Exam 7: Reporting and Analyzing Receivables

Exam 1: Introducing Financial Accounting270 Questions

Exam 2: Accounting System and Financial Statements236 Questions

Exam 3: Adjusting Accounts for Financial Statements271 Questions

Exam 4: Reporting and Analyzing Merchandising Operations263 Questions

Exam 5: Reporting and Analyzing Inventories218 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls215 Questions

Exam 7: Reporting and Analyzing Receivables207 Questions

Exam 8: Reporting and Analyzing Long-Term Assets255 Questions

Exam 9: Reporting and Analyzing Current Liabilities224 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity248 Questions

Exam 12: Reporting and Analyzing Cash Flows226 Questions

Exam 13: Analyzing and Interpreting Financial Statements223 Questions

Exam 14: Applying Present and Future Values76 Questions

Exam 15: Investments and International Operations215 Questions

Exam 16: Reporting and Analyzing Partnerships168 Questions

Select questions type

The matching principle, as applied to bad debts, requires:

(Multiple Choice)

4.9/5  (40)

(40)

The amount due on the maturity date of a $6,000, 60-day 4%, note receivable is:

(Multiple Choice)

4.8/5  (40)

(40)

A company has net sales of $1,200,000 and average accounts receivable of $400,000. What is its accounts receivable turnover for the period?

(Multiple Choice)

4.8/5  (39)

(39)

The following series of transactions occurred during Year 1 and Year 2, when Foxworth Co. sold merchandise to Kevin Lewis. Foxworth's annual accounting period ends on December 31. The company uses the net method of accounting for sales discounts.  Prepare Foxworth Co.'s journal entries to record the above transactions. The company uses the allowance method to account for its bad debt expense.

Prepare Foxworth Co.'s journal entries to record the above transactions. The company uses the allowance method to account for its bad debt expense.

(Essay)

4.8/5  (36)

(36)

Sellers allow customers to use credit cards to pay for products and services for all of the following reasons except:

(Multiple Choice)

4.9/5  (31)

(31)

On October 17 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the allowance method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets?

(Multiple Choice)

4.8/5  (32)

(32)

The percent of sales method for estimating bad debts assumes that a given percent of a company's credit sales for the period are uncollectible.

(True/False)

4.8/5  (38)

(38)

A company borrowed $16,000 by signing a 120-day promissory note at 12%. The total interest on the note is $640.

$16,000 * 0.12 * 120/360 = $640

(True/False)

4.8/5  (37)

(37)

A promissory note received from a customer in exchange for an account receivable is recorded by the payee as:

(Multiple Choice)

4.7/5  (39)

(39)

Mullis Company sold merchandise on account to a customer for $625, terms n/30. The journal entry to record the collection on account would be:

(Multiple Choice)

4.9/5  (40)

(40)

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

(Multiple Choice)

4.8/5  (40)

(40)

A company borrowed $10,000 by signing a 180-day promissory note at 5% interest. The total amount of interest is $25.

$10,000 * .05 * 180/360 = $250

(True/False)

4.7/5  (40)

(40)

Giorgio Italian Market bought $4,000 worth of merchandise from Food Suppliers and signed a 90-day, 6% promissory note for the $4,000. Food Supplier's journal entry to record the collection on the maturity date is:

(Multiple Choice)

4.8/5  (43)

(43)

If a credit card sale is made, the seller can either debit Cash or debit Accounts Receivable at the time of the sale, depending on the type of credit card.

(True/False)

4.9/5  (35)

(35)

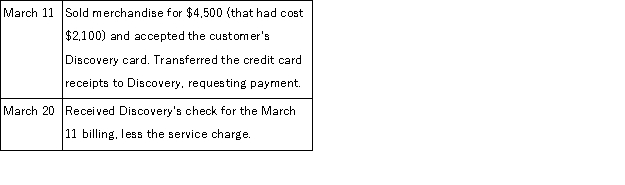

Mercks accepts the Discovery credit card for credit card sales. Mercks sends credit card receipts to Discovery on a weekly basis. Discovery charges Mercks a 3% fee. Mercks usually receives payment from Discovery within a week. Prepare journal entries to record the following transactions.

(Essay)

4.7/5  (36)

(36)

Craigmont uses the allowance method to account for uncollectible accounts. Its year-end unadjusted trial balance shows Accounts Receivable of $104,500, allowance for doubtful accounts of $665 (credit) and sales of $925,000. If uncollectible accounts are estimated to be 0.5% of sales, what is the amount of the bad debts expense adjusting entry?

(Multiple Choice)

5.0/5  (37)

(37)

At December 31, Yarrow Company reports the following results for its calendar year from the adjusted trial balance.  a. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be 1.1% of credit sales.

b. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be .8% of total sales.

c. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be 7.0% of year-end accounts receivable.

a. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be 1.1% of credit sales.

b. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be .8% of total sales.

c. Prepare the adjusting entry to record Bad Debts Expense assuming uncollectibles are estimated to be 7.0% of year-end accounts receivable.

(Essay)

4.9/5  (40)

(40)

Showing 101 - 120 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)