Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential

Exam 1: Intercorporate Acquisitions and Investments in Other Entities47 Questions

Exam 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential39 Questions

Exam 3: The Reporting Entity and Consolidation of Less-Than-Wholly-Owned Subsidiaries With No Differential39 Questions

Exam 4: Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book Value47 Questions

Exam 5: Consolidation of Less-Than-Wholly-Owned Subsidiaries Acquired at More Than Book Value41 Questions

Exam 6: Intercompany Inventory Transactions51 Questions

Exam 7: Intercompany Transfers of Services and Noncurrent Assets46 Questions

Exam 8: Multinational Accounting: Foreign Currency Transactions and Financial Instruments56 Questions

Exam 9: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements60 Questions

Exam 10: Partnerships: Formation, Operation, and Changes in Membership56 Questions

Exam 11: Partnerships: Liquidation49 Questions

Exam 12: Governmental Entities: Introduction and General Fund Accounting69 Questions

Exam 13: Governmental Entities: Special Funds and Government-Wide Financial Statements68 Questions

Select questions type

In the absence of other evidence, common stock ownership of 20 percent or more is viewed as indicating that the investor is able to exercise significant influence over the investee. What are some of the other factors that could constitute evidence of the ability to exercise significant influence?

Free

(Essay)

4.7/5  (40)

(40)

Correct Answer:

APB stated that these include:

1. Representation on board of directors

2. Participation in policy making

3. Material intercompany transactions

4. Interchange of managerial personnel

5. Technological dependency

6. Size of investment in relation to concentration of other shareholdings

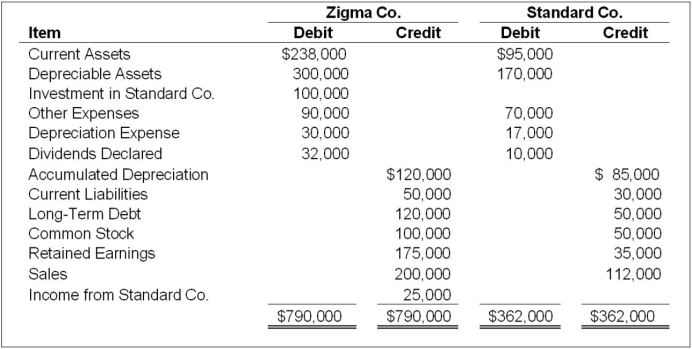

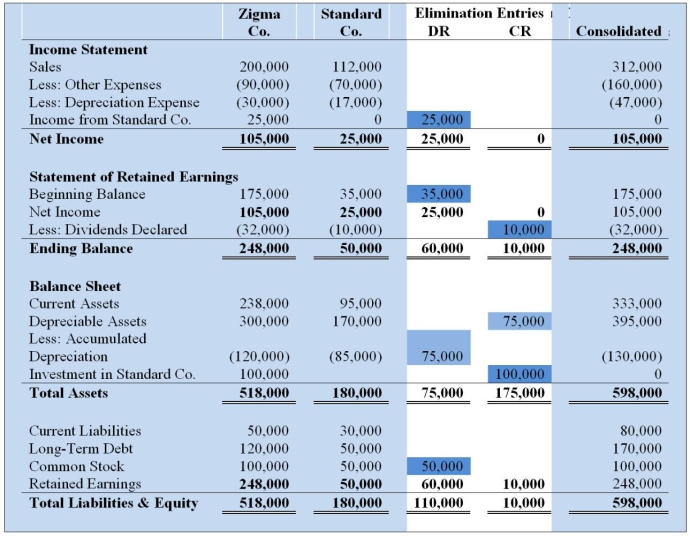

On January 1, 20X9, Zigma Company acquired 100 percent of Standard Company's common shares at underlying book value. Zigma uses the equity method in accounting for its ownership of Standard. On December 31, 20X9, the trial balances of the two companies are as follows:  Required:

1) Prepare the eliminating entries needed as of December 31, 20X9, to complete a consolidation worksheet.

2) Prepare a three-part consolidation worksheet as of December 31, 20X9.

Required:

1) Prepare the eliminating entries needed as of December 31, 20X9, to complete a consolidation worksheet.

2) Prepare a three-part consolidation worksheet as of December 31, 20X9.

Free

(Essay)

4.9/5  (43)

(43)

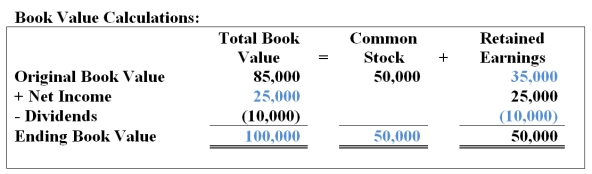

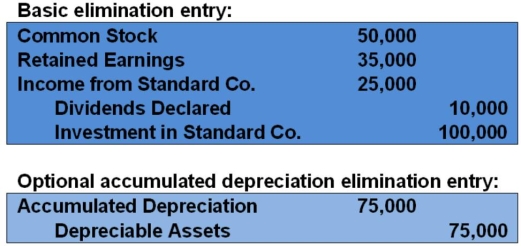

Correct Answer:

1)

(T-Accounts not required)

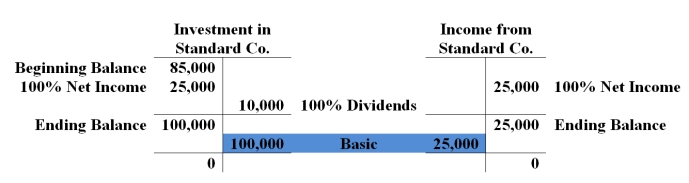

(T-Accounts not required)  2)

2)

Parent Co. purchases 100% of Son Company on January 1, 20X1 when Parent's retained earnings balance is $520,000 and Son's is $150,000. During 20X1, Son reports $15,000 of net income and declares $6,000 of dividends. Parent reports $105,000 of separate operating earnings plus $15,000 of equity-method income from its 100 percent interest in Son; Parent declares dividends of $40,000.

-Based on the preceding information, what is the consolidated retained earnings balance on December 31, 20X1?

Free

(Multiple Choice)

4.8/5  (47)

(47)

Correct Answer:

C

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

-Based on the preceding information, what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition?

(Multiple Choice)

4.8/5  (33)

(33)

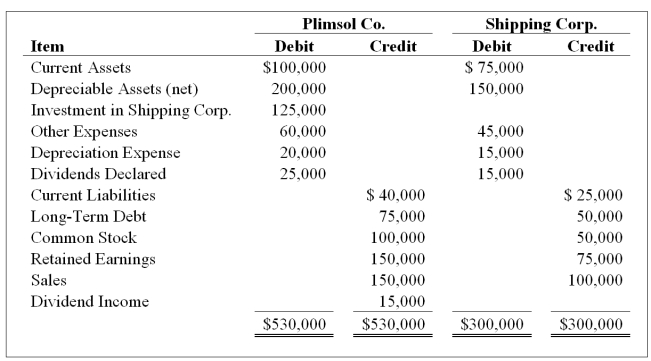

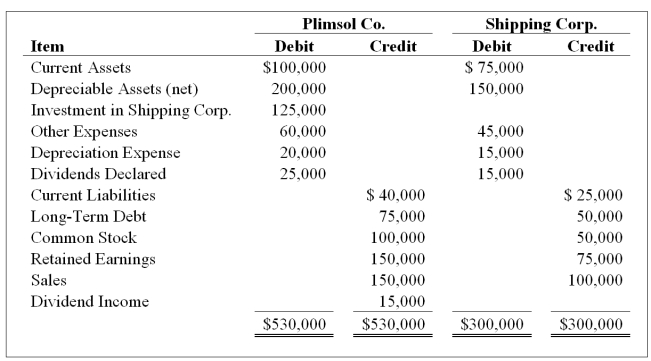

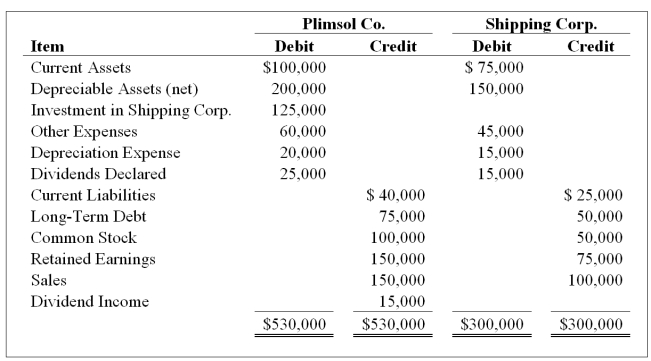

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:  -Based on the information provided, what amount of retained earnings will be reported in the consolidated balance sheet prepared on December 31, 20X4?

-Based on the information provided, what amount of retained earnings will be reported in the consolidated balance sheet prepared on December 31, 20X4?

(Multiple Choice)

4.8/5  (39)

(39)

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

-Based on the preceding information, what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

(Multiple Choice)

4.8/5  (35)

(35)

A change from the cost method to the equity method of accounting for an investment in common stock resulting from an increase in the number of shares held by the investor requires:

(Multiple Choice)

4.7/5  (46)

(46)

Which of the following observations is consistent with the equity method of accounting?

(Multiple Choice)

4.8/5  (40)

(40)

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:  -Based on the information provided, what amount of total stockholder's equity will be reported in the consolidated balance sheet prepared on December 31, 20X4?

-Based on the information provided, what amount of total stockholder's equity will be reported in the consolidated balance sheet prepared on December 31, 20X4?

(Multiple Choice)

4.8/5  (40)

(40)

If Push Company owned 51 percent of the outstanding common stock of Shove Company, which reporting method would be appropriate?

(Multiple Choice)

5.0/5  (32)

(32)

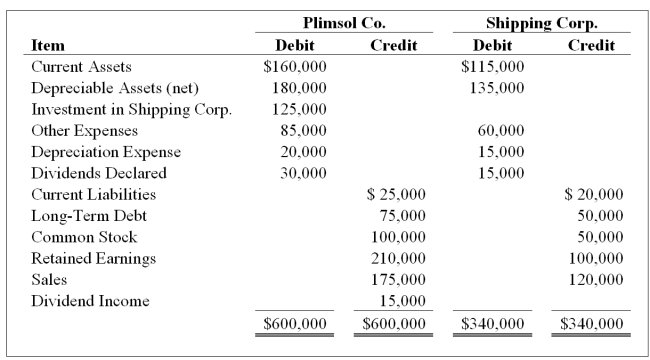

On January 1, 20X7, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's reported retained earnings of $75,000 on the date of acquisition. The trial balances for Plimsol Company and Shipping Corporation as of December 31, 20X8, follow:  Required:

1) Provide all eliminating entries required to prepare a full set of consolidated statements for 20X8.

2) Prepare a three-part consolidation worksheet in good form as of December 31, 20X8.

Required:

1) Provide all eliminating entries required to prepare a full set of consolidated statements for 20X8.

2) Prepare a three-part consolidation worksheet in good form as of December 31, 20X8.

(Essay)

4.9/5  (38)

(38)

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

-Based on the preceding information, what amount will be reported by Yang as balance in investment in Spiel on December 31, 20X8, if it used the fair value method of accounting?

(Multiple Choice)

4.7/5  (37)

(37)

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:  -Based on the information provided, what amount of total liabilities will be reported in the consolidated balance sheet prepared on December 31, 20X4?

-Based on the information provided, what amount of total liabilities will be reported in the consolidated balance sheet prepared on December 31, 20X4?

(Multiple Choice)

4.8/5  (33)

(33)

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

-Based on the preceding information, what amount will be reported by Yang as income from its investment in Spiel for 20X8, if it used the equity method of accounting?

(Multiple Choice)

4.9/5  (46)

(46)

On January 1, 20X8, William Company acquired 30 percent of eGate Company's common stock, at underlying book value of $100,000. eGate has 100,000 shares of $2 par value, 5 percent cumulative preferred stock outstanding. No dividends are in arrears. eGate reported net income of $150,000 for 20X8 and paid total dividends of $72,000. William uses the equity method to account for this investment.

-Based on the preceding information, what amount would William Company receive as dividends from eGate for the year?

(Multiple Choice)

4.9/5  (32)

(32)

Under the equity method of accounting for a stock investment, the investment initially should be recorded at:

(Multiple Choice)

4.7/5  (33)

(33)

Parent Co. purchases 100% of Son Company on January 1, 20X1 when Parent's retained earnings balance is $520,000 and Son's is $150,000. During 20X1, Son reports $15,000 of net income and declares $6,000 of dividends. Parent reports $105,000 of separate operating earnings plus $15,000 of equity-method income from its 100 percent interest in Son; Parent declares dividends of $40,000.

-Based on the preceding information, what is Son's post closing retained earnings balance on December 31, 20X1?

(Multiple Choice)

4.8/5  (38)

(38)

The main pronouncement on equity-method reporting, APB 19 (ASC 323 and 325) requires all of the following except:

(Multiple Choice)

4.9/5  (39)

(39)

What portion of the balances of subsidiary stockholders' equity accounts are eliminated in preparing the consolidated balance sheet?

(Multiple Choice)

4.9/5  (41)

(41)

Dear Corporation acquired 100 percent of the voting shares of Therry Inc. by issuing 10,000 new shares of $5 par value common stock with a $30 market value.

Required:

1) Which company is the parent and which is the subsidiary?

2) Define a subsidiary corporation.

3) Define a parent corporation.

4) Which entity prepares consolidated worksheet?

5) Why are elimination entries used?

(Essay)

4.9/5  (33)

(33)

Showing 1 - 20 of 39

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)