufacturing overhead that would be applied to a unit of product G27U under the company's traditional costing system is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

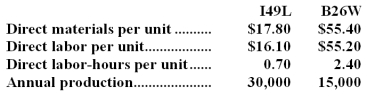

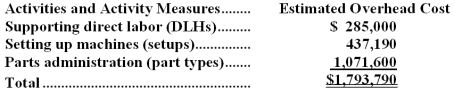

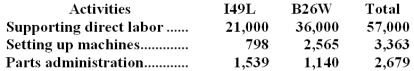

Kuechle Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,I49L and B26W,about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1,793,790 and the company's estimated total direct labor-hours for the year is 57,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,793,790 and the company's estimated total direct labor-hours for the year is 57,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

(Essay)

4.8/5  (30)

(30)

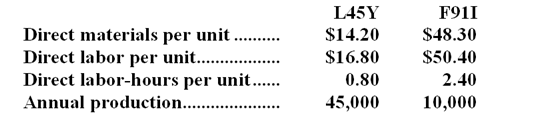

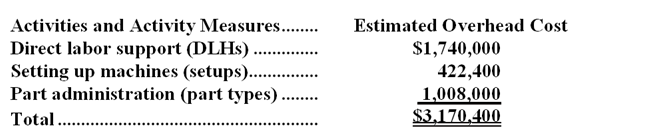

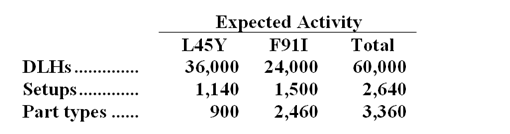

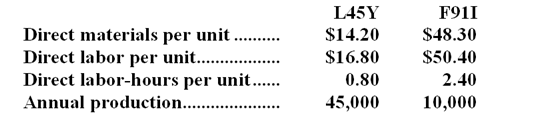

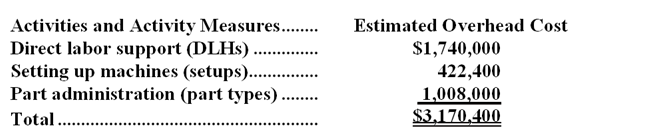

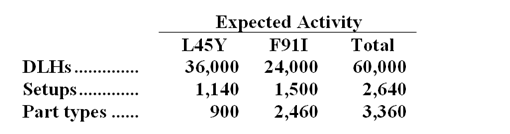

Scholes Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, L45Y and F91I, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product L45Y under the company's traditional costing system is closest to:

-The unit product cost of product L45Y under the company's traditional costing system is closest to:

(Multiple Choice)

4.9/5  (36)

(36)

Scholes Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, L45Y and F91I, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product F91I under the activity-based costing system is closest to:

-The unit product cost of product F91I under the activity-based costing system is closest to:

(Multiple Choice)

4.9/5  (36)

(36)

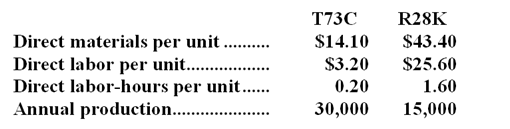

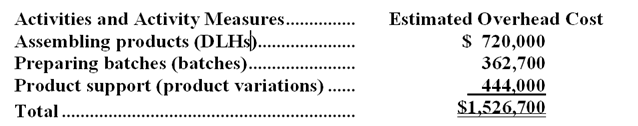

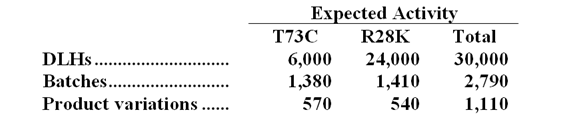

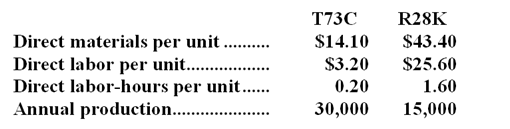

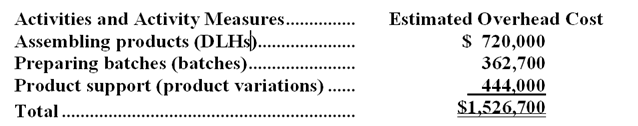

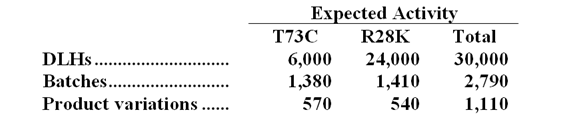

Latting Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, T73C and R28K, about which it has provided the following data: The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product T73C under the company's traditional costing system is closest to:

-The manufacturing overhead that would be applied to a unit of product T73C under the company's traditional costing system is closest to:

(Multiple Choice)

4.8/5  (44)

(44)

Solum Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, V47Q and K41P, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product K41P under the activity-based costing system is closest to:

-The unit product cost of product K41P under the activity-based costing system is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Latting Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, T73C and R28K, about which it has provided the following data: The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product R28K under the activity-based costing system is closest to:

-The manufacturing overhead that would be applied to a unit of product R28K under the activity-based costing system is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)