Exam 20: Exchange Rate Crises: How Pegs Work and How They Break

Exam 1: Trade in the Global Economy135 Questions

Exam 2: Trade and Technology: The Ricardian Model202 Questions

Exam 3: Gains and Losses From Trade in the Specific-Factors Model148 Questions

Exam 4: Trade and Resources: the Heckscher-Ohlin Model138 Questions

Exam 5: Movement of Labor and Capital Between Countries159 Questions

Exam 6: Increasing Returns to Scale and Monopolistic Competition149 Questions

Exam 7: Offshoring of Goods and Services128 Questions

Exam 8: Import Tariffs and Quotas Under Perfect Competition183 Questions

Exam 9: Import Tariffs and Quotas Under Imperfect Competition201 Questions

Exam 10: Export Subsidies in Agriculture and High-Technology Industries155 Questions

Exam 11: International Agreements: Trade, Labor, and the Environment173 Questions

Exam 12: The Global Macroeconomy100 Questions

Exam 13: Introduction to Exchange Rates and the Foreign Exchange Market160 Questions

Exam 14: Exchange Rates I: the Monetary Approach in the Long Run161 Questions

Exam 15: Exchange Rates II: the Asset Approach in the Short Run159 Questions

Exam 16: National and International Accounts: Income, Wealth, and the Balance of Payments156 Questions

Exam 17: Balance of Payments I: the Gains From Financial Globalization153 Questions

Exam 18: Balance of Payments II: Output, Exchange Rates, and Macroeconomic Policies in the Short Run153 Questions

Exam 19: Fixed Versus Floating: International Monetary Experience182 Questions

Exam 20: Exchange Rate Crises: How Pegs Work and How They Break148 Questions

Exam 21: The Euro148 Questions

Exam 22: Topics in International Macroeconomics148 Questions

Select questions type

In the event a nation adopts a currency board system to peg its exchange rate:

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

B

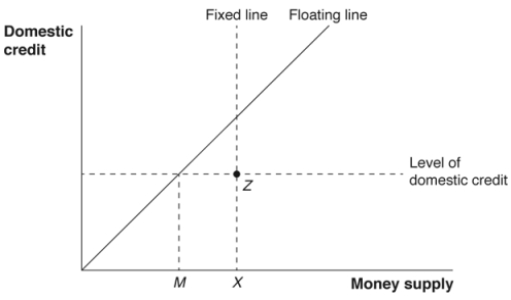

(Figure: Central Bank Balance Sheet) When an economy with a pegged exchange rate operates with the money supply backed 100% by reserves, it is at point __________ on the diagram, and the situation is known as __________.

Free

(Multiple Choice)

4.7/5  (32)

(32)

Correct Answer:

D

With a credible peg, whenever there is a rise in the foreign interest rate:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

An economy is better able to withstand a shock to the money demand if:

(Multiple Choice)

4.7/5  (35)

(35)

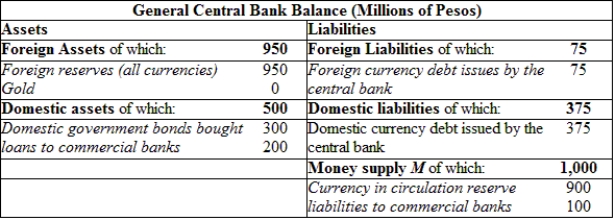

(Table: Central Bank Balance Sheet) In the balance sheet provided, if the central bank did not issue debt (domestic and foreign), then:

(Multiple Choice)

4.9/5  (38)

(38)

Part of the default risk in developing nations is investor fear of all of the following, EXCEPT:

(Multiple Choice)

4.9/5  (35)

(35)

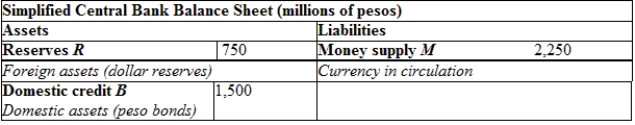

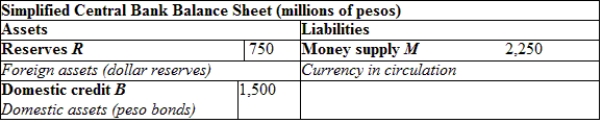

(Table: Mexico's Central Bank Balance Sheet) Suppose output in Mexico rises, causing money demand to change by 75 million pesos. What will happen to reserves, domestic credit, and the backing ratio? Explain how these changes take place.

(Not Answered)

This question doesn't have any answer yet

Investors in emerging markets often require ______ added to their return because they are concerned about defaults and exchange rate volatility.

(Multiple Choice)

4.8/5  (38)

(38)

Because of speculative attacks due to the belief a fixed rate will fail, pegged exchange rates:

(Multiple Choice)

4.7/5  (38)

(38)

Consider an economy with a fixed exchange rate and money supply equal to 2 billion pesos. The country has 1 billion in reserves and 1 billion in domestic credit. If the output in the country were to increase by 5%, then:

(Multiple Choice)

4.8/5  (36)

(36)

When other emerging market nations experience an exchange rate crisis, it affects healthy emerging market economies (raises risk premiums) because of investor worry. This phenomenon is known as:

(Multiple Choice)

4.8/5  (38)

(38)

An expansion of the domestic money supply can be offset by the sale of foreign reserves. This technique is called:

(Multiple Choice)

4.9/5  (47)

(47)

If domestic credit is constant, then any change in the demand for money will result in:

(Multiple Choice)

4.8/5  (45)

(45)

(Table: Mexico's Central Bank Balance Sheet) If the country sells 325 million pesos of foreign assets and reduces domestic credit by 425 million pesos, then:

(Multiple Choice)

4.8/5  (35)

(35)

In the home economy, when "money" is a liability of the government, the supply of money is equal to:

(Multiple Choice)

4.8/5  (32)

(32)

Paul Krugman has analyzed fixed currency pegs and the likely cause for them to break. His model is one in which the central bank is under political control, which results in:

(Multiple Choice)

4.9/5  (32)

(32)

A phenomenon that has perplexed many is that emerging market economies have sought to ____ their foreign currency reserves, thus _____ the backing ratio to _____.

(Multiple Choice)

4.7/5  (42)

(42)

What is the likely cause of an interest rate spread for similar assets denominated in the same currency?

(Multiple Choice)

4.8/5  (49)

(49)

To have adequate protection to cover a depreciation, the central bank must keep its foreign currency reserves at the level at which:

(Multiple Choice)

4.9/5  (36)

(36)

When the central bank engages in sterilization of reserves, it is:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)