Multiple Choice

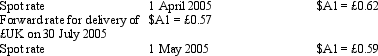

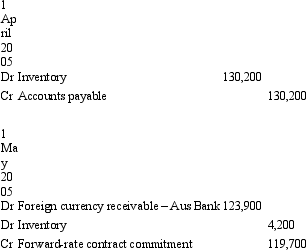

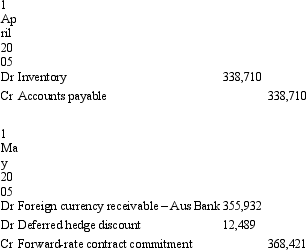

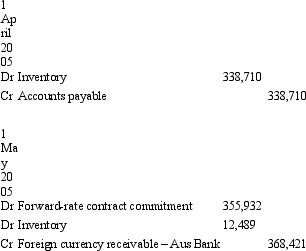

Sure Ltd purchased goods for £210,000 from a British supplier on 1 April 2005. The amount owing on the purchase is payable on 30 July 2005. On 1 May 2005 a forward-exchange contract for the delivery of £210,000 on 30 July 2005 is taken out with Aus Bank. Exchange rates are as follows:

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Exchange gains or losses on a qualifying

Q33: On 1 July 2003 Kanga Consultants Ltd

Q37: AASB 121 requires that foreign currency monetary

Q37: On 1 July 2004 Waugh Ltd enters

Q38: Exchange differences recognised as borrowing costs and

Q49: The functional currency of an entity:<br>A) never

Q52: Which of the following is not a

Q56: The hedge effectiveness criteria prescribed in AASB

Q57: Common examples of qualifying assets are assets

Q58: An exception to the requirement that foreign