Exam 6: Variable Costing: a Tool for Management

Exam 1: Managerial Accounting and the Business Environment24 Questions

Exam 2: Managerial Accounting and Cost Concepts149 Questions

Exam 3: Cost Behavior: Analysis and Use127 Questions

Exam 4: Cost-Volume-Profit Relationships214 Questions

Exam 5: Systems Design: Job-Order Costing114 Questions

Exam 6: Variable Costing: a Tool for Management137 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making75 Questions

Exam 8: Profit Planning144 Questions

Exam 9: Flexible Budgets and Performance Analysis294 Questions

Exam 10: Standard Costs and Operating Performance Measures162 Questions

Exam 11: Segment Reporting,decentralization,and the Balanced Scorecard96 Questions

Exam 12: Relevant Costs for Decision Making129 Questions

Exam 13: Capital Budgeting Decisions137 Questions

Exam 14: Pricing Products and Services62 Questions

Exam 15: Profitability Analysis72 Questions

Exam 16: Least-Squares Regression Computations14 Questions

Exam 17: The Predetermined Overhead Rate and Capacity26 Questions

Exam 18: Abc Action Analysis14 Questions

Exam 19: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System88 Questions

Exam 20: Transfer Pricing19 Questions

Exam 21: Service Department Charges34 Questions

Exam 22: The Concept of Present Value14 Questions

Exam 23: Income Taxes in Capital Budgeting Decisions33 Questions

Select questions type

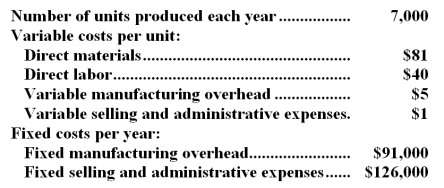

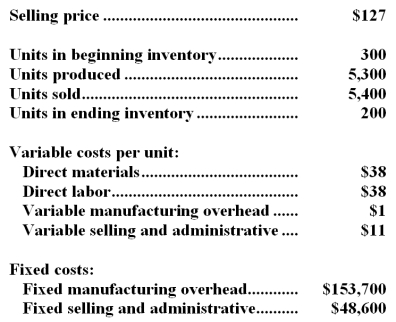

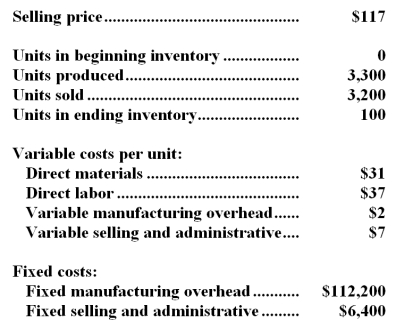

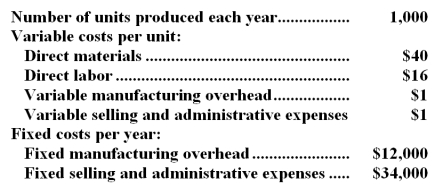

Mcgougan Corporation produces a single product and has the following cost structure:  -The unit product cost under absorption costing is:

-The unit product cost under absorption costing is:

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

Under variable costing,product cost contains some fixed manufacturing overhead cost.

Free

(True/False)

4.9/5  (40)

(40)

Correct Answer:

False

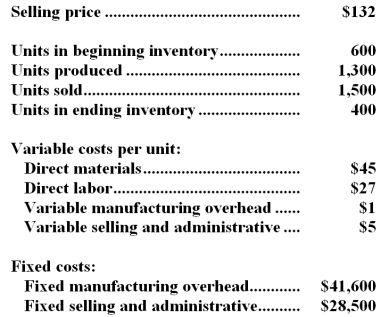

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?

Free

(Multiple Choice)

4.7/5  (44)

(44)

Correct Answer:

C

Erie Company manufactures a single product.Assume the following data for the year just completed:  There were no units in inventory at the beginning of the year.During the year 30,000 units were produced and 25,000 units were sold.Each unit sells for $35.

-Under absorption costing,the unit product cost would be:

There were no units in inventory at the beginning of the year.During the year 30,000 units were produced and 25,000 units were sold.Each unit sells for $35.

-Under absorption costing,the unit product cost would be:

(Multiple Choice)

4.8/5  (31)

(31)

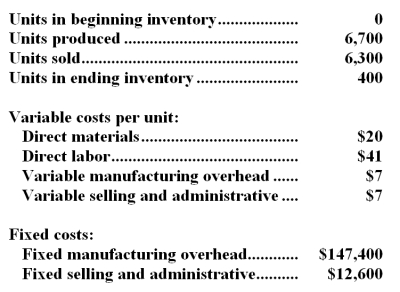

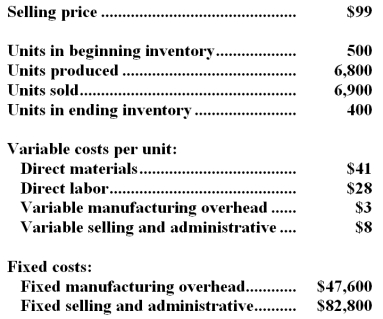

Hackney Company,which has only one product,has provided the following data concerning its most recent month of operations:  -What is the unit product cost for the month under variable costing?

-What is the unit product cost for the month under variable costing?

(Multiple Choice)

4.8/5  (38)

(38)

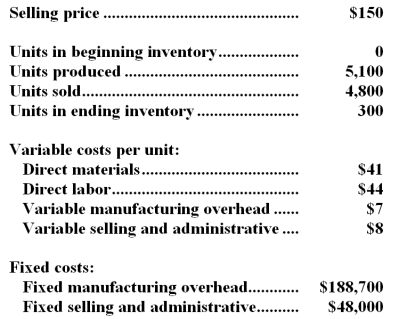

Kidwell Company,which has only one product,has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the net operating income for the month under absorption costing?

The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.8/5  (32)

(32)

Abdol Company,which has only one product,has provided the following data concerning its most recent month of operations:  -What is the net operating income for the month under absorption costing?

-What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.8/5  (34)

(34)

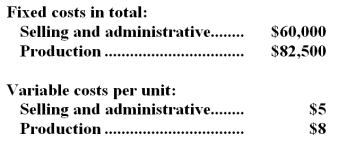

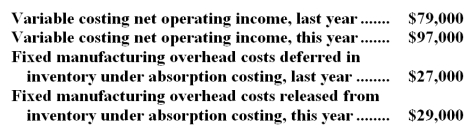

Boyar Corporation manufactures a variety of products.The following data pertain to the company's operations over the last two years:  Required:

a.Determine the absorption costing net operating income last year.Show your work!

b.Determine the absorption costing net operating income this year.Show your work!

Required:

a.Determine the absorption costing net operating income last year.Show your work!

b.Determine the absorption costing net operating income this year.Show your work!

(Essay)

4.9/5  (44)

(44)

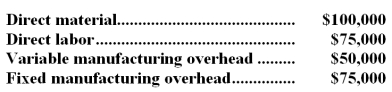

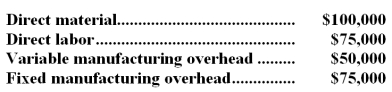

Walsh Company produces a single product.Last year,the company manufactured 25,000 units and sold 22,000 units.Production costs were as follows:  Sales totaled $440,000,variable selling and administrative expenses were $110,000,and fixed selling and administrative expenses were $45,000.There was no beginning inventory.Assume that direct labor is a variable cost.

-The net operating income under variable costing would be:

Sales totaled $440,000,variable selling and administrative expenses were $110,000,and fixed selling and administrative expenses were $45,000.There was no beginning inventory.Assume that direct labor is a variable cost.

-The net operating income under variable costing would be:

(Multiple Choice)

4.8/5  (44)

(44)

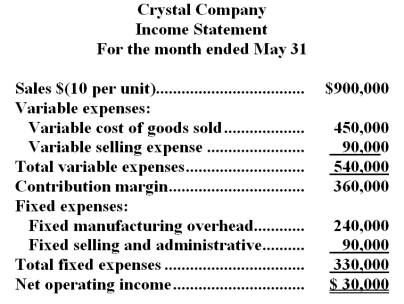

Crystal Company produces a single product.The company's variable costing income statement for the month of May appears below:  The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units.Variable production costs per unit and total fixed costs have remained constant over the past several months.

-The dollar value of the company's inventory on May 31 under the absorption costing method would be:

The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units.Variable production costs per unit and total fixed costs have remained constant over the past several months.

-The dollar value of the company's inventory on May 31 under the absorption costing method would be:

(Multiple Choice)

4.8/5  (32)

(32)

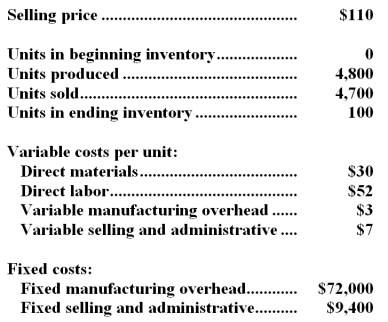

Qiu Company,which has only one product,has provided the following data concerning its most recent month of operations:  Required:

a.What is the unit product cost for the month under variable costing?

b.Prepare a contribution format income statement for the month using variable costing.

c.Without preparing an income statement,determine the absorption costing net operating income for the month.(Hint: Use the reconciliation method. )

Required:

a.What is the unit product cost for the month under variable costing?

b.Prepare a contribution format income statement for the month using variable costing.

c.Without preparing an income statement,determine the absorption costing net operating income for the month.(Hint: Use the reconciliation method. )

(Essay)

4.8/5  (43)

(43)

Leibson Company,which has only one product,has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a.What is the unit product cost for the month under variable costing?

b.What is the unit product cost for the month under absorption costing?

c.Prepare a contribution format income statement for the month using variable costing.

d.Prepare an income statement for the month using absorption costing.

e.Reconcile the variable costing and absorption costing net operating incomes for the month.

The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a.What is the unit product cost for the month under variable costing?

b.What is the unit product cost for the month under absorption costing?

c.Prepare a contribution format income statement for the month using variable costing.

d.Prepare an income statement for the month using absorption costing.

e.Reconcile the variable costing and absorption costing net operating incomes for the month.

(Essay)

4.9/5  (42)

(42)

Schubert Corporation manufactures a variety of products.Variable costing net operating income last year was $59,000 and this year was $70,000.Last year,$31,000 in fixed manufacturing overhead costs were released from inventory under absorption costing.This year,$22,000 in fixed manufacturing overhead costs were deferred in inventory under absorption costing.

-What was the absorption costing net operating income this year?

(Multiple Choice)

4.9/5  (43)

(43)

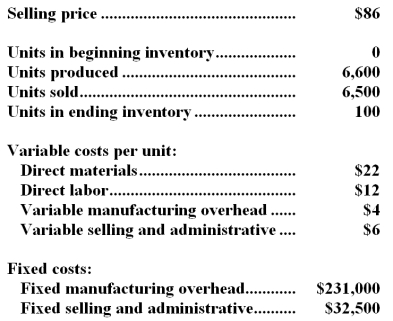

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under absorption costing?

What is the total period cost for the month under absorption costing?

(Multiple Choice)

4.9/5  (35)

(35)

Schubert Corporation manufactures a variety of products.Variable costing net operating income last year was $59,000 and this year was $70,000.Last year,$31,000 in fixed manufacturing overhead costs were released from inventory under absorption costing.This year,$22,000 in fixed manufacturing overhead costs were deferred in inventory under absorption costing.

-What was the absorption costing net operating income last year?

(Multiple Choice)

4.9/5  (37)

(37)

Penna Corporation produces a single product and has the following cost structure:  Required:

a.Compute the unit product cost under absorption costing.Show your work!

b.Compute the unit product cost under variable costing.Show your work!

Required:

a.Compute the unit product cost under absorption costing.Show your work!

b.Compute the unit product cost under variable costing.Show your work!

(Essay)

4.9/5  (35)

(35)

Lee Company produces a single product.At the end of last year,the company had 30,000 units in its ending inventory.Lee's variable production costs are $10 per unit and its fixed manufacturing overhead costs are $5 per unit every year.The company's net operating income for the year was $12,000 higher under variable costing than under absorption costing.Given these facts,the number of units of product in inventory at the beginning of the year must have been:

(Multiple Choice)

4.9/5  (35)

(35)

Jarmon Company,which has only one product,has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the unit product cost for the month under variable costing?

The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

-What is the unit product cost for the month under variable costing?

(Multiple Choice)

5.0/5  (32)

(32)

Walsh Company produces a single product.Last year,the company manufactured 25,000 units and sold 22,000 units.Production costs were as follows:  Sales totaled $440,000,variable selling and administrative expenses were $110,000,and fixed selling and administrative expenses were $45,000.There was no beginning inventory.Assume that direct labor is a variable cost.

-Under variable costing,the total amount of fixed manufacturing cost in the ending inventory would be:

Sales totaled $440,000,variable selling and administrative expenses were $110,000,and fixed selling and administrative expenses were $45,000.There was no beginning inventory.Assume that direct labor is a variable cost.

-Under variable costing,the total amount of fixed manufacturing cost in the ending inventory would be:

(Multiple Choice)

4.8/5  (38)

(38)

Assuming that direct labor is a variable cost,product costs under variable costing include only:

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)