Exam 13: The Open Economy Revisited: the Mundell-Fleming Model and the Exchange-Rate Regime

Exam 1: The Science of Macroeconomics66 Questions

Exam 2: The Data of Macroeconomics122 Questions

Exam 3: National Income: Where It Comes From and Where It Goes171 Questions

Exam 4: The Monetary System: What It Is and How It Works118 Questions

Exam 5: Inflation: Its Causes, Effects, and Social Costs118 Questions

Exam 6: The Open Economy139 Questions

Exam 7: Unemployment and the Labor Market118 Questions

Exam 8: Economic Growth I: Capital Accumulation and Population Growth121 Questions

Exam 9: Economic Growth II: Technology, Empirics, and Policy103 Questions

Exam 10: Introduction to Economic Fluctuations124 Questions

Exam 11: Aggregate Demand I: Building the Is-Lm Model126 Questions

Exam 12: Aggregate Demand Ii: Applying the Is-Lm Model145 Questions

Exam 13: The Open Economy Revisited: the Mundell-Fleming Model and the Exchange-Rate Regime135 Questions

Exam 14: Aggregate Supply and the Short-Run Tradeoff Between Inflation and Unemployment112 Questions

Exam 15: A Dynamic Model of Economic Fluctuations110 Questions

Exam 16: Understanding Consumer Behavior121 Questions

Exam 17: The Theory of Investment112 Questions

Exam 18: Alternative Perspectives on Stabilization Policy100 Questions

Exam 19: Government Debt and Budget Deficits100 Questions

Exam 20: The Financial System: Opportunities and Dangers120 Questions

Select questions type

When a country abandons its national currency and adopts the currency of the United States, this is known as:

(Multiple Choice)

4.8/5  (32)

(32)

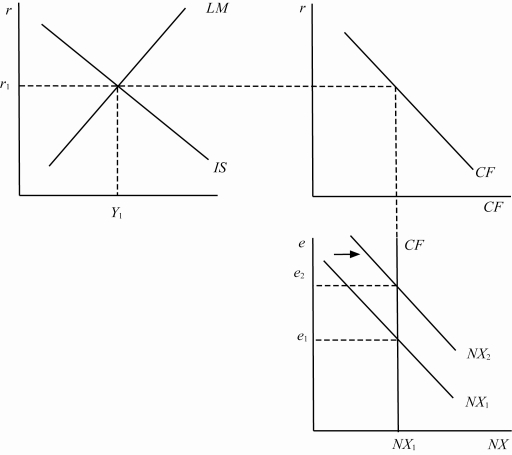

Suppose the government of a small open economy with a floating exchange rate imposes 50 percent tariffs on all imports. Use the Mundell-Fleming model to illustrate graphically the short-run impact of the tariffs of the exchange rate and output in the country. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium levels; iv. the direction the curves shift; and v. the new short-run equilibrium.

(Essay)

4.9/5  (41)

(41)

In a short-run model of a large open economy with a floating exchange rate, a monetary expansion causes a decrease in the interest rate and:

(Multiple Choice)

4.7/5  (35)

(35)

If short-run equilibrium in the Mundell-Fleming model is represented by a graph with Y along the horizontal axis and the exchange rate along the vertical axis, then the LM* curve:

(Multiple Choice)

4.9/5  (33)

(33)

In a small open economy with a floating exchange rate, if the government decreases the money supply, then in the new short-run equilibrium:

(Multiple Choice)

4.8/5  (37)

(37)

In a small open economy with a floating exchange rate, the exchange rate will appreciate if:

(Multiple Choice)

4.8/5  (43)

(43)

During periods of economic downturn, there is frequently pressure to protect domestic production from foreign competition in the belief that protectionist policies will save domestic jobs. Will protectionist policies increase or decrease domestic production in a large open economy with a floating exchange rate, holding all else constant? Illustrate your answer graphically and explain in words.

(Essay)

4.8/5  (33)

(33)

An arrangement by which a central bank holds enough foreign currency to back each unit of the domestic currency is called a:

(Multiple Choice)

4.8/5  (34)

(34)

Economic expansion throughout the rest of the world raises the world interest rate. Use the Mundell-Fleming model to illustrate graphically the impact of an increase in the world interest rate on the exchange rate and level of output in a small open economy with a floating-exchange-rate system. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium levels; iv. the direction the curves shift; and v. the new short-run equilibrium.

(Essay)

4.8/5  (34)

(34)

In a small open economy with a floating exchange rate, if the government imposes an import quota, then in the new short-run equilibrium the IS* curve shifts to the right, raising the exchange rate:

(Multiple Choice)

4.9/5  (37)

(37)

In a short-run model of a large open economy with a floating exchange rate, a fiscal expansion causes an increase in:

(Multiple Choice)

4.9/5  (32)

(32)

A monetary union with a common currency is an example of a:

(Multiple Choice)

4.9/5  (30)

(30)

In a small open economy with a floating exchange rate, an effective policy to increase equilibrium output is to:

(Multiple Choice)

4.8/5  (34)

(34)

If short-run equilibrium in the Mundell-Fleming model is represented by a graph with Y along the horizontal axis and the exchange rate along the vertical axis, then the IS* curve:

(Multiple Choice)

4.9/5  (43)

(43)

Showing 121 - 135 of 135

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)