Exam 5: Accounting for Inventories

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Accounting for Accruals and Deferrals151 Questions

Exam 3: The Double-Entry Accounting System156 Questions

Exam 4: Accounting for Merchandising Businesses157 Questions

Exam 5: Accounting for Inventories142 Questions

Exam 6: Internal Control and Accounting for Cash140 Questions

Exam 7: Accounting for Receivables145 Questions

Exam 8: Accounting for Long-Term Operational Assets159 Questions

Exam 9: Accounting for Current Liabilities and Payroll130 Questions

Exam 10: Accounting for Long-Term Debt158 Questions

Exam 11: Proprietorships, Partnerships, and Corporations153 Questions

Exam 12: Statement of Cash Flows134 Questions

Exam 13: Financial Statement Analysis Available Online in the Connect Library139 Questions

Select questions type

Cho Co. sells product

A. The beginning inventory for product A was 70 units @ $60 per unit. During the year, Cho purchased 110 units of product A at $54 per unit. The company sold 140 units of product A @ $100 per unit at the end of the year.Required:

Determine the amount of product cost that would be allocated to cost of goods sold and ending inventory using (1) FIFO, (2) LIFO, and (3) weighted average.

(Essay)

4.8/5  (39)

(39)

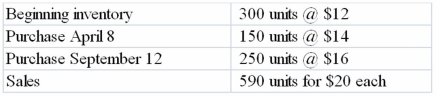

The following information is for Blakemore Company for 2013  Required:

Assuming that Blakemore uses the FIFO cost flow method,

a) How much product cost would be allocated to Cost of Goods Sold?

b) How much product cost would be allocated to Merchandise Inventory at the end of the year?

c) Calculate the average number of days to sell inventory for the year.

Required:

Assuming that Blakemore uses the FIFO cost flow method,

a) How much product cost would be allocated to Cost of Goods Sold?

b) How much product cost would be allocated to Merchandise Inventory at the end of the year?

c) Calculate the average number of days to sell inventory for the year.

(Essay)

4.9/5  (30)

(30)

Bowden Company paid cash to purchase two identical inventory items. The first purchase cost $16.00 cash and the second cost $18.00 cash. Bowden sold one inventory item for $28.00 cash. Based on this information alone, without considering the effect of income tax,:

(Multiple Choice)

4.9/5  (33)

(33)

Zeus Company understated its ending inventory. Which of the following answers correctly states the effect of the error in the present period?

(Multiple Choice)

4.8/5  (30)

(30)

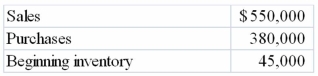

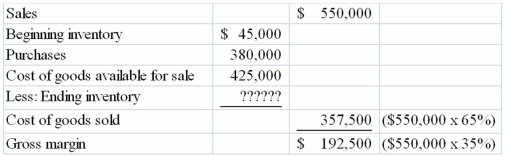

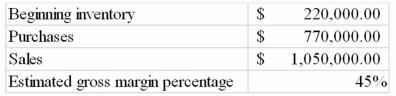

The Banks Company had its entire inventory destroyed when a fire swept through the company's warehouse on April 30, 2013. Fortunately, the accounting records were locked in a fireproof safe and were not damaged. The following information for the period up to the date of the fire was taken from the accounting records  Required:

Assuming that the gross margin has averaged 35 percent of selling price, what is the estimated value of the inventory destroyed in the fire? Show all calculations in good form.

Required:

Assuming that the gross margin has averaged 35 percent of selling price, what is the estimated value of the inventory destroyed in the fire? Show all calculations in good form.

(Essay)

4.8/5  (40)

(40)

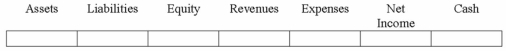

Sinclair, Inc. uses the perpetual inventory system. The company's management, under pressure to report favorable results to shareholders, counted $15,000 of inventory that had already been sold at year-end. Compared to an accurate inventory count, what is the effect of counting this inventory on the financial statements?

(Short Answer)

4.8/5  (37)

(37)

At a time of declining prices, which cost flow assumption will result in the highest ending inventory?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following businesses is most likely to use a specific identification cost flow method?

(Multiple Choice)

4.9/5  (38)

(38)

In a period of rising prices, use of the FIFO cost flow method would cause a company to pay more income taxes than would use of LIFO.

(True/False)

4.8/5  (34)

(34)

Determine the amount of cost of goods sold assuming the LIFO cost flow method.

(Multiple Choice)

4.8/5  (38)

(38)

A company uses a cost flow method (such as LIFO or FIFO) to allocate product costs between cost of goods sold and beginning inventory.

(True/False)

4.8/5  (41)

(41)

If a company uses the LIFO cost flow method, it is not required by generally accepted accounting principles to apply the lower-of-cost-or-market rule.

(True/False)

4.8/5  (33)

(33)

During a period of rising prices the FIFO cost flow method will result in higher total assets than LIFO.

(True/False)

4.8/5  (35)

(35)

Determine the amount of ending inventory assuming the FIFO cost flow method.

(Multiple Choice)

4.9/5  (37)

(37)

When preparing its quarterly financial statements, Patterson Co. uses the gross margin method to estimate ending inventory. The following information is available for the 1st quarter of 2013:  What was Patterson's estimated inventory on March 31, 2013?

What was Patterson's estimated inventory on March 31, 2013?

(Multiple Choice)

4.7/5  (34)

(34)

Trainer Co. had beginning inventory of $400 and ending inventory of $600. Trainer Co. had cost of goods sold amounting to $1,800. Based on this information, Trainer Co. must have purchased inventory amounting to:

(Multiple Choice)

4.8/5  (30)

(30)

Kurtz Company has provided the following figures as of December 31, 2013: Sales, $600,000; cost of goods sold, $320,000; net income, $120,000; inventory, $64,000. Indicate whether each of the above statements pertaining to the Kurtz Company is true or false.

_____ a) Kurtz's inventory turnover is 5.0.

_____ b) Kurtz's average number of days to sell inventory ratio is 39.5.

_____ c) Kurtz could increase its inventory turnover by increasing prices.

_____ d) Kurtz's gross margin as a percentage of sales was 46.7%.

_____ e) A local competitor in the same line of business has an inventory turnover of 6.5. Assuming each firm has approximately the same gross margin rate, Kurtz is likely to be more profitable than the competitor.

(Short Answer)

4.9/5  (33)

(33)

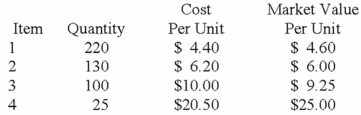

Reichart Company has four different categories of inventory. Quantity, cost, market value for each inventory category is shown below:  The company carries inventory at lower-of-cost-or-market applied to the inventory in aggregate. The implementation of the lower-of-cost-or-market rule would:

The company carries inventory at lower-of-cost-or-market applied to the inventory in aggregate. The implementation of the lower-of-cost-or-market rule would:

(Multiple Choice)

4.8/5  (39)

(39)

Assuming Chandler uses a FIFO cost flow method, the ending inventory on January 31 is:

(Multiple Choice)

4.8/5  (37)

(37)

If the replacement cost of inventory is greater than its historical cost, the increase in value does not affect the company's financial statements.

(True/False)

4.9/5  (44)

(44)

Showing 81 - 100 of 142

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)