Exam 16: Companies: Formation and Operations

Exam 1: Decision Making and the Role of Accounting44 Questions

Exam 2: Financial Statements for Decision Making67 Questions

Exam 3: Recording Transactions64 Questions

Exam 4: Adjusting the Accounts and Preparing Financial Statements65 Questions

Exam 5: Completing the Accounting Cycle Closing and Reversing Entries65 Questions

Exam 6: Accounting for Retailing65 Questions

Exam 7: Accounting for Systems63 Questions

Exam 8: Accounting for Manufacturing65 Questions

Exam 9: Cost Accounting Systems66 Questions

Exam 10: Cash Management and Control65 Questions

Exam 11: Cost-Volume-Profit Analysis for Decision Making65 Questions

Exam 12: Budgeting for Planning and Control65 Questions

Exam 13: Performance Evaluation for Managers65 Questions

Exam 14: Differential Analysis, Profitability Analysis and Capital Budgeting65 Questions

Exam 15: Partnerships: Formation, Operation and Reporting65 Questions

Exam 16: Companies: Formation and Operations65 Questions

Exam 17: Regulation and the Conceptual Framework64 Questions

Exam 18: Receivables65 Questions

Exam 19: Inventories60 Questions

Exam 20: Non-Current Assets: Acquisition and Depreciation65 Questions

Exam 21: Non-Current Assets: Revaluation, Disposal and Other Aspects65 Questions

Exam 22: Liabilities63 Questions

Exam 23: Presentation of Financial Statements65 Questions

Exam 24: Statement of Cash Flows65 Questions

Exam 25: Analysis and Interpretation of Financial Statements64 Questions

Select questions type

At the end of the year a company declared a final cash dividend out of its retained earnings. Which of the following is the journal entry to record the declaration?

Free

(Multiple Choice)

5.0/5  (39)

(39)

Correct Answer:

D

The person who maintains the minutes of the meetings of the directors and shareholders and represents the company in many legal and contractual matters is:

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

D

Which of the following statements concerning cash dividends is not true?

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

B

How many of the following statements, relating to ordinary shareholders, are true?

Ordinary shareholders generally have greater risks than preference shareholders.

Ordinary shareholders are the last to receive a distribution if the company is wound up.

Ordinary shareholders have a greater opportunity for gain if the company is profitable than preference shareholders.

Ordinary shareholders have the right to vote at meetings of the company.

(Multiple Choice)

4.9/5  (36)

(36)

Under current accounting standards share issue expenses must be treated as a(n):

(Multiple Choice)

4.9/5  (38)

(38)

Which of these is not one of the three major categories that a company's equity can be divided into?

(Multiple Choice)

4.8/5  (31)

(31)

Malaysia Company Ltd decided to issue 200 000 ordinary shares for $2.10c each, payable in instalments, 40c on application, $1 on allotment and the balance payable at the discretion of the company. Applications were received for 220 000 shares. The shares were allotted by the directors at a meeting held a week after the close of applications and refunds were made for 20 000 shares. The journal entry to record the full receipt of the allotment instalment is which of the following?

(Multiple Choice)

4.9/5  (37)

(37)

Malaysia Company Ltd decided to issue 200 000 ordinary shares for $2.10c each, payable in instalments, 40c on application, $1 on allotment and the balance payable at the discretion of the company. Applications were received for 220 000 shares. The shares were allotted by the directors at a meeting held a week after the close of applications and refunds were made for 20 000 shares. The correct journal entry to record the amount due to the company for the allotment instalment is which of the following?

(Multiple Choice)

4.7/5  (43)

(43)

Under current accounting standards share issue expenses are treated as a(n):

(Multiple Choice)

4.8/5  (32)

(32)

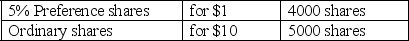

Fletcher Ltd was incorporated on 1 January 2014 and on that date issued:

During December 2017 DT Ltd declared a total of $5000 in dividends. This was the first dividend declared by DT Ltd, that is, no dividends were declared or paid during the first two years of operations. If the preference shares are cumulative and non-participating the total amount of the $5000 dividend that will be available for payment to the ordinary shareholders is:

During December 2017 DT Ltd declared a total of $5000 in dividends. This was the first dividend declared by DT Ltd, that is, no dividends were declared or paid during the first two years of operations. If the preference shares are cumulative and non-participating the total amount of the $5000 dividend that will be available for payment to the ordinary shareholders is:

(Multiple Choice)

4.8/5  (27)

(27)

Diamonta Ltd decided to issue 200 000 ordinary shares for $2.10c each, payable in instalments, 40c on application, $1 on allotment and the balance payable at the discretion of the company. Applications were received for 220 000 shares. The shares were allotted by the directors at a meeting held a week after the close of applications. After refunding applications for 20 000 shares, which of the following is the correct journal entry to transfer the application money to the share capital account?

(Multiple Choice)

4.7/5  (36)

(36)

A company is a legal entity and as such has an additional expense for ________________ in its income statement that sole traders and partnerships do not have.

(Multiple Choice)

4.9/5  (32)

(32)

Kent Ltd issued 15 000 shares with an issue price of $1.60 on which the full price has been paid to the company. The maximum additional amount the shareholders can be asked to contribute if the company cannot pay its debts is:

(Multiple Choice)

4.9/5  (40)

(40)

How many of the following are reasons for a company to declare a share dividend (bonus issue)?

To reduce the market price of their shares.

To capitalise the retained earnings of the company.

To conserve cash.

(Multiple Choice)

4.8/5  (46)

(46)

A legal document accompanying an invitation to purchase shares, containing information about the issuing company, is called a(n):

(Multiple Choice)

4.8/5  (29)

(29)

Which of these accounts used to record the issue of shares is a permanent account?

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 65

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)