Exam 7: Advanced Option Strategies

Exam 1: Introduction40 Questions

Exam 2: Structure of Options Markets63 Questions

Exam 3: Principles of Option Pricing56 Questions

Exam 4: Option Pricing Models: the Binomial Model60 Questions

Exam 5: Option Pricing Models: the Black-Scholes-Merton Model60 Questions

Exam 6: Basic Option Strategies60 Questions

Exam 7: Advanced Option Strategies60 Questions

Exam 8: Principles of Pricing Forwards,futures and Options on Futures59 Questions

Exam 9: Futures Arbitrage Strategies59 Questions

Exam 10: Forward and Futures Hedging,spread,and Target Strategies60 Questions

Exam 11: Swaps60 Questions

Exam 12: Interest Rate Forwards and Options60 Questions

Exam 13: Advanced Derivatives and Strategies60 Questions

Exam 14: Financial Risk Management Techniques and Appplications62 Questions

Exam 15: Managing Risk in an Organization58 Questions

Select questions type

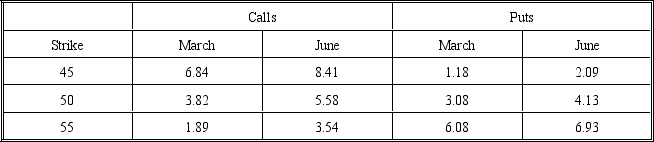

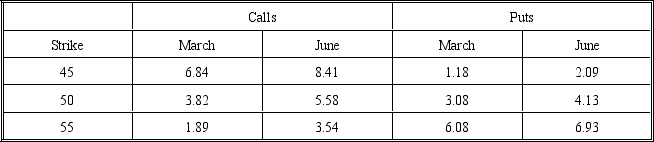

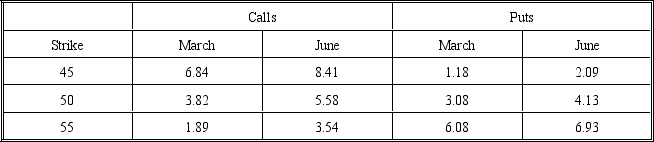

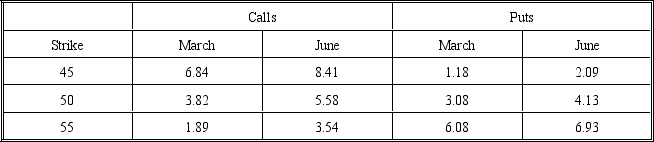

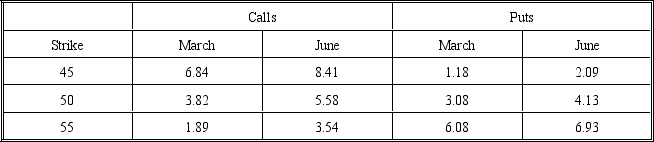

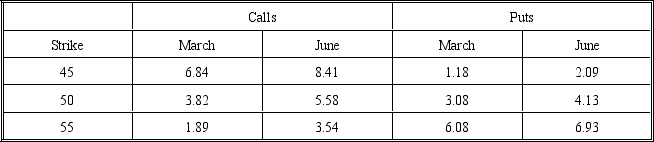

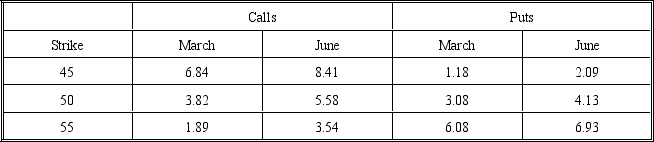

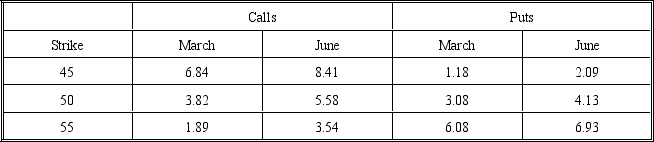

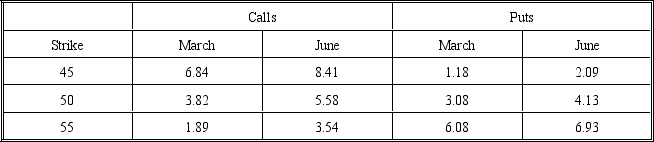

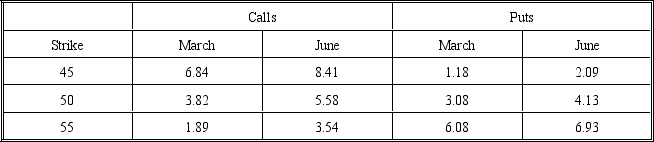

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-How much will the spread cost?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-How much will the spread cost?

(Multiple Choice)

4.7/5  (38)

(38)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the maximum profit on the spread?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the maximum profit on the spread?

(Multiple Choice)

4.9/5  (33)

(33)

A spread that is profitable if the options are in-the-money is called a money spread.

(True/False)

4.8/5  (36)

(36)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-Suppose a put is added to a straddle.This overall transaction is called a strip.Determine the profit at expiration on a strip if the stock price at expiration is $36.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-Suppose a put is added to a straddle.This overall transaction is called a strip.Determine the profit at expiration on a strip if the stock price at expiration is $36.

(Multiple Choice)

4.9/5  (30)

(30)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What will the straddle cost?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What will the straddle cost?

(Multiple Choice)

4.8/5  (30)

(30)

The profit from a collar option strategy when the terminal stock price ends up in between the two strike prices is ST - S0 - P1 + C2 where X2 > X1.

(True/False)

4.8/5  (35)

(35)

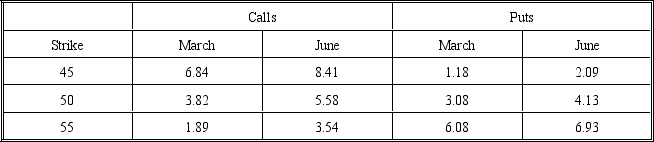

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-Suppose the investor adds a call to the long straddle,a transaction known as a strap.What will this do to the breakeven stock prices?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-Suppose the investor adds a call to the long straddle,a transaction known as a strap.What will this do to the breakeven stock prices?

(Multiple Choice)

4.8/5  (36)

(36)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

-Suppose you wish to construct a ratio spread using the March and June 50 calls.You want to buy 100 June 50 call contracts.How many March 50 calls would you sell?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

-Suppose you wish to construct a ratio spread using the March and June 50 calls.You want to buy 100 June 50 call contracts.How many March 50 calls would you sell?

(Multiple Choice)

4.8/5  (48)

(48)

At the expiration of a box spread,at most there will be only one option exercised.

(True/False)

4.8/5  (35)

(35)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

-What is the profit if the stock price at expiration is $52.50?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

-What is the profit if the stock price at expiration is $52.50?

(Multiple Choice)

4.9/5  (40)

(40)

The breakeven points for a long straddle strategy are equidistant from the current stock price regardless of the chosen strike price.

(True/False)

4.9/5  (35)

(35)

One of the risks of a calendar spread is that the intrinsic values may be different.

(True/False)

4.8/5  (38)

(38)

A ratio spread can be conducted with money spreads or time spreads.

(True/False)

4.8/5  (37)

(37)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

-What is the cost of the box spread?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

-What is the cost of the box spread?

(Multiple Choice)

4.9/5  (43)

(43)

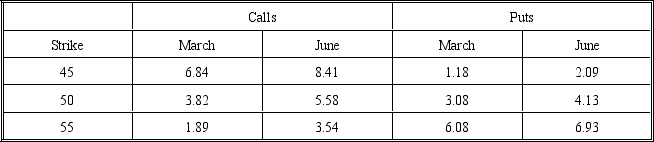

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the maximum loss on the spread?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the maximum loss on the spread?

(Multiple Choice)

4.9/5  (28)

(28)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the breakeven point?

A)$48.02

A)none of the above

B)$41.98

C)$55.66

D)$50.00

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the breakeven point?

A)$48.02

A)none of the above

B)$41.98

C)$55.66

D)$50.00

(Short Answer)

4.9/5  (36)

(36)

A spread option strategy is a transaction in one option and an opposite transaction in the underlying instrument.

(True/False)

4.8/5  (34)

(34)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What is the profit if the position is held for 90 days and the stock price is $55?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What is the profit if the position is held for 90 days and the stock price is $55?

(Multiple Choice)

4.8/5  (29)

(29)

The delta of a straddle would be the call delta plus the put delta.

(True/False)

4.9/5  (38)

(38)

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What is the profit if the stock price at expiration is at $64.75?

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares)unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What is the profit if the stock price at expiration is at $64.75?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 60

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)