Exam 20: Non-Current Assets: Acquisition and Depreciation

Exam 1: Decision Making and the Role of Accounting44 Questions

Exam 2: Financial Statements for Decision Making67 Questions

Exam 3: Recording Transactions64 Questions

Exam 4: Adjusting the Accounts and Preparing Financial Statements65 Questions

Exam 5: Completing the Accounting Cycle Closing and Reversing Entries65 Questions

Exam 6: Accounting for Retailing65 Questions

Exam 7: Accounting for Systems63 Questions

Exam 8: Accounting for Manufacturing65 Questions

Exam 9: Cost Accounting Systems66 Questions

Exam 10: Cash Management and Control65 Questions

Exam 11: Cost-Volume-Profit Analysis for Decision Making65 Questions

Exam 12: Budgeting for Planning and Control65 Questions

Exam 13: Performance Evaluation for Managers65 Questions

Exam 14: Differential Analysis, Profitability Analysis and Capital Budgeting65 Questions

Exam 15: Partnerships: Formation, Operation and Reporting65 Questions

Exam 16: Companies: Formation and Operations65 Questions

Exam 17: Regulation and the Conceptual Framework64 Questions

Exam 18: Receivables65 Questions

Exam 19: Inventories60 Questions

Exam 20: Non-Current Assets: Acquisition and Depreciation65 Questions

Exam 21: Non-Current Assets: Revaluation, Disposal and Other Aspects65 Questions

Exam 22: Liabilities63 Questions

Exam 23: Presentation of Financial Statements65 Questions

Exam 24: Statement of Cash Flows65 Questions

Exam 25: Analysis and Interpretation of Financial Statements64 Questions

Select questions type

A decline in the ratio net sales/average property, plant and equipment over time could mean:

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

D

If the straight-line method of depreciation rather than the reducing-balance method is selected, in the early years of the asset's life the depreciation charge will be comparatively:

Free

(Multiple Choice)

4.9/5  (44)

(44)

Correct Answer:

B

Melbourne Manufacturing purchased a machine for $60 000 on 1 January 2015 which is expected to have a 5 year life, no residual value, and to produce a total of 20 000 wingdings before it is scrapped. Assuming the Melbourne Manufacturing uses the units- of-production method and actual production up to 31 December 2015, (the end of the accounting year) is 5000 wingdings, calculate depreciation expense for 2015.

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

D

Kamp Gravel Co purchased three trucks for $50 000 each plus GST by making a $20 000 down payment and agreeing to pay the balance at the end six months. The journal entry to record the acquisition is which of the following?

$ $

(Multiple Choice)

4.8/5  (42)

(42)

The factor that distinguishes fixed assets such as property, plant and equipment from other assets is:

(Multiple Choice)

4.8/5  (35)

(35)

The correct entry to record the purchase of a motor vehicle for $25 000 cash, plus 10% GST is which of the following?

(Multiple Choice)

4.8/5  (36)

(36)

Ryan Co purchased a computer for $15 000. Originally it had an estimated useful life of 4 years and a residual value of $3000, but on the first day of the 4th year of life the estimated useful life was extended by a further two years and the residual value was reduced to zero. Ryan Co uses the straight-line method to depreciate its computer equipment. At the end of year 4, how much depreciation should be recorded for the computer?

(Multiple Choice)

4.8/5  (33)

(33)

The historical cost of an asset less its residual (scrap) value is called:

(Multiple Choice)

4.9/5  (43)

(43)

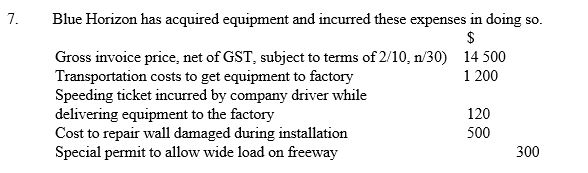

The equipment should be recorded in Blue Horizon's records at:

The equipment should be recorded in Blue Horizon's records at:

(Multiple Choice)

4.8/5  (29)

(29)

Wong purchased a computer for $15 000, net of GST. Originally it had an estimated useful life of 4 years and a residual value of $3000. The straight-line method is used. At the start of the third year of usage Wong revised the life of the computer to a total life of 6 years. The residual value had not changed. What depreciation expense should be recorded for the computer for year 3?

(Multiple Choice)

5.0/5  (37)

(37)

On what basis would the costs of several items of property, plant and equipment, acquired for a lump-sum payment, normally be allocated?

(Multiple Choice)

4.9/5  (34)

(34)

Which of these is not an example of a fixed asset for a company engaged in mining coal?

(Multiple Choice)

4.8/5  (26)

(26)

A popular method for an entity to acquire the benefits of property, plant and equipment is to lease assets. How many of these asset types are commonly subject to lease agreements?

Motor vehicles

Land and buildings

Machinery

Storage space

(Multiple Choice)

4.8/5  (31)

(31)

How many of these are ways in which a residual value can be recovered from an asset on its disposal?

Trade in

Sell second-hand

Gift the asset to charity

Sell for scrap

(Multiple Choice)

4.8/5  (30)

(30)

The depreciation method most commonly used in Australia, as disclosed by a survey of the annual reports of listed companies, is:

(Multiple Choice)

4.9/5  (34)

(34)

An asset bought for $147 000 with a zero residual value was expected to last for seven years before it needed replacing. If at the end of the third year it was decided to extend its total useful life by four years (new remaining life is now eight years), calculate the new depreciation charge using the straight-line approach.

(Multiple Choice)

4.7/5  (41)

(41)

When a second-hand building is purchased which of these should not be debited to the building account but charged to a separate asset account?

(Multiple Choice)

4.7/5  (23)

(23)

If the cost of a major service on a motor vehicle, which did not increased the vehicles' useful life was incorrectly capitalised and added to the carrying amount of the vehicle rather than being expensed, expenses would be:

(Multiple Choice)

4.8/5  (26)

(26)

Showing 1 - 20 of 65

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)