Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

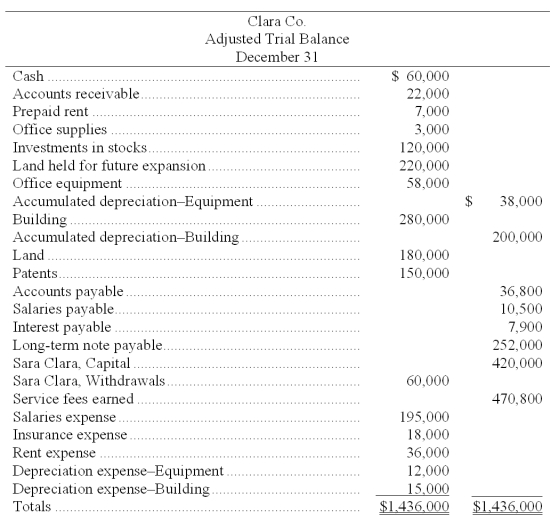

The following adjusted trial balance is for Clara Co. at year-end December 31. The credit balance in Clara, Capital at the beginning of the year, January 1, was $320,000. The owner, Sara Clara, invested an additional $100,000 during the current year. The land held for future expansion was also purchased during the current year.  Required:

Prepare a classified balance sheet. (Note: A $21,000 installment on the long-term note payable is due within one year.)

Required:

Prepare a classified balance sheet. (Note: A $21,000 installment on the long-term note payable is due within one year.)

Free

(Not Answered)

This question doesn't have any answer yet

On a work sheet, a loss is indicated if the total of the Income Statement Debit column exceeds the total of the Income Statement Credit column.

Free

(True/False)

4.7/5  (29)

(29)

Correct Answer:

True

A trial balance prepared after the closing entries have been journalized and posted is the:

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

At the beginning of the year, a company's balance sheet reported the following balances: Total Assets = $125,000; Total Liabilities = $75,000; and Owner's Capital = $50,000. During the year, the company reported revenues of $46,000 and expenses of $30,000. In addition, owner's withdrawals for the year totaled $20,000. Assuming no other changes to owner's capital, the balance in the owner's capital account at the end of the year would be:

(Multiple Choice)

4.8/5  (27)

(27)

Revenues, expenses, withdrawals, and Income Summary are called _________________ accounts because they are closed at the end of each accounting period.

(Short Answer)

4.8/5  (39)

(39)

A classified balance sheet organizes assets and liabilities into important subgroups that provide more information to decision makers.

(True/False)

4.9/5  (33)

(33)

Which of the following errors would cause the Balance Sheet and Statement of Owner's Equity columns of a work sheet to be out of balance?

(Multiple Choice)

4.8/5  (32)

(32)

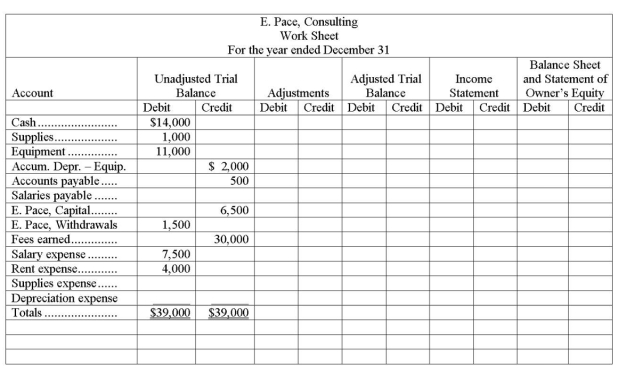

The unadjusted trial balance of

E. Pace, Consultant is entered on the partial work sheet below. Complete the work sheet using the following information:

(a) Salaries earned by employees that are unpaid and unrecorded, $500.

(b) An inventory of supplies showed $800 of unused supplies still on hand.

(c) Depreciation on equipment, $1,300.

(Not Answered)

This question doesn't have any answer yet

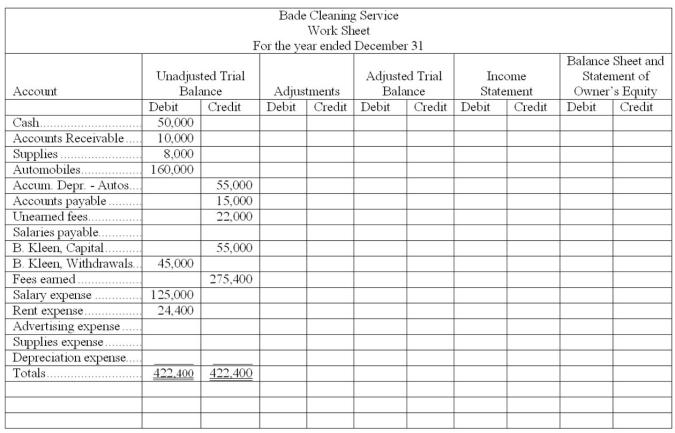

The unadjusted trial balance of Bade Cleaning Service is entered on the partial work sheet below. Complete the work sheet using the following information:

(a) Salaries earned by employees that are unpaid and unrecorded, $4,000.

(b) An inventory of supplies showed $3,000 of unused supplies still on hand.

(c) Depreciation on automobiles, $30,000.

(d) Services paid in advance by customers of $12,000 have now been provided to customers.

(e) Advertising for November and December in the amount of $8,000 remains unpaid and unrecorded.

(Not Answered)

This question doesn't have any answer yet

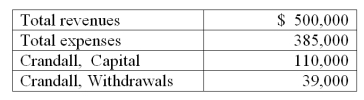

The following information is available for Crandall Company before closing the accounts. After all of the closing entries are made, what will be the balance in the Crandall, Capital account?

(Multiple Choice)

4.8/5  (25)

(25)

What is the purpose of closing entries? Describe the closing process.

(Essay)

4.9/5  (34)

(34)

The ______________ refers to the steps in preparing financial statements for users.

(Short Answer)

4.8/5  (37)

(37)

In the process of completing a work sheet, you determine that the Income Statement debit column totals $83,000, while the Income Statement credit column totals $65,000. To enter net income (or net loss) for the period into the work sheet would require an entry to

(Multiple Choice)

4.8/5  (35)

(35)

A classified balance sheet differs from an unclassified balance sheet in that

(Multiple Choice)

4.8/5  (29)

(29)

All necessary numbers to prepare the balance sheet can be found in the balance sheet columns of the work sheet including ending owner's capital.

(True/False)

4.9/5  (32)

(32)

A work sheet is a tool to help organize information needed in adjusting the accounts and preparing the financial statements.

(True/False)

4.8/5  (33)

(33)

Bentley records adjusting entries at its December 31 year end. At December 31, employees had earned $12,000 of unpaid and unrecorded salaries. The next payday is January 3, at which time $30,000 will be paid. Prepare the journal on January 3 to record payment assuming the correct adjusting and reversing entries were made on December 31 and January 1.

(Multiple Choice)

4.9/5  (34)

(34)

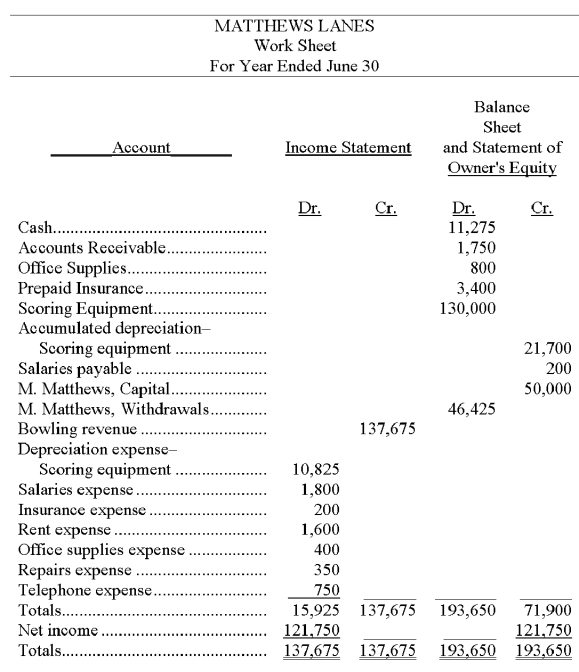

Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of owner's equity and a classified balance sheet (Assume the owner did not make any investments in the business this year.)

(Not Answered)

This question doesn't have any answer yet

Since it is an important financial statement, the trial balance must be prepared according to specified accounting procedures.

(True/False)

4.8/5  (35)

(35)

How is the current ratio calculated? How is it used to evaluate a company?

(Essay)

4.9/5  (41)

(41)

Showing 1 - 20 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)