Exam 24: The Us Taxation of Multinational Transactions

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance, the IRS, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery109 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation101 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations109 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

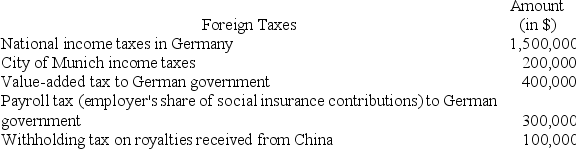

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacture quidgets to an unrelated company in China. During the current year, Rainier paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

(Essay)

4.7/5  (40)

(40)

Boomerang Corporation, a New Zealand corporation, is owned by the following unrelated persons: 40 percent by a U.S. corporation, 15 percent by a U.S. individual, and 45 percent by an Australian corporation. During the year, Boomerang earned $3,000,000 of subpart F income. Which of the following statements is true about the application of subpart F to the income earned by Boomerang?

(Multiple Choice)

4.8/5  (36)

(36)

A rectangle with an inverted triangle within it is a symbol used to represent what organizational form?

(Multiple Choice)

4.9/5  (41)

(41)

Under a U.S. treaty, what must a non-resident corporation create in the United States before it is subject to U.S. taxation on its business profits?

(Multiple Choice)

4.8/5  (41)

(41)

Janet Mothra, a U.S. citizen, is employed by Caterpillar Corporation, a U.S. corporation. In May 2018, Caterpillar relocated Janet to its operations in Spain for the remainder of 2018. Janet was paid a salary of $200,000. As part of her compensation package for moving to Spain, Janet received a housing allowance of $40,000. Janet's salary was earned ratably over the twelve-month period. During 2018 Janet worked 280 days, 168 of which were in Spain and 112 of which were in the United States. How much of Janet's total compensation is treated as foreign source income for 2018?

(Essay)

4.7/5  (36)

(36)

Which of the following transactions engaged in by a Swiss controlled foreign corporation creates foreign base company sales income?

(Multiple Choice)

4.8/5  (35)

(35)

The gross profit from a sale of inventory manufactured in the United States and sold by a U.S. retailer to a customer in Spain will always be treated as 100 percent U.S. source income.

(True/False)

4.9/5  (38)

(38)

Rafael is a citizen of Spain and a resident of the United States. During 2018, Rafael received the following income:

Compensation of $5 million from competing in tennis matches in the U.S.

Cash dividends of $10,000 from a Spanish corporation that earns 50 percent of its income from sales in the United States

Interest of $2,000 from a Spanish citizen who is a resident of the U.S.

Rent of $5,000 from U.S. residents who rented his villa in Italy

Gain of $10,000 on the sale of stock in a German corporation

Determine the source (U.S. or foreign) of each item of income Rafael received in 2017.

(Essay)

4.7/5  (40)

(40)

Nicole is a citizen and resident of Australia. She has a full-time job in Australia and has lived there with her family for the past 10 years. In 2016, Nicole came to the United States on business and stayed for 180 days. She came to the United States again on business in 2017 and stayed for 150 days. In 2018 she came back to the United States on business and stayed for 100 days. Does Nicole meet the U.S. statutory definition of a resident alien in 2018 under the substantial presence test?

(Essay)

4.8/5  (27)

(27)

What form is used by a U.S. corporation to "check-the-box" to elect the U.S. tax consequences of forming a hybrid entity outside the United States?

(Multiple Choice)

4.9/5  (34)

(34)

Under which of the following scenarios could Charles, a citizen of England, be eligible to claim the "closer connection" exception to the substantial presence test in 2018?

(Multiple Choice)

4.7/5  (43)

(43)

Under the book value method of allocating and apportioning interest expense for FTC purposes, assets are characterized as being either U.S. or non-U.S. based on their geographic location.

(True/False)

4.9/5  (42)

(42)

Alex, a U.S. citizen, became a resident of Belgium in 2018. Alex will no longer be subject to U.S. taxation on income he earns in Belgium if such income is exempted from tax under the U.S. - Belgium treaty.

(True/False)

4.9/5  (33)

(33)

A non-U.S. citizen with a green card will always be treated as a resident alien for U.S. tax purposes regardless of the number of days she spends in the United States during the current year.

(True/False)

4.8/5  (41)

(41)

Which of the following tax benefits does not arise when a U.S. corporation forms a corporation in Ireland through which to earn business profits in Ireland?

(Multiple Choice)

4.9/5  (36)

(36)

Amy is a U.S. citizen. During the year she earned income from an investment in a French company. Amy will be subject to U.S. taxation on her income under the principle of source-based taxation.

(True/False)

4.8/5  (42)

(42)

All passive income earned by a CFC will be treated as foreign personal holding company income under subpart F for U.S. tax purposes.

(True/False)

4.9/5  (38)

(38)

A U.S. corporation reports its foreign tax credit computation on which tax form?

(Multiple Choice)

4.9/5  (29)

(29)

Portsmouth Corporation, a British corporation, is a wholly owned subsidiary of Salem Corporation, a U.S. corporation. During the year, Portsmouth reported the following income:

$250,000 interest income received from a loan to an unrelated French corporation.

$100,000 dividend income received from a less than 1 percent owned unrelated Dutch corporation.

$150,000 rent income from an unrelated British corporation on property Portsmouth actively manages.

$500,000 gross profit from the sale of inventory manufactured by Portsmouth in Great Britain and sold to a 100 percent owned subsidiary in Germany.

What amount of subpart F income does Portsmouth recognize in the current year?

(Essay)

4.8/5  (36)

(36)

Holmdel, Inc., a U.S. corporation, received the following sources of income during 2018:

$10,000 interest income from a loan to its 100 percent owned Swiss subsidiary

$50,000 dividend income from its 5 percent owned French subsidiary

$100,000 royalty income from its Bermuda subsidiary for use of a trademark outside the United States

$25,000 rent income from its Canadian subsidiary for use of a warehouse located in New Jersey

$50,000 capital gain from sale of stock in its 40 percent owned Japanese joint venture. Title passed in Japan.

What amount of foreign source income does Holmdel have in 2018?

(Essay)

4.9/5  (31)

(31)

Showing 61 - 80 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)