Exam 5: Modern Portfolio Concepts

Exam 1: The Investment Environment83 Questions

Exam 2: Securities Markets and Transactions114 Questions

Exam 3: Investment Information and Securities Transactions134 Questions

Exam 4: Return and Risk133 Questions

Exam 5: Modern Portfolio Concepts111 Questions

Exam 6: Common Stocks137 Questions

Exam 7: Analyzing Common Stocks131 Questions

Exam 8: Stock Valuation124 Questions

Exam 9: Market Efficiency and Behavioral Finance122 Questions

Exam 10: Fixed-Income Securities129 Questions

Exam 11: Bond Valuation125 Questions

Exam 12: Mutual Funds and Exchange-Traded Funds121 Questions

Exam 13: Managing Your Own Portfolio123 Questions

Exam 14: Options: Puts and Calls132 Questions

Exam 15: Futures Markets and Securities112 Questions

Select questions type

Small company stocks are yielding 10.7% while the U.S.Treasury bill has a 1.3% yield and a bank savings account is yielding 0.8%.What is the risk premium on small company stocks?

(Multiple Choice)

4.8/5  (38)

(38)

Portfolio betas will always be lower than the weighted average betas of the securities in the portfolio.

(True/False)

4.8/5  (32)

(32)

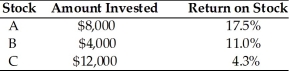

Melissa owns the following portfolio of stocks.What is the return on her portfolio?

(Multiple Choice)

4.9/5  (26)

(26)

Which of the following represent systematic risks?

I.the president of a company suddenly resigns

II.the economy goes into a recessionary period

III.a company's product is recalled for defects

IV.the Federal Reserve unexpectedly changes interest rates

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following will always lower a portfolio's beta?

I.Diversify among different types of securities and across industry and geographic lines.

II.Add investments with low betas to the portfolio.

III.Hold more cash or Treasury Bills in the portfolio.

IV.Reduce the percentage of the portfolio invested in high beta securities.

(Multiple Choice)

4.9/5  (33)

(33)

Which one of the following will provide the greatest international diversification?

(Multiple Choice)

4.9/5  (41)

(41)

The stock of a technology company has an expected return of 15% and a standard deviation of 20% The stock of a pharmaceutical company has an expected return of 13% and a standard deviation of 18%.A portfolio consisting of 50% invested in each stock will have an expected return of 14 % and a standard deviation

(Multiple Choice)

4.8/5  (44)

(44)

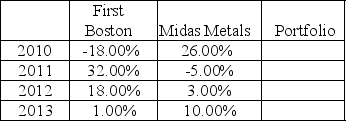

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a.Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b.Compute the standard deviation for each stock and the portfolio.

c.Are the stocks positively or negatively correlated and what is the effect on risk?

a.Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b.Compute the standard deviation for each stock and the portfolio.

c.Are the stocks positively or negatively correlated and what is the effect on risk?

(Essay)

4.7/5  (37)

(37)

Correlation is a measure of the relationship between two series of numbers.

(True/False)

4.9/5  (31)

(31)

The basic theory linking portfolio risk and return is the Capital Asset Pricing Model.

(True/False)

4.9/5  (45)

(45)

Which of the following statements about the Security Market Line are correct?

I.The intercept point is the risk-free rate of return.

II.The slope of the line is beta.

III.An investor should accept any return located above the SML line.

IV.A beta of 1.0 indicates the risk-free rate of return.

(Multiple Choice)

4.8/5  (31)

(31)

Betas for actively traded stocks.are readily available from online sources.

(True/False)

4.7/5  (48)

(48)

Market return is estimated from the average return on a large sample of stocks such as those in the Standard & Poor's 500 Stock Composite Index.

(True/False)

4.8/5  (40)

(40)

Explain the differences in how modern and traditional theories of portfolio management approach the issue of diversification.

(Essay)

4.9/5  (43)

(43)

In severe market downturns different asset classes become less correlated.

(True/False)

4.9/5  (48)

(48)

Explain the relationship between correlation, diversification, and risk reduction.

(Essay)

4.7/5  (42)

(42)

If there is no relationship between the rates of return of two assets over time, these assets are

(Multiple Choice)

4.9/5  (41)

(41)

Showing 21 - 40 of 111

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)