Exam 9: Forecasting Exchange Rates

Exam 1: Multinational Financial Management: an Overview79 Questions

Exam 2: International Flow of Funds75 Questions

Exam 3: International Financial Markets102 Questions

Exam 4: Exchange Rate Determination74 Questions

Exam 5: Currency Derivatives163 Questions

Exam 6: Government Influence on Exchange Rates117 Questions

Exam 7: International Arbitrage and Interest Rate Parity97 Questions

Exam 8: Relationships Among Inflation, Interest Rates, and Exchange Rates62 Questions

Exam 9: Forecasting Exchange Rates92 Questions

Exam 10: Measuring Exposure to Exchange Rate Fluctuations90 Questions

Exam 11: Managing Transaction Exposure92 Questions

Exam 12: Managing Economic Exposure and Translation Exposure63 Questions

Exam 13: Direct Foreign Investment62 Questions

Exam 14: Multinational Capital Budgeting63 Questions

Exam 15: International Corporate Governance and Control74 Questions

Exam 16: Country Risk Analysis57 Questions

Exam 17: Multinational Cost of Capital and Capital Structure71 Questions

Exam 18: Long-Term Debt Financing54 Questions

Exam 19: Financing International Trade73 Questions

Exam 20: Short-Term Financing55 Questions

Exam 21: International Cash Management49 Questions

Select questions type

If it was determined that the movement of exchange rates was not related to previous exchange rate values, this implies that a ____ is not valuable for speculating on expected exchange rate movements.

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

A

Using the inflation differential between two countries to forecast their exchange rates is not always accurate because of such factors as the uncertain timing of the impact of inflation and barriers to trade.

Free

(True/False)

4.8/5  (42)

(42)

Correct Answer:

True

Foreign exchange markets are generally found to be at least ____ efficient.

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

B

The absolute forecast error of a currency is ____, on average, in periods when the currency is more ____.

(Multiple Choice)

4.8/5  (40)

(40)

A fundamental forecast that uses multiple values of the influential factors is an example of:

(Multiple Choice)

4.8/5  (43)

(43)

Usually, fundamental forecasting is used for short-term forecasts, while technical forecasting is used for longer-term forecasts.

(True/False)

4.8/5  (39)

(39)

The one-year forward rate of the British pound is $1.55, while the current spot rate is $1.60. Based on the forward rate, what is the expected percentage change in the British pound over the next year?

(Multiple Choice)

4.7/5  (34)

(34)

If the forward rate was expected to be an unbiased estimate of the future spot rate, and interest rate parity holds, then:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is not one of the major reasons for MNCs to forecast exchange rates?

(Multiple Choice)

4.8/5  (40)

(40)

The following regression model was estimated to forecast the value of the Malaysian ringgit (MYR): MYRt = a0 + a1INCt - 1 + a2INFt - 1 + t,

Where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the previous quarterly percentage change in the income growth differential. Regression results indicate coefficients of a0 = .005; a1 = .4; and a2 = .7. The most recent quarterly percentage change in the inflation differential is -5%, while the most recent quarterly percentage change in the income differential is 3%. Using this information, the forecast for the percentage change in the ringgit is:

(Multiple Choice)

4.8/5  (40)

(40)

If speculators expect the spot rate of the yen in 60 days to be ____ than the 60-day forward rate on the yen, they will ____ the yen forward and put ____ pressure on the yen's forward rate.

(Multiple Choice)

4.8/5  (43)

(43)

MNCs can forecast exchange rate volatility to determine the potential range surrounding their exchange rate forecast.

(True/False)

4.7/5  (33)

(33)

In market-based forecasting, a forward rate quoted for a specific date in the future can be used as the forecasted spot rate on that future date.

(True/False)

4.9/5  (32)

(32)

The following is not a limitation of technical forecasting:

(Multiple Choice)

4.7/5  (32)

(32)

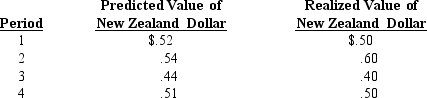

Assume the following information:  Given this information, the mean absolute forecast error as a percentage of the realized value is about:

Given this information, the mean absolute forecast error as a percentage of the realized value is about:

(Multiple Choice)

4.8/5  (37)

(37)

Silicon Co. has forecasted the Canadian dollar for the most recent period to be $0.73. The realized value of the Canadian dollar in the most recent period was $0.80. Thus, the absolute forecast error as a percentage of the realized value was ____%.

(Multiple Choice)

4.8/5  (42)

(42)

If the pattern of currency values over time appears random, then technical forecasting is appropriate.

(True/False)

4.8/5  (36)

(36)

Which of the following is not a limitation of fundamental forecasting?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 92

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)