Exam 21: Incremental Analysis

Exam 1: Accounting: Information for Decision Making118 Questions

Exam 2: Basic Financial Statements142 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events150 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals131 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results126 Questions

Exam 6: Merchandising Activities121 Questions

Exam 7: Financial Assets206 Questions

Exam 8: Inventories and the Cost of Goods Sold147 Questions

Exam 9: Plant and Intangible Assets147 Questions

Exam 10: Liabilities197 Questions

Exam 11: Stockholders Equity: Paid-In Capital148 Questions

Exam 12: Income and Changes in Retained Earnings133 Questions

Exam 13: Statement of Cash Flows163 Questions

Exam 14: Financial Statement Analysis146 Questions

Exam 15: Global Business and Accounting82 Questions

Exam 16: Management Accounting112 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations103 Questions

Exam 18: Process Costing83 Questions

Exam 19: Costing and the Value Chain70 Questions

Exam 20: Cost-Volume-Profit Analysis121 Questions

Exam 21: Incremental Analysis97 Questions

Exam 22: Responsibility Accounting and Transfer Pricing88 Questions

Exam 23: Operational Budgeting93 Questions

Exam 24: Standard Cost Systems110 Questions

Exam 25: Rewarding Business Performance69 Questions

Exam 26: Capital Budgeting99 Questions

Exam 27: the Time Value of Money: Future Amounts and Present Values49 Questions

Exam 28: Forms of Business Organization51 Questions

Select questions type

Direct material costs are always considered relevant costs in a make or buy decision.

(True/False)

4.7/5  (41)

(41)

Products resulting from a shared manufacturing process are referred to as complimentary products.

(True/False)

4.8/5  (41)

(41)

[The following information applies to the questions displayed below.]

JCN Industries normally produces and sells 5,000 keyboards for personal computers each month.Variable manufacturing costs amount to $25 per unit,and fixed costs are $146,000 per month.The regular sales price of the keyboards is $86 per unit.JCN has been approached by a foreign company that wants to purchase an additional 1,000 keyboards per month at a reduced price.Filling this special order would not affect JCN 's regular sales volume or fixed manufacturing costs.

-On the basis of the above information only,which of the following is not true?

(Multiple Choice)

4.8/5  (41)

(41)

[The following information applies to the questions displayed below.]

General Chemical Company (GCC)manufactures two products as part of a joint process: A1 and B1.Joint costs up to the split-off point total $22,000.The joint costs are allocated to A1 and B1 in proportion to their relative sales values.At the split-off point,product A1 can be sold for $42,000,whereas product B1 can be sold for $63,000.Product A1 can be processed further to make product A2,at an incremental cost of $38,000.A2 can be sold for $85,000.Product B1 can be processed further to make product B2,at an incremental cost of $48,000.B2 can be sold for $95,000.

-Joint costs allocated to product A1 total:

(Multiple Choice)

4.8/5  (48)

(48)

[The following information applies to the questions displayed below.]

Express,Inc. ,is considering replacing equipment.The following data are available:

![[The following information applies to the questions displayed below.] Express,Inc. ,is considering replacing equipment.The following data are available: -Which of the data above is a sunk cost?](https://storage.examlex.com/TB1009/11eaae1a_a2a7_a5a7_b09f_19b73a1e7520_TB1009_00.jpg) -Which of the data above is a sunk cost?

-Which of the data above is a sunk cost?

(Multiple Choice)

4.7/5  (42)

(42)

[The following information applies to the questions displayed below.]

John Boyd Corporation manufactures and sells 1,000 tractors each month.The primary component in each tractor is the motor.John Boyd has the monthly capacity to produce 1,300 motors.The variable costs associated with manufacturing each motor are shown below:

![[The following information applies to the questions displayed below.] John Boyd Corporation manufactures and sells 1,000 tractors each month.The primary component in each tractor is the motor.John Boyd has the monthly capacity to produce 1,300 motors.The variable costs associated with manufacturing each motor are shown below: Fixed manufacturing overhead per month (for up to 1,300 units of production)averages $27,000.Joan Reid,Inc.has offered to purchase 200 motors from John Boyd per month to be used in its own outboard motors. -If Joan Reid's order is rejected,what will be John Boyd 's average unit cost of manufacturing each motor?](https://storage.examlex.com/TB1009/11eaae1a_a2a3_ae02_b09f_3f594e434b2d_TB1009_00_TB1009_00.jpg) Fixed manufacturing overhead per month (for up to 1,300 units of production)averages $27,000.Joan Reid,Inc.has offered to purchase 200 motors from John Boyd per month to be used in its own outboard motors.

-If Joan Reid's order is rejected,what will be John Boyd 's average unit cost of manufacturing each motor?

Fixed manufacturing overhead per month (for up to 1,300 units of production)averages $27,000.Joan Reid,Inc.has offered to purchase 200 motors from John Boyd per month to be used in its own outboard motors.

-If Joan Reid's order is rejected,what will be John Boyd 's average unit cost of manufacturing each motor?

(Multiple Choice)

4.8/5  (35)

(35)

A cost that has already been incurred and cannot be changed is called a(n):

(Multiple Choice)

4.8/5  (39)

(39)

Perfect Plumbing Corporation currently manufactures a valve for use in water pumps that it produces for sale.The company is considering purchasing the valves from an outside supplier rather than manufacturing them.Which of the following costs is not relevant to the decision?

(Multiple Choice)

4.9/5  (31)

(31)

Incremental analysis - accepting a special order

Essential Company normally produces and sells 4,000 video monitors for personal computers each month.Variable manufacturing costs amount to $62 per unit,and fixed manufacturing costs are $170,000 per month.The regular sales price of the monitors is $140 per unit.The company is considering a special order from a foreign computer maker to buy an additional 1,000 monitors per month at a special price of $70 per unit.Filling this special order would not affect Essential Company's regular sales volume or fixed manufacturing costs.

(a)The average cost per unit at the 4,000-unit-per-month production level is $________ per unit.

(b)The average cost per unit at the 5,000-unit-per-month production level is $________ per unit.

(c)The amount of increase or decrease (indicate the correct term)in Essential Company's operating income that would result from accepting the special order is $________.

(Essay)

4.8/5  (35)

(35)

Seeking creative solutions to problems

Explain why it would be irresponsible and shortsighted for managers to base decisions entirely on revenue and cost figures.

(Essay)

4.9/5  (36)

(36)

Which factor is not relevant in deciding whether or not to accept a special order?

(Multiple Choice)

4.9/5  (31)

(31)

Joint production decisions

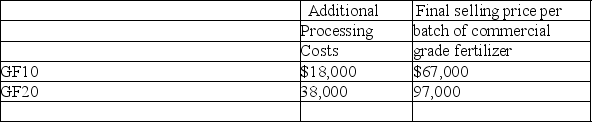

Grassy Fertilizer manufactures two lines of garden grade fertilizer as part of a joint production process: GF10 and GF20.Joint costs up to the split-off point total $85,000 per batch.These joint costs are allocated to GF10 and GF20 in proportion to their relative sales values at the split-off point of $40,000 and $60,000,respectively.

Both lines of garden grade fertilizer can be further processed into commercial grade fertilizer.The following table summarizes the costs and revenue associated with additional processing of GF10 and GF20:

(a)The $85,000 in joint costs should be allocated to each product as follows:

GF10 $________,GF20 $________

(b)Which product (GF10 or GF20)would result in a net decrease in operating income if processed into a commercial grade fertilizer?

________

(c)Which product (GF10 or GF20)would result in a net increase in operating income if processed into a commercial grade fertilizer?

________

(a)The $85,000 in joint costs should be allocated to each product as follows:

GF10 $________,GF20 $________

(b)Which product (GF10 or GF20)would result in a net decrease in operating income if processed into a commercial grade fertilizer?

________

(c)Which product (GF10 or GF20)would result in a net increase in operating income if processed into a commercial grade fertilizer?

________

(Essay)

4.8/5  (37)

(37)

[The following information applies to the questions displayed below.]

Perry's Cycle Company manufactures annually 20,000 units of TushSeat,a bicycle seat used on many of the company's products,and also sold directly to retailers for $38 per unit.At the current level of production,the cost per unit to produce TushSeat consists of:

![[The following information applies to the questions displayed below.] Perry's Cycle Company manufactures annually 20,000 units of TushSeat,a bicycle seat used on many of the company's products,and also sold directly to retailers for $38 per unit.At the current level of production,the cost per unit to produce TushSeat consists of: It has come to the attention of management that a seat of similar quality can be purchased from outside suppliers. -Assume that seats can be purchased from the outside supplier at $25 each,and that 60% of total fixed costs incurred in producing TushSeat will be eliminated by this strategy.Buying the seats instead of manufacturing them would cause Perry's operating income to:](https://storage.examlex.com/TB1009/11eaae1a_a2a5_f7f4_b09f_0bb8da33717f_TB1009_00_TB1009_00.jpg) It has come to the attention of management that a seat of similar quality can be purchased from outside suppliers.

-Assume that seats can be purchased from the outside supplier at $25 each,and that 60% of total fixed costs incurred in producing TushSeat will be eliminated by this strategy.Buying the seats instead of manufacturing them would cause Perry's operating income to:

It has come to the attention of management that a seat of similar quality can be purchased from outside suppliers.

-Assume that seats can be purchased from the outside supplier at $25 each,and that 60% of total fixed costs incurred in producing TushSeat will be eliminated by this strategy.Buying the seats instead of manufacturing them would cause Perry's operating income to:

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following types of cost are always relevant to a decision?

(Multiple Choice)

4.9/5  (33)

(33)

Burns decides to accept the special order for 5,000 units from Allen at a unit sales price that will add $100,000 per month to its operating income.The unit price Burns charging Allen is:

(Multiple Choice)

4.8/5  (35)

(35)

What are the total relevant costs of keeping the old equipment?

(Multiple Choice)

4.7/5  (41)

(41)

Showing 61 - 80 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)