Exam 6: Inventories and Cost of Sales

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

Explain the difference between the retail inventory method and gross profit inventory method for valuing inventory.

Free

(Essay)

4.9/5  (33)

(33)

Correct Answer:

The retail method is generally used to prepare interim statements. It uses the cost to retail ratio to give an estimated ending inventory at cost. The gross profit method is typically used to reconstruct the value of lost, stolen, or destroyed inventory. It uses the (historical) gross profit ratio to estimate cost of goods sold and the value of ending inventory.

Pettis needs to determine its year-end inventory. The warehouse contains 20,000 units, of which 3,000 were damaged by flood and cannot be sold. Another 2,000 units, shipped FOB shipping point, are in transit. The company also consigns goods and has 4,000 units at a consignee's location. How many units should Pettis include in its year-end inventory?

Free

(Multiple Choice)

4.9/5  (32)

(32)

Correct Answer:

B

The _________________ method is commonly used to estimate the value of inventory that has been destroyed, lost, or stolen.

Free

(Short Answer)

4.8/5  (27)

(27)

Correct Answer:

Gross profit

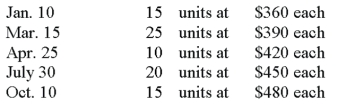

A company made the following purchases during the year:  On December 31, there were 28 units in ending inventory. These 28 units consisted of 1 from the January 10 purchase, 2 from the March 15 purchase, 5 from the April 25 purchase, 15 from the July 30 purchase, and 5 from the October 10 purchase. Using specific identification, calculate the cost of the ending inventory.

On December 31, there were 28 units in ending inventory. These 28 units consisted of 1 from the January 10 purchase, 2 from the March 15 purchase, 5 from the April 25 purchase, 15 from the July 30 purchase, and 5 from the October 10 purchase. Using specific identification, calculate the cost of the ending inventory.

(Not Answered)

This question doesn't have any answer yet

The full disclosure principle requires that the notes to the financial statements report a change in accounting method for inventory.

(True/False)

4.7/5  (35)

(35)

Acceptable methods of assigning specific costs to inventory and cost of goods sold include all of the following except:

(Multiple Choice)

4.8/5  (40)

(40)

The choice of an inventory valuation method can have a major impact on gross profit and cost of sales.

(True/False)

4.8/5  (33)

(33)

An inventory error is sometimes said to be self-correcting because it causes an offsetting error in the next period.

(True/False)

4.7/5  (37)

(37)

The inventory valuation method that identifies each item in ending inventory with a specific purchase and invoice is the:

(Multiple Choice)

4.8/5  (34)

(34)

An understatement of the ending inventory balance will understate cost of goods sold and overstate net income.

(True/False)

4.8/5  (23)

(23)

A company's total cost of inventory was $305,000 and its market value is $297,000. Under the lower cost or market, the amount reported should be $305,000.

(True/False)

4.7/5  (34)

(34)

A company's store was destroyed by a fire on February 10 of the current year. The only information for the current period that could be salvaged included the following:

Beginning inventory, January 1: $34,000

Purchases to date: $118,000

Sales to date: $140,000

Historically, the company's gross profit ratio has been 30%. Estimate the value of the destroyed inventory using the gross profit method.

(Not Answered)

This question doesn't have any answer yet

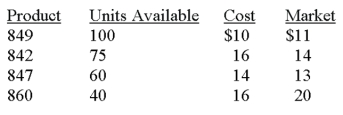

A company reported the following data related to its ending inventory:  Calculate the lower-of-cost-or-market on the: (a) Inventory as a whole and (b) inventory applied separately to each product.

Calculate the lower-of-cost-or-market on the: (a) Inventory as a whole and (b) inventory applied separately to each product.

(Not Answered)

This question doesn't have any answer yet

A company has inventory of 10 units at a cost of $10 each on June 1. On June 3, it purchased 20 units at $12 each. 12 units are sold on June 5. Using the FIFO perpetual inventory method, what is the cost of the 12 units that were sold?

(Multiple Choice)

4.8/5  (30)

(30)

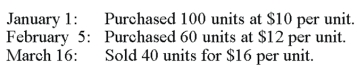

Using the information given below, prepare the general journal entry to record the March 16 sale assuming a cash sale and the weighted average method is used.

(Not Answered)

This question doesn't have any answer yet

If the _______________ is responsible for paying the freight, ownership of merchandise inventory passes when goods are loaded on the transport vehicle.

(Short Answer)

4.7/5  (25)

(25)

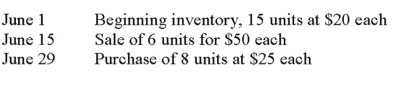

Given the following information, determine the cost of the inventory at June 30 using the LIFO perpetual inventory method.  The cost of the ending inventory is

The cost of the ending inventory is

(Multiple Choice)

4.7/5  (44)

(44)

The inventory manager's compensation includes a bonus plan based on gross profit. You discover that the inventory manager has knowingly overstated ending inventory by $2 million. What effect does this error have on the financial statements of the company and specifically gross profit? Why would the manager knowingly overstate ending inventory? Would this be considered an ethics violation?

(Essay)

4.9/5  (39)

(39)

The lower of cost or market rule for inventory valuation must be applied to each individual unit separately, and not to major categories of inventory or to the entire inventory.

(True/False)

4.8/5  (33)

(33)

Showing 1 - 20 of 198

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)