Exam 5: Time Value of Money

Exam 1: An Overview of Financial Management65 Questions

Exam 2: Financial Markets and Institutions33 Questions

Exam 3: Financial Statements,cash Flow and Taxes138 Questions

Exam 4: Analysis of Financial Statements133 Questions

Exam 5: Time Value of Money164 Questions

Exam 6: A Continuous-Compounding-And-Discounting8 Questions

Exam 7: Interest Rates76 Questions

Exam 8: Bonds and Their Valuation92 Questions

Exam 9: Risk and Rates of Return147 Questions

Exam 10: Stocks and Their Valuation89 Questions

Exam 11: The Cost of Capital94 Questions

Exam 12: The Basics of Capital Budgeting107 Questions

Exam 13: Cash Flow Estimation and Risk Analysis73 Questions

Exam 14: Capital Structure and Leverage88 Questions

Exam 16: Working Capital Management124 Questions

Exam 17: Financial Planning and Forecasting39 Questions

Exam 18: Multinational Financial Management100 Questions

Exam 19: Zero-Coupon-Bonds18 Questions

Exam 20: Bankruptcy and Reorganization3 Questions

Exam 21: Calculating Beta Coefficients8 Questions

Exam 22: Using the CAPM to Estimate the Risk-Adjusted Cost of Capital5 Questions

Exam 23: Techniques for Measuring Beta Risk3 Questions

Exam 24: Comparing Mutually Exclusive Projects with Unequal Lives2 Questions

Exam 25: Degree of Leverage23 Questions

Select questions type

Pace Co.borrowed $25,000 at a rate of 7.25%,simple interest,with interest paid at the end of each month.The bank uses a 360-day year.How much interest would Pace have to pay in a 30-day month?

(Multiple Choice)

4.7/5  (27)

(27)

You want to go to Europe 5 years from now,and you can save $7,300 per year,beginning one year from today.You plan to deposit the funds in a mutual fund that you think will return 8.5% per year.Under these conditions,how much would you have just after you make the 5th deposit,5 years from now?

(Multiple Choice)

4.9/5  (37)

(37)

Charter Bank pays a 4.50% nominal rate on deposits,with monthly compounding.What effective annual rate (EFF%)does the bank pay?

(Multiple Choice)

4.9/5  (40)

(40)

Suppose a State of California bond will pay $1,000 eight years from now.If the going interest rate on these 8-year bonds is 6.6%,how much is the bond worth today?

(Multiple Choice)

4.8/5  (32)

(32)

Bob has $2,500 invested in a bank that pays 6.6% annually.How long will it take for his funds to double?

(Multiple Choice)

4.9/5  (38)

(38)

Suppose you have $1,375 and plan to purchase a 5-year certificate of deposit (CD)that pays 3.5% interest,compounded annually.How much will you have when the CD matures?

(Multiple Choice)

4.7/5  (40)

(40)

What is the PV of an annuity due with 5 payments of $4,200 at an interest rate of 5.5%?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT?

(Multiple Choice)

4.8/5  (31)

(31)

If we are given a periodic interest rate,say a monthly rate,we can find the nominal annual rate by dividing the periodic rate by the number of periods per year.

(True/False)

4.8/5  (33)

(33)

Last year Thomson Inc's earnings per share were $3.50,and its growth rate during the prior 5 years was 10.2% per year.If that growth rate were maintained,how many years would it take for Thomson's EPS to triple?

(Multiple Choice)

4.8/5  (31)

(31)

Your aunt has $780,000 invested at 5.5%,and she now wants to retire.She wants to withdraw $45,000 at the beginning of each year,beginning immediately.She also wants to have $50,000 left to give you when she ceases to withdraw funds from the account.For how many years can she make the $45,000 withdrawals and still have $50,000 left in the end?

(Multiple Choice)

4.8/5  (24)

(24)

Suppose a U.S.treasury bond will pay $4,475 five years from now.If the going interest rate on 5-year treasury bonds is 4.25%,how much is the bond worth today?

(Multiple Choice)

5.0/5  (42)

(42)

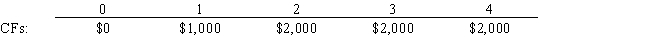

You sold a car and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 13.0%?

(Multiple Choice)

4.8/5  (44)

(44)

How much would $1,growing at 12.0% per year,be worth after 75 years?

(Multiple Choice)

4.9/5  (41)

(41)

Your uncle has $310,000 invested at 7.5%,and he now wants to retire.He wants to withdraw $35,000 at the end of each year,starting at the end of this year.He also wants to have $25,000 left to give you when he ceases to withdraw funds from the account.For how many years can he make the $35,000 withdrawals and still have $25,000 left in the end?

(Multiple Choice)

4.9/5  (33)

(33)

Your grandmother just died and left you $40,000 in a trust fund that pays 6.5% interest.You must spend the money on your college education,and you must withdraw the money in 4 equal installments,beginning immediately.How much could you withdraw today and at the beginning of each of the next 3 years and end up with zero in the account?

(Multiple Choice)

4.9/5  (41)

(41)

Suppose an Exxon Corporation bond will pay $4,500 ten years from now.If the going interest rate on safe 10-year bonds is 5.70%,how much is the bond worth today?

(Multiple Choice)

4.7/5  (31)

(31)

Suppose you deposited $8,000 in a bank account that pays 5.25% with daily compounding based on a 360-day year.How much would be in the account after 8 months,assuming each month has 30 days?

(Multiple Choice)

4.8/5  (37)

(37)

A U.S.Treasury bond will pay a lump sum of $1,000 exactly 3 years from today.The nominal interest rate is 6%,semiannual compounding.Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (32)

(32)

Janice has $5,000 invested in a bank that pays 11.0% annually.How long will it take for her funds to triple?

(Multiple Choice)

4.8/5  (45)

(45)

Showing 141 - 160 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)