Essay

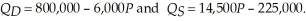

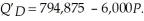

The local community is considering two options to raise money to finance a new civic center. The first option is to institute a per unit tax on restaurant meals of $2.46. The market demand and supply functions for restaurant meals are:  Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:

Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:  Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?

Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?

Correct Answer:

Verified

First we must determine the market equil...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Use the following statements to answer this

Q111: The market demand curve for a popular

Q112: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.2 -Refer

Q113: For national security reasons a government decides

Q114: The market demand and supply functions for

Q116: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.4.1 -Refer

Q117: Deadweight loss refers to:<br>A) losses in consumer

Q118: The market demand and supply functions for

Q119: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.2 -Refer

Q120: Consider a good whose own price elasticity