Exam 7: Analyzing Common Stocks

Exam 1: The Investment Environment82 Questions

Exam 2: Securities Markets and Transactions113 Questions

Exam 3: Investment Information and Securities Transactions134 Questions

Exam 4: Return and Risk130 Questions

Exam 5: Modern Portfolio Concepts110 Questions

Exam 6: Common Stocks136 Questions

Exam 7: Analyzing Common Stocks128 Questions

Exam 8: Stock Valuation122 Questions

Exam 9: Market Efficiency and Behavioral Finance114 Questions

Exam 10: Fixed-Income Securities128 Questions

Exam 11: Bond Valuation120 Questions

Exam 12: Mutual Funds and Exchange-Traded Funds121 Questions

Exam 13: Managing Your Own Portfolio121 Questions

Exam 14: Options: Puts and Calls128 Questions

Exam 15: Futures Markets and Securities110 Questions

Select questions type

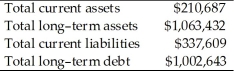

On March 31, Adolpha, Inc. reported the following information on its financial statements.  What is the available net working capital for Adolpha, Inc.?

What is the available net working capital for Adolpha, Inc.?

(Multiple Choice)

4.7/5  (40)

(40)

A firm with a very low debt-equity ratio has a low risk of defaulting on its loans.

(True/False)

4.9/5  (39)

(39)

Financial ratios can reveal a lot about a company's liquidity, activity, and profitability.

(True/False)

4.9/5  (27)

(27)

Markets can only be efficient if many competent analysts are performing fundamental analysis.

(True/False)

4.9/5  (43)

(43)

For a company to remain in business for the long term, cash flow from investing activities and financing activities must generally be positive numbers.

(True/False)

4.8/5  (39)

(39)

Which of the following is a readily available source of industry comparisons.

I. Standard & Poor's

II. MSN Money, Yahoo Finance and other financial portals

III. Mergent (Moody's)

IV. The Wall Street Journal

(Multiple Choice)

4.8/5  (30)

(30)

Investors who want to analyze a company's ratios usually need to compute them from the financial statements.

(True/False)

4.8/5  (42)

(42)

The business cycle reflects economic changes only in the industrial sectors of the economy.

(True/False)

4.8/5  (43)

(43)

In addition to company reports, Value Line also publishes industry analyses.

(True/False)

4.8/5  (35)

(35)

Economic analysis is relatively useless for investment purposes since the stock market is used to forecast the economy.

(True/False)

4.8/5  (31)

(31)

Which of the following would be found on a company's balance sheet?

I. Accounts receivable

II. Interest expense

III. Property plant and equipment

IV. Total stockholders' equity

(Multiple Choice)

4.8/5  (40)

(40)

Banks can use the times interest earned ratio as a measure of a borrower's ability to repay their loan.

(True/False)

4.8/5  (42)

(42)

Fundamental analysis encompasses return, but not risk, in the valuation process.

(True/False)

5.0/5  (44)

(44)

Price-to-book-value indicates how aggressively a stock is being priced.

(True/False)

4.8/5  (36)

(36)

For most companies, the dividend payout ratio falls within the range of

(Multiple Choice)

4.9/5  (44)

(44)

Rising corporate profits and are likely to have the greatest effect on which of the following industrial sectors?

(Multiple Choice)

4.8/5  (34)

(34)

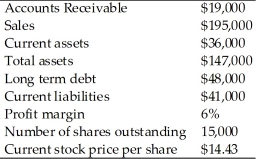

The following information is available for the Oil Creek Corporation.  (a) What is the current ratio?

(b) What is the net working capital?

(c) What is the net income?

(d) What is the return on equity?

(e) What is the total asset turnover?

(f) What is the debt-equity ratio?

(g) What is the accounts receivable turnover?

(h) What is the earnings per share (EPS)?

(i) What is the price to earnings (P/E) ratio?

(a) What is the current ratio?

(b) What is the net working capital?

(c) What is the net income?

(d) What is the return on equity?

(e) What is the total asset turnover?

(f) What is the debt-equity ratio?

(g) What is the accounts receivable turnover?

(h) What is the earnings per share (EPS)?

(i) What is the price to earnings (P/E) ratio?

(Essay)

4.8/5  (30)

(30)

Which of the following measures excludes non-cash charges against income.

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)