Exam 1: Introducing Financial Accounting

Exam 1: Introducing Financial Accounting270 Questions

Exam 2: Accounting System and Financial Statements236 Questions

Exam 3: Adjusting Accounts for Financial Statements271 Questions

Exam 4: Reporting and Analyzing Merchandising Operations263 Questions

Exam 5: Reporting and Analyzing Inventories218 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls215 Questions

Exam 7: Reporting and Analyzing Receivables207 Questions

Exam 8: Reporting and Analyzing Long-Term Assets255 Questions

Exam 9: Reporting and Analyzing Current Liabilities224 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities231 Questions

Exam 11: Reporting and Analyzing Equity248 Questions

Exam 12: Reporting and Analyzing Cash Flows226 Questions

Exam 13: Analyzing and Interpreting Financial Statements223 Questions

Exam 14: Applying Present and Future Values76 Questions

Exam 15: Investments and International Operations215 Questions

Exam 16: Reporting and Analyzing Partnerships168 Questions

Select questions type

The business entity principle means that accounting information reflects a presumption that the business will continue operating instead of being closed or sold.

(True/False)

4.8/5  (45)

(45)

To include the personal assets and transactions of a business's stockholders in the records and reports of the business would be in conflict with the:

(Multiple Choice)

4.9/5  (43)

(43)

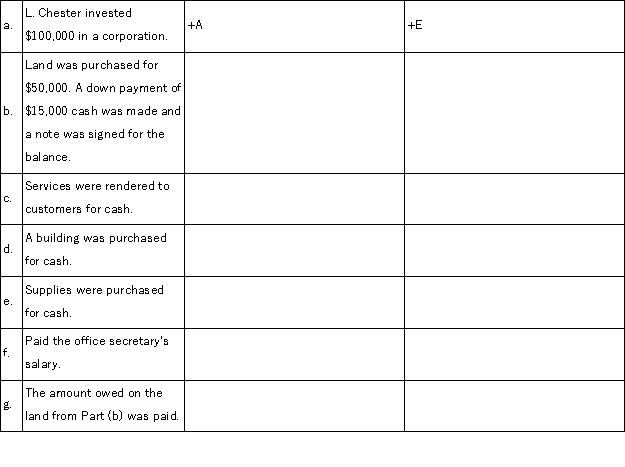

For each of the following transactions, identify the effects as reflected in the accounting equation. Use "+" to indicate an increase and "-" to indicate a decrease. Use "A", "L", and "E" to indicate assets, liabilities, and equity, respectively. Part A has been completed as an example.

(Essay)

4.7/5  (34)

(34)

Operating activities include long-term borrowing and repaying cash from lenders, and cash investments or dividends to stockholders.

(True/False)

4.8/5  (41)

(41)

Accounting is an information and measurement system that does all of the following except:

(Multiple Choice)

4.9/5  (38)

(38)

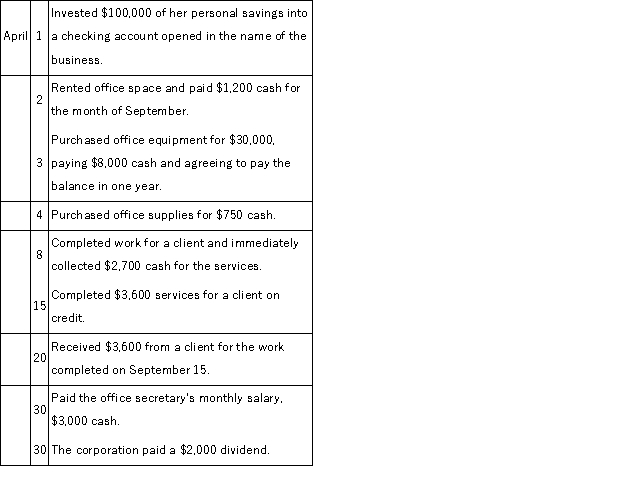

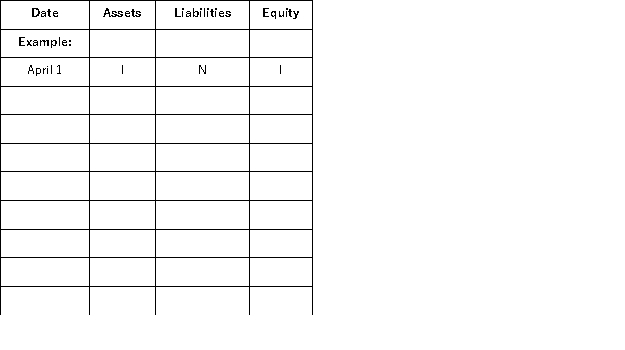

Soo Lin, the sole stockholder, began an Internet Consulting practice organized as a corporation and completed these transactions during April of the current year:  Show the effects of the above transactions on the accounting equation of Soo Lin, Consultant. Use the following format for your answers. The first item is shown as an example.

Increase = I Decrease = D No effect = N

Show the effects of the above transactions on the accounting equation of Soo Lin, Consultant. Use the following format for your answers. The first item is shown as an example.

Increase = I Decrease = D No effect = N

(Essay)

4.9/5  (40)

(40)

Rico's Taqueria had cash inflows from operating activities of $27,000; cash outflows from investing activities of $22,000, and cash outflows from financing activities of $12,000. Calculate the net increase or decrease in cash.

(Multiple Choice)

4.8/5  (37)

(37)

If assets are $365,000 and equity is $120,000, then liabilities are:

(Multiple Choice)

4.9/5  (26)

(26)

Rent expense appears on which of the following statements?

(Multiple Choice)

4.8/5  (32)

(32)

Investing activities involve the buying and selling of assets such as land and equipment that are held for long-term use in the business.

(True/False)

4.9/5  (39)

(39)

The business entity assumption means that a business is accounted for separately from other business entities, including its owner or owners.

(True/False)

5.0/5  (39)

(39)

Alpha Company has assets of $600,000, liabilities of $250,000, and equity of $350,000. It buys office equipment on credit for $75,000. What would be the effects of this transaction on the accounting equation?

(Multiple Choice)

4.9/5  (40)

(40)

Use the following information as of December 31 to determine equity.

(Multiple Choice)

4.7/5  (38)

(38)

If a company purchases equipment costing $4,500 on credit, the effect on the accounting equation would be:

(Multiple Choice)

4.9/5  (31)

(31)

Generally the lower the risk, the higher the return that can be expected.

(True/False)

4.7/5  (32)

(32)

The assumption that requires that a business be accounted for separately from its owners is the __________________ assumption.

(Short Answer)

4.9/5  (40)

(40)

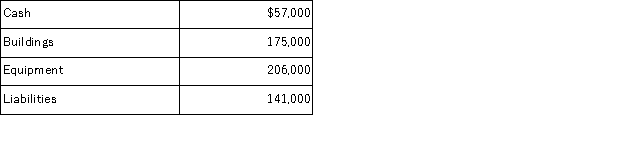

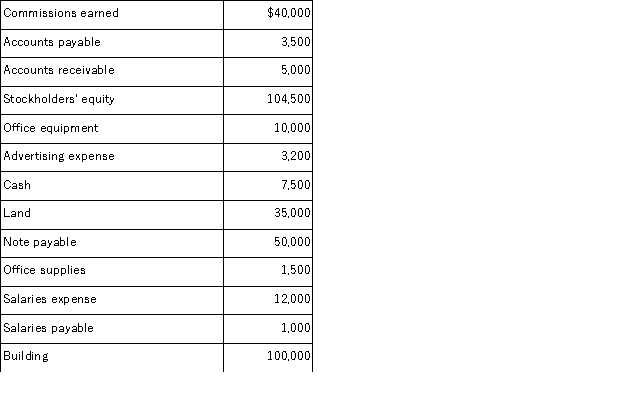

Prepare a December 31 balance sheet in proper form for Cane Property Management, Inc. using the following accounts and amounts:

(Essay)

4.8/5  (35)

(35)

Showing 221 - 240 of 270

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)