Exam 3: Operating Decisions and the Accounting System

Exam 1: Financial Statements and Business Decisions130 Questions

Exam 2: Investing and Financing Decisions and the Accounting System139 Questions

Exam 3: Operating Decisions and the Accounting System128 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings138 Questions

Exam 5: Communicating and Interpreting Accounting Information119 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash130 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory137 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources131 Questions

Exam 9: Reporting and Interpreting Liabilities129 Questions

Exam 10: Reporting and Interpreting Bond Securities128 Questions

Exam 11: Reporting and Interpreting Stockholders Equity133 Questions

Exam 12: Statement of Cash Flows121 Questions

Exam 13: Analyzing Financial Statements125 Questions

Exam 14: PPA: Reporting and Interpreting Investments in Other Corporations115 Questions

Select questions type

Daring Dolls, Inc. received an order to provide SuperDolls for a big department store. The store paid Daring Dolls in advance for the order of SuperDolls. Which of the following describes what will occur when Daring Dolls recognizes revenue?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following correctly applies the revenue recognition principle?

(Multiple Choice)

4.9/5  (43)

(43)

A company purchased supplies for cash, which will be consumed during future months. Which of the following does not correctly describe the impact on the financial statements when the supplies are used during future months?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is an example of revenue or expense to be recognized in the current period's income statement?

(Multiple Choice)

4.8/5  (34)

(34)

Describe the difference between operating expenses and losses from the sale of plant and equipment while providing examples of each.

(Essay)

4.8/5  (41)

(41)

Colby Corporation has provided the following information: • Operating revenues from customers were $199,700.

• Operating expenses for the store were $111,000.

• Interest expense was $9,200.

• Gain from sale of plant and equipment was $3,300.

• Dividend payments to Colby's stockholders were $7,700.

• Income tax expense was $36,000.

• Prepaid rent expense was $5,000.

How much was Colby's net income?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following expenses does not affect the reporting of operating income?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following transactions would be reported as cash flow from operating activities on a cash flow statement?

(Multiple Choice)

4.7/5  (27)

(27)

Which of the following best describes the time period assumption?

(Multiple Choice)

4.8/5  (36)

(36)

Expense accounts have debit balances because they decrease net income, retained earnings, and stockholders' equity.

(True/False)

4.8/5  (38)

(38)

Which of the following transactions will result in an increase in operating income as of the date of the transaction?

(Multiple Choice)

4.9/5  (43)

(43)

According to the expense recognition principle, wages expense is recognized on the income statement when the wages are paid rather than when the employee provides the work.

(True/False)

4.9/5  (33)

(33)

Which of the following journal entries correctly records a transaction where services were provided to a customer on account?

(Multiple Choice)

4.8/5  (41)

(41)

The following information has been provided by Flatiron Company for the year ended December 31, 2016:

Net income was $71,000;

Income tax expense was $47,000;

Dividends declared and paid totaled $7,500;

Interest expense was $8,700;

Loss on sale of plant assets was $15,000;

Operating expenses for rent, wages, and insurance totaled $91,000;

Cash collected from customers was $220,000.

Required:

Calculate Flatiron's operating income.

(Essay)

4.8/5  (41)

(41)

Expenses are the result of decreases in assets or increases in liabilities incurred in order to generate revenues.

(True/False)

4.7/5  (34)

(34)

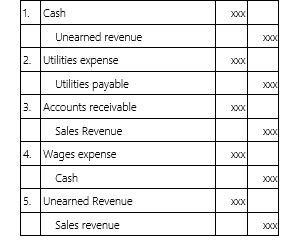

Describe the transaction that created the following journal entries (amounts omitted).

(Essay)

4.8/5  (35)

(35)

Mama June Pizza Company determined that dough, sauce, cheese and other ingredients costing $8,700 were used to make pizzas during July. Which of the following statements is false with respect to the use of the ingredients?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following transactions would not be reported as cash flow from operating activities on a cash flow statement?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 101 - 120 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)