Exam 14: Pricing Products and Services

Exam 1: Managerial Accounting and the Business Environment24 Questions

Exam 2: Managerial Accounting and Cost Concepts149 Questions

Exam 3: Cost Behavior: Analysis and Use127 Questions

Exam 4: Cost-Volume-Profit Relationships214 Questions

Exam 5: Systems Design: Job-Order Costing114 Questions

Exam 6: Variable Costing: a Tool for Management137 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making75 Questions

Exam 8: Profit Planning144 Questions

Exam 9: Flexible Budgets and Performance Analysis294 Questions

Exam 10: Standard Costs and Operating Performance Measures162 Questions

Exam 11: Segment Reporting,decentralization,and the Balanced Scorecard96 Questions

Exam 12: Relevant Costs for Decision Making129 Questions

Exam 13: Capital Budgeting Decisions137 Questions

Exam 14: Pricing Products and Services62 Questions

Exam 15: Profitability Analysis72 Questions

Exam 16: Least-Squares Regression Computations14 Questions

Exam 17: The Predetermined Overhead Rate and Capacity26 Questions

Exam 18: Abc Action Analysis14 Questions

Exam 19: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System88 Questions

Exam 20: Transfer Pricing19 Questions

Exam 21: Service Department Charges34 Questions

Exam 22: The Concept of Present Value14 Questions

Exam 23: Income Taxes in Capital Budgeting Decisions33 Questions

Select questions type

Hostetter Corporation would like to use target costing for a new product it is considering introducing.At a selling price of $30 per unit,management projects sales of 30,000 units.The new product would require an investment of $200,000.The desired return on investment is 13%.The target cost per unit is closest to:

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

D

The more sensitive customers are to price,

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

C

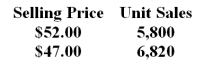

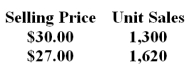

Pasternack Corporation recently changed the selling price of one of its products.Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $23.10 per unit.

Required:

a Compute the product's price elasticity of demand as defined in the text.

b.Compute the product's profit-maximizing price according to the formula in the text.

The product's variable cost is $23.10 per unit.

Required:

a Compute the product's price elasticity of demand as defined in the text.

b.Compute the product's profit-maximizing price according to the formula in the text.

Free

(Essay)

4.8/5  (36)

(36)

Correct Answer:

a.% change in quantity = 17.59%

% change in price = -9.62%

Price elasticity of demand =

= ln(1 + % change in quantity sold)/ln(1 + % change in price)

= ln(1 + 17.59%)/ln(1 + -9.62%) = -1.60

b.Profit-maximizing markup on variable cost = -1/(1 + ed) = -1/(1 + (-1.60)) = 1.66

Profit-maximizing price = (1 + Profit-maximizing markup on variable cost) * Variable cost per unit

= (1 + 1.66) = $23.10 = (2.66) * $23.10 = $61.44

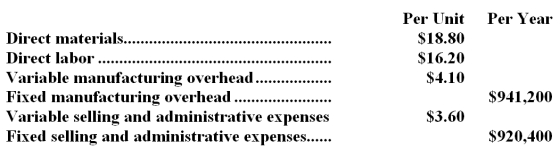

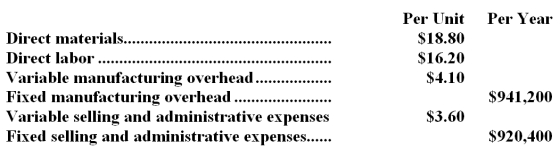

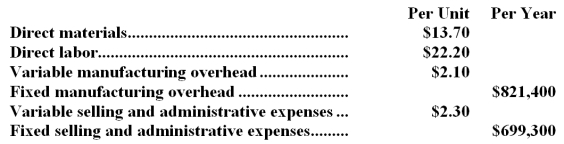

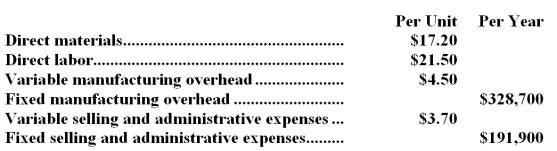

Diehl Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-If every 10% increase in price leads to an 11% decrease in quantity sold,the profit-maximizing price is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-If every 10% increase in price leads to an 11% decrease in quantity sold,the profit-maximizing price is closest to:

(Multiple Choice)

4.8/5  (26)

(26)

Diehl Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-The markup on absorption cost is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-The markup on absorption cost is closest to:

(Multiple Choice)

4.7/5  (33)

(33)

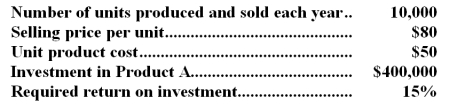

The following information is available on Product A:  The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data,the total selling and administrative expenses each year would be:

The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data,the total selling and administrative expenses each year would be:

(Multiple Choice)

4.8/5  (36)

(36)

Coble Company recently changed the selling price of one of its products.Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $15.70 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

The product's variable cost is $15.70 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

The management of Fanton Corporation is considering introducing a new product--a compact lawn blower.At a selling price of $38 per unit,management projects sales of 60,000 units.The lawn blower would require an investment of $500,000.The desired return on investment is 18%.

-The desired profit according to the target costing calculations is:

(Multiple Choice)

4.8/5  (39)

(39)

Gorsche Company's management has found that every 3% increase in the selling price of one of the company's products leads to a 8% decrease in the product's total unit sales.The product's absorption costing unit product cost is $11.50.The variable production cost of the product is $6.20 per unit and the variable selling and administrative cost is $1.00 per unit. According to the formula in the text,the product's profit-maximizing price is closest to:

(Multiple Choice)

4.7/5  (32)

(32)

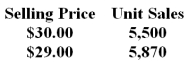

Harvey Company recently changed the selling price of one of its products.Data concerning sales for comparable periods before and after the price change are presented below.  The product's price elasticity of demand as defined in the text is closest to:

The product's price elasticity of demand as defined in the text is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

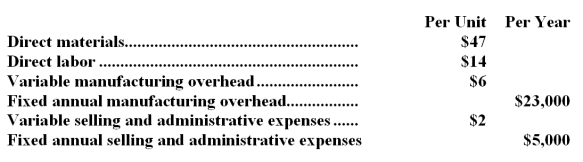

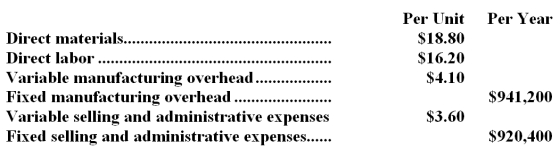

Roal Corporation manufactures a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 37,000 units per year.

The company has invested $220,000 in this product and expects a return on investment of 9%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 37,000 units per year.

The company has invested $220,000 in this product and expects a return on investment of 9%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

(Essay)

4.8/5  (33)

(33)

The management of Matsuura Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 1,000 units of the new product annually.The new product would require an investment of $254,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

Management plans to produce and sell 1,000 units of the new product annually.The new product would require an investment of $254,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

(Multiple Choice)

4.9/5  (46)

(46)

Kirby,Inc. ,manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 19,000 units per year. The company has invested $580,000 in this product and expects a return on investment of 14%.

The selling price based on the absorption costing approach would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 19,000 units per year. The company has invested $580,000 in this product and expects a return on investment of 14%.

The selling price based on the absorption costing approach would be closest to:

(Multiple Choice)

4.9/5  (34)

(34)

Okino Company's management believes that every 8% increase in the selling price of one of the company's products would lead to a 17% decrease in the product's total unit sales.The variable cost per unit of this product is $44.60.

Required:

a.Compute the product's price elasticity of demand as defined in the text.

b.Compute the product's profit-maximizing price according to the formula in the text.

(Essay)

4.9/5  (43)

(43)

Nichnols Corporation's marketing manager believes that every 6% decrease in the selling price of one of the company's products would lead to a 18% increase in the product's total unit sales.The product's absorption costing unit product cost is $10.10.The variable production cost is $1.70 per unit and the variable selling and administrative cost is $1.60.

Required:

a.Compute the product's price elasticity of demand as defined in the text.

b.Compute the product's profit-maximizing price according to the formula in the text.

(Essay)

4.8/5  (34)

(34)

Diehl Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-The selling price based on the absorption costing approach is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-The selling price based on the absorption costing approach is closest to:

(Multiple Choice)

4.7/5  (42)

(42)

Straus Company,a manufacturer of electronic products,wants to introduce a new calculator.To compete effectively,the calculator could not be priced at more than $40.The company requires a 20% rate of return on investment on all new products.In order to produce and sell 30,000 calculators each year,the company would have to make an investment of $850,000.The target cost per calculator would be:

(Multiple Choice)

4.8/5  (37)

(37)

Hauber Corporation would like to use target costing for a new product it is considering introducing.At a selling price of $26 per unit,management projects sales of 60,000 units.The new product would require an investment of $300,000.The desired return on investment is 20%.

-The desired profit according to the target costing calculations is:

(Multiple Choice)

4.9/5  (36)

(36)

Management of Delaune Corporation is considering a new product,an outdoor speaker that would have a selling price of $45 per unit and projected sales of 70,000 units.Launching the new product would require an investment of $200,000.The desired return on investment is 12%.

Required:

Determine the target cost per unit for the outdoor speaker.

(Essay)

4.9/5  (39)

(39)

Showing 1 - 20 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)