Exam 11: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts190 Questions

Exam 2: Least-Squares Regression Computations21 Questions

Exam 3: Cost of Quality42 Questions

Exam 4: Job-Order Costing166 Questions

Exam 5: Activity-Based Absorption Costing17 Questions

Exam 6: The Predetermined Overhead Rate and Capacity28 Questions

Exam 7: Process Costing126 Questions

Exam 8: Fifo Method82 Questions

Exam 9: Service Department Allocations56 Questions

Exam 10: Cost-Volume-Profit Relationships187 Questions

Exam 11: Variable Costing and Segment Reporting: Tools for Management236 Questions

Exam 12: Super-Variable Costing49 Questions

Exam 13: Activity-Based Costing: a Tool to Aid Decision Making150 Questions

Exam 14: Abc Action Analysis16 Questions

Select questions type

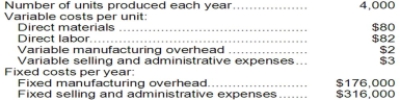

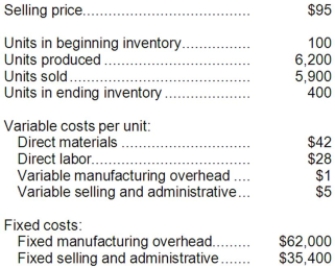

Redstone Corporation produces a single product and has the following cost structure:  Required:

a. Compute the unit product cost under absorption costing. Show your work!

b. Compute the unit product cost under variable costing. Show your work!

Required:

a. Compute the unit product cost under absorption costing. Show your work!

b. Compute the unit product cost under variable costing. Show your work!

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

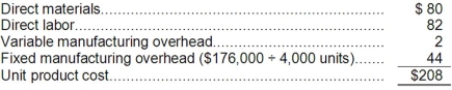

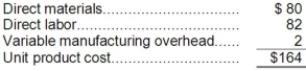

a. Absorption costing:  b. Variable costing:

b. Variable costing:

The unit product cost under variable costing was:

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

D

What is the total period cost for the month under the absorption costing?

Free

(Multiple Choice)

4.7/5  (41)

(41)

Correct Answer:

A

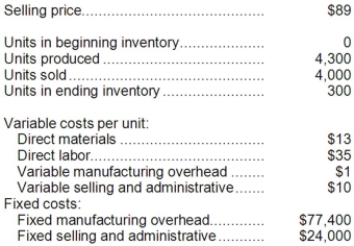

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:

(Multiple Choice)

4.8/5  (30)

(30)

What is the company's overall net operating income if it operates at the break-even points for its two divisions?

(Multiple Choice)

4.9/5  (46)

(46)

Assuming the LIFO inventory flow assumption, if production equals sales for the period, absorption costing and variable costing will produce the same net operating income.

(True/False)

4.7/5  (36)

(36)

Bode Corporation has two divisions: East and West. Data from the most recent month appear below:  The company's common fixed expenses total $47,300. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

The company's common fixed expenses total $47,300. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

(Multiple Choice)

4.7/5  (40)

(40)

Segment margin is a better measure of the long-run profitability of a segment than contribution margin.

(True/False)

4.9/5  (41)

(41)

For the year in question, net operating income under variable costing will be:

(Multiple Choice)

4.9/5  (34)

(34)

Pen Corporation manufactures a single product. Last year, the company's variable costing net operating income was $55,700 and ending inventory increased by 800 units. Fixed manufacturing overhead cost per unit was $3 in both beginning and ending inventory.

Required:

Determine the absorption costing net operating income for last year. Show your work!

(Essay)

4.8/5  (37)

(37)

Lee Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month. Assume direct labor is a variable cost.

Required:

a. What is the unit product cost for the month under variable costing?

b. What is the unit product cost for the month under absorption costing?

c. Prepare a contribution format income statement for the month using variable costing.

d. Prepare an income statement for the month using absorption costing.

e. Reconcile the variable costing and absorption costing net operating incomes for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month. Assume direct labor is a variable cost.

Required:

a. What is the unit product cost for the month under variable costing?

b. What is the unit product cost for the month under absorption costing?

c. Prepare a contribution format income statement for the month using variable costing.

d. Prepare an income statement for the month using absorption costing.

e. Reconcile the variable costing and absorption costing net operating incomes for the month.

(Essay)

4.8/5  (46)

(46)

If a cost is a common cost of the segments on a segmented income statement, the cost should:

(Multiple Choice)

4.9/5  (40)

(40)

A proposal has been made that will lower variable expenses in Store A to 62% of sales. However, this reduction can only be accomplished by an increase in Store A's traceable fixed expenses of $8,000. If this proposal is implemented and sales remain constant, overall company net operating income should:

(Multiple Choice)

4.8/5  (36)

(36)

Under variable costing, ending inventory on the balance sheet would be valued at:

(Multiple Choice)

4.7/5  (34)

(34)

Managers will often allocate common fixed expenses to business segments because:

(Multiple Choice)

4.8/5  (32)

(32)

Quinnett Corporation has two divisions: the Export Products Division and the Business Products Division. The Export Products Division's divisional segment margin is $34,300 and the Business Products Division's divisional segment margin is $86,700. The total amount of common fixed expenses not traceable to the individual divisions is $95,600. What is the company's net operating income?

(Multiple Choice)

4.7/5  (41)

(41)

Net operating income is affected by the number of units produced when absorption costing is used.

(True/False)

4.9/5  (42)

(42)

Showing 1 - 20 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)