Multiple Choice

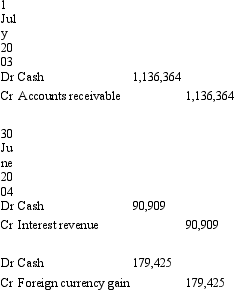

On 1 July 2003 Kanga Consultants Ltd completes a contract to provide advice on the installation of a networked computer system to a company in the US. The client pays the fee of US$500,000 into Kanga Consultants' US bank account on that date. The bank pays interest of 8 per cent annually on 30 June. The exchange rate information is:

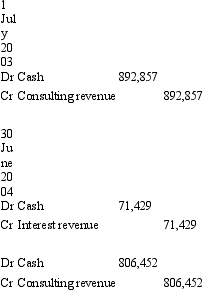

What journal entries are required in Kanga Consultants Ltd's books for 1 July 2003 and 30 June 2004 in accordance with AASB 1012 (rounded to the nearest whole $A) ?

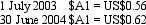

A)

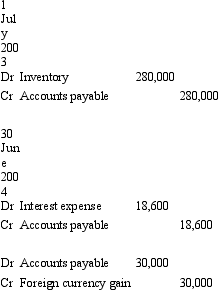

B)

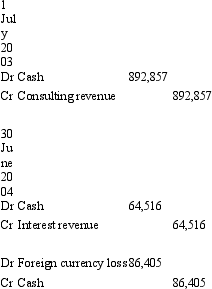

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: An entity's may change its functional currency

Q35: Sure Ltd purchased goods for £210,000 from

Q37: AASB 121 requires that foreign currency monetary

Q37: On 1 July 2004 Waugh Ltd enters

Q38: Exchange differences recognised as borrowing costs and

Q46: The exchange rate for a currency depends

Q49: The functional currency of an entity:<br>A) never

Q52: Which of the following is not a

Q56: The hedge effectiveness criteria prescribed in AASB

Q57: Common examples of qualifying assets are assets