Exam 20: Forming and Operating Partnerships

Under general circumstances, debt is allocated from the partnership to each partner in the following manner:

C

A partnership may use the cash method despite having a corporate partner when the partnership's average gross receipts for the prior three taxable years don't exceed ________.

C

Why are guaranteed payments deducted in calculating the ordinary business income (loss) of partnerships and treated as a separately-stated item for the partners that receive the payment?

Guaranteed payments are conceptually similar to salary payments made to specific partners for services provided to partnerships. For this reason, partnerships treat guaranteed payments similar to salary or wage payments made to unrelated parties-they are typically deducted in calculating the ordinary business income (loss) of partnerships. Including guaranteed payments as separately-stated items on the Schedule K-1s of partners receiving guaranteed payments serves the same function as providing W-2 forms to employees. It puts these partners on notice that they must report ordinary income related to the guaranteed payments they have received. However, unlike an employee's W-2 form, the Schedule K-1 also reports partners' guaranteed payments as separately-stated self-employment income from the partnership.

In X1, Adam and Jason formed ABC, LLC, a car dealership in Kansas City. In X2, Adam and Jason realized they needed an advertising expert to assist in their business. Thus, the two members offered Cory, a marketing expert, a 1/3 capital interest in their partnership for contributing his expert services. Cory agreed to this arrangement and received his capital interest in X2. If the value of the LLC's capital equals $180,000 when Cory receives his 1/3 capital interest, which of the following tax consequences does not occur in X2?

Partnerships tax rules incorporate both the entity and aggregate approaches.

TQK, LLC provides consulting services and was formed on 1/31/X5. Aaron and ABC, Inc. each hold a 50% capital and profits interest in TQK. If TQK averaged $27,000,000 in annual gross receipts over the last three years, what accounting method can TQK use for X9?

A partner can generally apply passive activity losses against passive activity income for the year.

A partner's outside basis must first be decreased by any negative basis adjustments and then increased by any positive basis adjustments.

On March 15, 20X9, Troy, Peter, and Sarah formed Picture Perfect general partnership. This partnership was created to sell a variety of cameras, picture frames, and other photography accessories. When it was formed, the partners received equal profits and capital interests and the following items were contributed by each partner:

-Troy - cash of $3,000, inventory with a FMV and tax basis of $5,000, and a building with a FMV of $22,000 and adjusted basis of $10,000. Additionally, the building was secured by a $10,000 nonrecourse mortgage.

-Peter - cash of $5,000, accounts payable of $12,000 (recourse debt for which each partner becomes equally responsible), and land with a FMV of $27,000 and tax basis of $20,000.

-Sarah - cash of $2,000, accounts receivable with a FMV and tax basis of $1,000, and equipment with a FMV of $40,000 and adjusted basis of $3,500. Sarah also contributed a $23,000 nonrecourse note payable secured by the equipment.

What is each partner's outside basis and how much gain (loss) must the partners recognize in 20X9 when Picture Perfect was formed?

Fred has a 45% profits interest and 30% capital interest in the SAP Partnership and his tax basis before considering his share of SAP's current year loss is $11,000. Included in his tax basis is a $2,600 share of recourse debt and $5,300 share of nonrecourse debt. Fred is a limited partner in SAP. He is not involved in any other activities. If SAP has a $15,000 ordinary loss for the year, how much of the loss can be deducted currently, and how much of the loss is suspended because of the tax basis, the at-risk, and the passive activity loss limitations?

What is the difference between a partner's tax basis and at-risk amount?

In what order are the loss limitations for partnerships applied?

Styling Shoes, LLC filed its 20X8 Form 1065 on March 15, 20X9. Styling had three members with the following ownership interests and tax basis at the beginning of the 20X8: (1) Jane, a member with a 25% profits and capital interest and a $5,000 outside basis, (2) Joe, a member with a 45% profits and capital interest and a $10,000 outside basis, and (3) Jack, a member with a 30% profits and capital interest and a $2,000 outside basis. The following items were reported on Styling's Schedule K for the year: ordinary income of $100,000, Section 1231 gain of $15,000, charitable contributions of $25,000, and tax-exempt income of $3,000. In addition, Styling received an additional bank loan of $12,000 during 20X8. What is Jane's tax basis after adjustment for her share of these items?

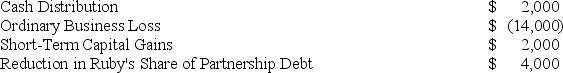

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Jay has a tax basis of $14,000 in his partnership interest at the beginning of the partnership tax year. The following amounts of partnership debt were allocated to Jay and are included in his beginning of the year tax basis: (1) recourse debt - $3,000, (2) qualified nonrecourse debt - $1,000, and (3) nonrecourse debt - $500. There were no changes to the debt allocated to Jay during the tax year. If Jay is allocated a $15,000 loss for the current year, how much of the loss will be suspended under the tax basis and at-risk limitations?

This year, HPLC, LLC was formed by H Inc., P Inc., L Inc., and C Inc. Each member had an equal share in the LLC's capital. H Inc., P Inc., and L Inc. each had a 30% profits interest in the LLC with C Inc. having a 10% profits interest. The members had the following tax year-ends: H Inc. [1/31], P Inc. [5/31], L Inc. [7/31], and C Inc. [10/31]. What tax year-end must the LLC use?

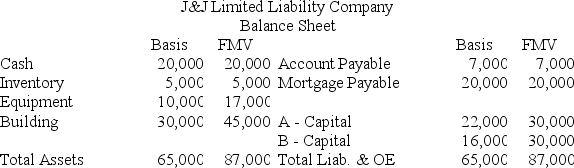

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Jerry, a partner with 30% capital and profit interest, received his Schedule K-1 from Plush Pillows, LP. At the beginning of the year, Jerry's tax basis in his partnership interest was $50,000. His current year Schedule K-1 reported an ordinary loss of $15,000, long-term capital gain of $3,000, qualified dividends of $2,000, $500 of non-deductible expenses, a $10,000 cash contribution, and a reduction of $4,000 in his share of partnership debt. What is Jerry's adjusted basis in his partnership interest at the end of the year?

Partners must generally treat the value of profits interests they receive in exchange for services as ordinary income.

Peter, Matt, Priscilla, and Mary began the year in the PMPM General Partnership sharing profits, losses, and capital equally. They each had a tax basis at the beginning of the year of $3,000, $10,000, $8,000, and $11,000 respectively. Early in the year, Mary provided general consulting services to the partnership and received an additional 15 percent profits, losses, and capital interest in the partnership. The liquidation value of her additional interest was $45,000. Later the same year, the partnership received cash contributions of $25,000 from Peter and Matt that it used to repay the partnership's $35,000 recourse debt. According to state law, the partners shared responsibility for this debt in accordance with their loss sharing ratios. What is each partner's tax basis after adjustment for these transactions?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)