Exam 15: Exchange Rates II: the Asset Approach in the Short Run

Exam 1: Trade in the Global Economy135 Questions

Exam 2: Trade and Technology: The Ricardian Model202 Questions

Exam 3: Gains and Losses From Trade in the Specific-Factors Model148 Questions

Exam 4: Trade and Resources: the Heckscher-Ohlin Model138 Questions

Exam 5: Movement of Labor and Capital Between Countries159 Questions

Exam 6: Increasing Returns to Scale and Monopolistic Competition149 Questions

Exam 7: Offshoring of Goods and Services128 Questions

Exam 8: Import Tariffs and Quotas Under Perfect Competition183 Questions

Exam 9: Import Tariffs and Quotas Under Imperfect Competition201 Questions

Exam 10: Export Subsidies in Agriculture and High-Technology Industries155 Questions

Exam 11: International Agreements: Trade, Labor, and the Environment173 Questions

Exam 12: The Global Macroeconomy100 Questions

Exam 13: Introduction to Exchange Rates and the Foreign Exchange Market160 Questions

Exam 14: Exchange Rates I: the Monetary Approach in the Long Run161 Questions

Exam 15: Exchange Rates II: the Asset Approach in the Short Run159 Questions

Exam 16: National and International Accounts: Income, Wealth, and the Balance of Payments156 Questions

Exam 17: Balance of Payments I: the Gains From Financial Globalization153 Questions

Exam 18: Balance of Payments II: Output, Exchange Rates, and Macroeconomic Policies in the Short Run153 Questions

Exam 19: Fixed Versus Floating: International Monetary Experience182 Questions

Exam 20: Exchange Rate Crises: How Pegs Work and How They Break148 Questions

Exam 21: The Euro148 Questions

Exam 22: Topics in International Macroeconomics148 Questions

Select questions type

Why would lowering its own interest rates affect a nation's exchange rate?

(Multiple Choice)

4.9/5  (43)

(43)

If the U.S. interest rate is 9% and the Eurozone interest rate is 5%, then in the short run we would expect:

(Multiple Choice)

4.9/5  (38)

(38)

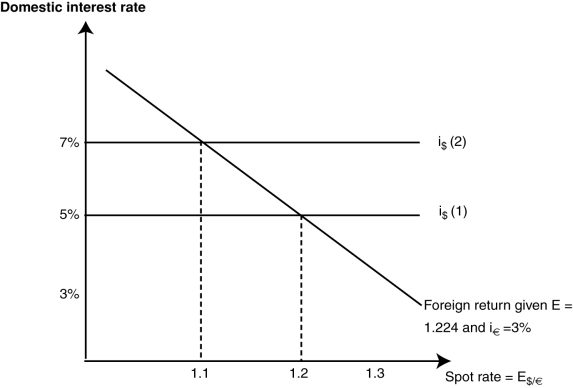

(Figure: The Domestic Interest Rate) Using the graph, if the dollar rate of interest increases from 5% to 7%, what result will occur in the short run?

(Multiple Choice)

4.8/5  (46)

(46)

In the short run, the chain of causality between monetary policy and the exchange rate under fixed rates differs from a floating rate. How?

(Multiple Choice)

4.9/5  (45)

(45)

What are the consequences for a nation that keeps its exchange rate fixed, holds its own domestic interest rates below market to encourage domestic spending, and allows free foreign investment?

(Multiple Choice)

4.8/5  (32)

(32)

The dependent variable (vertical axis) in standard graphical treatments of the money market is:

(Multiple Choice)

5.0/5  (32)

(32)

Suppose domestic interest rates are at 4.55%, while foreign returns are bringing 6.38%. According to the asset approach, if the expected future exchange rate is three dollars per unit of foreign currency, what can we say about the current spot rate if UIP holds?

(Short Answer)

5.0/5  (34)

(34)

Assuming sticky prices and given expectations of future exchange rates, what is the short-run effect on the exchange rate of the U.S. dollar (purchasing euros) and on domestic and foreign rates of return if there is a temporary increase in the quantity of U.S. dollars?

(Multiple Choice)

4.7/5  (39)

(39)

From full long-run equilibrium, expectations of future exchange rates can only change when there is a:

(Multiple Choice)

4.9/5  (39)

(39)

If UIP holds, the interest rate at home is 4%, and the exchange rate is expected to depreciate by 3%, then the foreign interest rate is:

(Multiple Choice)

4.9/5  (40)

(40)

Two currencies existed in Iraq before the U.S. invasion and subsequent conflict. What lessons are there for students of exchange rates?

(Multiple Choice)

4.8/5  (45)

(45)

The behavior of exchange rates during the period 1999-2004 ____ predictable based on the short run asset model if we assume that changes in the money supply were assumed to be _________.

(Multiple Choice)

4.9/5  (35)

(35)

A key assumption to ensure that domestic returns and foreign returns are in equilibrium is:

(Multiple Choice)

4.8/5  (36)

(36)

Explain why an increase in the European interest rate increases the dollar-euro exchange rate.

(Short Answer)

4.8/5  (38)

(38)

If Bulgaria, for instance, wished to keep its exchange rate with the dollar fixed, what monetary policy options are available to lower unemployment in the short run?

(Multiple Choice)

4.9/5  (34)

(34)

If the domestic dollar return (home nominal interest rate) is 5%, and the foreign nominal interest rate is 3%, and there is no expected change in future exchange rates, then as the spot exchange rate depreciates:

(Multiple Choice)

4.9/5  (37)

(37)

If UIP holds, the foreign interest rate is 10%, and the home currency is expected to depreciate by 4%, then the home interest rate is:

(Multiple Choice)

4.9/5  (39)

(39)

If UIP holds, the foreign interest rate is 6%, and the home currency is expected to appreciate by 2%, then the home interest rate is:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 101 - 120 of 159

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)