Exam 12: Super-Variable Costing

Exam 1: Managerial Accounting and Cost Concepts190 Questions

Exam 2: Least-Squares Regression Computations21 Questions

Exam 3: Cost of Quality42 Questions

Exam 4: Job-Order Costing166 Questions

Exam 5: Activity-Based Absorption Costing17 Questions

Exam 6: The Predetermined Overhead Rate and Capacity28 Questions

Exam 7: Process Costing126 Questions

Exam 8: Fifo Method82 Questions

Exam 9: Service Department Allocations56 Questions

Exam 10: Cost-Volume-Profit Relationships187 Questions

Exam 11: Variable Costing and Segment Reporting: Tools for Management236 Questions

Exam 12: Super-Variable Costing49 Questions

Exam 13: Activity-Based Costing: a Tool to Aid Decision Making150 Questions

Exam 14: Abc Action Analysis16 Questions

Select questions type

Assume that the company uses a variable costing system that assigns $22 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

D

The unit product cost under super-variable costing is:

Free

(Multiple Choice)

4.7/5  (35)

(35)

Correct Answer:

A

Assume that the company uses a variable costing system that assigns $19 of direct labor cost to each unit that is produced. The net operating income under this costing system is:

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

A

Goodwyn Corporation manufactures and sells one product. In the company's first year of operations, the variable cost consisted solely of direct materials of $89 per unit. The annual fixed costs were $1,269,000 of direct labor cost, $3,619,000 of fixed manufacturing overhead expense, and $1,260,000 of fixed selling and administrative expense. The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 47,000 units and sold 42,000 units. The company's only product is sold for $259 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses a variable costing system that assigns $27 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

(Essay)

4.8/5  (32)

(32)

All differences between super-variable costing and absorption costing are explained by:

(Multiple Choice)

4.7/5  (31)

(31)

Rhoda Corporation manufactures and sells one product. In the company's first year of operations, the variable cost consisted solely of direct materials of $87 per unit. The annual fixed costs were $912,000 of direct labor cost, $2,128,000 of fixed manufacturing overhead expense, and $1,320,000 of fixed selling and administrative expense. The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 38,000 units and sold 33,000 units. The company's only product is sold for $240 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year.

b. Assume the company uses super-variable costing. Prepare an income statement for the year.

(Essay)

4.9/5  (30)

(30)

The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.7/5  (32)

(32)

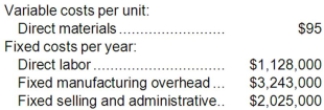

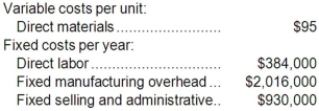

Mendoza Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 47,000 units and sold 45,000 units. The company's only product is sold for $275 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses a variable costing system that assigns $24 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

c. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 47,000 units and sold 45,000 units. The company's only product is sold for $275 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses a variable costing system that assigns $24 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

c. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

(Essay)

4.9/5  (47)

(47)

Assume that the company uses a variable costing system that assigns $16 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

(Multiple Choice)

4.9/5  (38)

(38)

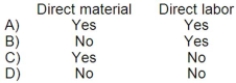

Calder Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 48,000 units and sold 45,000 units. The company's only product is sold for $258 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year.

b. Assume the company uses super-variable costing. Prepare an income statement for the year.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 48,000 units and sold 45,000 units. The company's only product is sold for $258 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year.

b. Assume the company uses super-variable costing. Prepare an income statement for the year.

(Essay)

4.9/5  (46)

(46)

Assume that the company uses a variable costing system that assigns $18 of direct labor cost to each unit that is produced. The net operating income under this costing system is:

(Multiple Choice)

4.8/5  (44)

(44)

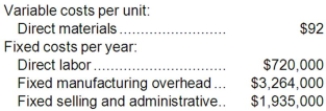

Under super-variable costing, which of the following is treated as a period cost?

(Multiple Choice)

4.8/5  (43)

(43)

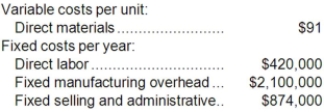

Griffy Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 30,000 units and sold 23,000 units. The company's only product is sold for $239 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 30,000 units and sold 23,000 units. The company's only product is sold for $239 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

c. Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

(Essay)

5.0/5  (28)

(28)

The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.9/5  (43)

(43)

Assume that the company uses a variable costing system that assigns $16 of direct labor cost to each unit that is produced. The net operating income under this costing system is:

(Multiple Choice)

4.9/5  (28)

(28)

Quiller Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $233 per unit. The company is considering using either super-variable costing or a variable costing system that assigns $12 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $233 per unit. The company is considering using either super-variable costing or a variable costing system that assigns $12 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

(Multiple Choice)

4.9/5  (36)

(36)

The company is considering using either super-variable costing or a variable costing system that assigns $14 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

(Multiple Choice)

5.0/5  (37)

(37)

Assume that the company uses a variable costing system that assigns $22 of direct labor cost to each unit that is produced. The net operating income under this costing system is:

(Multiple Choice)

4.7/5  (45)

(45)

The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.9/5  (42)

(42)

Showing 1 - 20 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)