Exam 5: Modern Portfolio Concepts

Exam 1: The Investment Environment82 Questions

Exam 2: Securities Markets and Transactions113 Questions

Exam 3: Investment Information and Securities Transactions134 Questions

Exam 4: Return and Risk130 Questions

Exam 5: Modern Portfolio Concepts110 Questions

Exam 6: Common Stocks136 Questions

Exam 7: Analyzing Common Stocks128 Questions

Exam 8: Stock Valuation122 Questions

Exam 9: Market Efficiency and Behavioral Finance114 Questions

Exam 10: Fixed-Income Securities128 Questions

Exam 11: Bond Valuation120 Questions

Exam 12: Mutual Funds and Exchange-Traded Funds121 Questions

Exam 13: Managing Your Own Portfolio121 Questions

Exam 14: Options: Puts and Calls128 Questions

Exam 15: Futures Markets and Securities110 Questions

Select questions type

The index used to represent market returns is always assigned a beta of 1.0.

(True/False)

4.8/5  (45)

(45)

In severe market downturns different asset classes become less correlated.

(True/False)

4.9/5  (35)

(35)

OKAY stock has a beta of 0.73. The market as a whole is expected to decline by 20% thereby causing OKAY stock to

(Multiple Choice)

4.8/5  (39)

(39)

When the Capital Asset Pricing Model is depicted graphically, the result is the

(Multiple Choice)

4.9/5  (39)

(39)

Analysts commonly use the ________ to measure market return.

(Multiple Choice)

4.8/5  (40)

(40)

The investment choice of an individual is affected by

I. their tolerance for risk.

II. their prior investment experience.

III. their marginal tax bracket.

IV. the stability of their income.

(Multiple Choice)

4.8/5  (36)

(36)

It is relatively easy to obtain the beta for actively traded stocks.

(True/False)

4.9/5  (41)

(41)

If the actual rate of return on an investment portfolio is constant from year to year, the standard deviation of that portfolio is zero.

(True/False)

4.8/5  (34)

(34)

If there is no relationship between the rates of return of two assets over time, these assets are

(Multiple Choice)

4.8/5  (37)

(37)

A portfolio with a beta of 1.5 will be 50% more volatile than the market portfolio.

(True/False)

4.9/5  (42)

(42)

The statement "A portfolio is less than the sum of its parts." means:

(Multiple Choice)

4.8/5  (41)

(41)

The stock of a technology company has an expected return of 15% and a standard deviation of 20%. The stock of a pharmaceutical company has an expected return of 13% and a standard deviation of 18%. A portfolio consisting of 50% invested in each stock will have an expected return of 14 % and a standard deviation

(Multiple Choice)

4.8/5  (42)

(42)

Modern portfolio theory seeks to minimize risk and maximize return by combining highly correlated assets.

(True/False)

4.8/5  (35)

(35)

Which one of the following conditions can be effectively eliminated through portfolio diversification?

(Multiple Choice)

4.8/5  (30)

(30)

Beta measures diversifiable risk while standard deviation measures systematic risk.

(True/False)

4.8/5  (36)

(36)

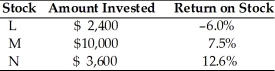

Marco owns the following portfolio of stocks. What is the expected return on his portfolio?

(Multiple Choice)

4.9/5  (39)

(39)

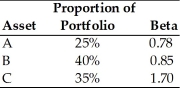

Jonathan has the following portfolio of assets.  What is the beta of Jonathan's portfolio?

What is the beta of Jonathan's portfolio?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 61 - 80 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)