Exam 28: Forms of Business Organization

Exam 1: Accounting: Information for Decision Making118 Questions

Exam 2: Basic Financial Statements142 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events150 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals131 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results126 Questions

Exam 6: Merchandising Activities121 Questions

Exam 7: Financial Assets206 Questions

Exam 8: Inventories and the Cost of Goods Sold147 Questions

Exam 9: Plant and Intangible Assets147 Questions

Exam 10: Liabilities197 Questions

Exam 11: Stockholders Equity: Paid-In Capital148 Questions

Exam 12: Income and Changes in Retained Earnings133 Questions

Exam 13: Statement of Cash Flows163 Questions

Exam 14: Financial Statement Analysis146 Questions

Exam 15: Global Business and Accounting82 Questions

Exam 16: Management Accounting112 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations103 Questions

Exam 18: Process Costing83 Questions

Exam 19: Costing and the Value Chain70 Questions

Exam 20: Cost-Volume-Profit Analysis121 Questions

Exam 21: Incremental Analysis97 Questions

Exam 22: Responsibility Accounting and Transfer Pricing88 Questions

Exam 23: Operational Budgeting93 Questions

Exam 24: Standard Cost Systems110 Questions

Exam 25: Rewarding Business Performance69 Questions

Exam 26: Capital Budgeting99 Questions

Exam 27: the Time Value of Money: Future Amounts and Present Values49 Questions

Exam 28: Forms of Business Organization51 Questions

Select questions type

The salaries paid to partners are shown as an expense on the income statement while the salary taken by a sole proprietor is debited to a drawing account.

(True/False)

4.8/5  (40)

(40)

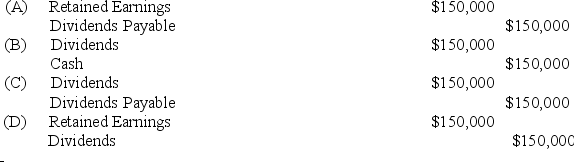

The journal entry when a dividend is declared for $150,000 would be:

(Multiple Choice)

4.8/5  (33)

(33)

John's Metalworks Incorporated recently issued 10,000 shares of stock in exchange for $100,000.Metal works' journal entry to record this transaction included:

(Multiple Choice)

5.0/5  (36)

(36)

Personal liability of the owners for any business debts is an important consideration when selecting an appropriate form of business organization.

(True/False)

4.9/5  (31)

(31)

Net income in a partnership may not be distributed to the partners:

(Multiple Choice)

4.8/5  (38)

(38)

X Corporation had a net income of $375,000 in 2018.The Board of Directors declared a dividend of $0.25 a share on the 150,000 shares outstanding on December 13 to be paid on December 23.Retained earnings on January 01,2019 were $630,000.

(a)Prepare the journal entries for the declaration of the dividends and for the payment of these dividends.

(b)Prepare the Retained Earnings Statement at the end of 2018.

(Essay)

5.0/5  (34)

(34)

C,D,and E are partners.C has $25,000 in her capital account.D has $35,000 in hers,and E has $45,000.Each gets a salary allowance of $15,000.C gets 10% interest on the beginning balance in the capital account,D gets 12%,and E gets 14%.The remainder is divided 20% to C,35% to E,and 45% to E.What is the balance in the capital account at the end of the year if net income was $80,000?

(Essay)

4.8/5  (38)

(38)

The entry to record the issuance of 100 shares of capital stock in exchange for $1,000 cash includes a debit to Capital Stock.

(True/False)

4.9/5  (39)

(39)

A partnership has a limited life and each partner has unlimited personal liability.

(True/False)

4.9/5  (34)

(34)

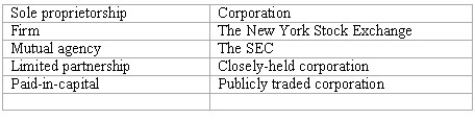

Listed below are several accounting terms introduced in this section.  Each of the following statements may (or may not)describe one of these accounting terms.In the space provided,indicate the term described,or enter "none" if the statement does not correctly describe any of the terms.

________ (A. )An unincorporated business owned by one person.

________ (B. )An example of an organized securities market.

________ (C. )The right of each partner to negotiate binding contracts.

________ (D. )The total earnings of a corporation less dividends paid out.

________ (E. )Investments by the owners of a corporation.

________ (F. )A partnership where one or more partners are not personally liable for the debts of the partnership.

________ (G. )An organization that serves the professional needs of a CPA.

________ (H. )A business that is responsible for its own debts and which pays income taxes on its earnings.

________ (I. )An unincorporated business owned by two or more people.

________ (J. )A corporation whose shares are not publicly traded.

Each of the following statements may (or may not)describe one of these accounting terms.In the space provided,indicate the term described,or enter "none" if the statement does not correctly describe any of the terms.

________ (A. )An unincorporated business owned by one person.

________ (B. )An example of an organized securities market.

________ (C. )The right of each partner to negotiate binding contracts.

________ (D. )The total earnings of a corporation less dividends paid out.

________ (E. )Investments by the owners of a corporation.

________ (F. )A partnership where one or more partners are not personally liable for the debts of the partnership.

________ (G. )An organization that serves the professional needs of a CPA.

________ (H. )A business that is responsible for its own debts and which pays income taxes on its earnings.

________ (I. )An unincorporated business owned by two or more people.

________ (J. )A corporation whose shares are not publicly traded.

(Essay)

4.8/5  (33)

(33)

The ability of a sole proprietorship to pay its debts may be determined by the financial strength of the owner.

(True/False)

4.8/5  (33)

(33)

Mutual agency refers to the ability of each partner to withdraw cash and other assets at will.

(True/False)

4.8/5  (36)

(36)

Which of the following is a characteristic of a corporation?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following is a characteristic of a corporation?

(Multiple Choice)

4.9/5  (44)

(44)

The assets of a partnership belong jointly to all the partners while the assets of a sole proprietorship belong to the proprietorship.

(True/False)

4.8/5  (36)

(36)

The adjusting entry to record income taxes in an unprofitable period would debit Income Tax Payable and credit Income Tax Expense.

(True/False)

4.9/5  (36)

(36)

Showing 21 - 40 of 51

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)