Multiple Choice

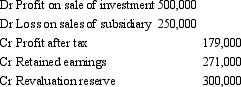

The following consolidation adjusting journal entries appeared at the end of a period in which the parent sold all of its shareholding in a subsidiary. It received $1,200,000 for the shares.

The amount of the share of post-acquisition profits and movements in equity balances, contributed to the group by the subsidiary, and attributable to the parent, is:

A) ($250,000) .

B) $350,000.

C) $750,000.

D) $1,200,000.

E) Cannot be determined from the information given.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following is not a

Q9: AASB 127 "Consolidated and Separate Financial Statements"

Q9: The profit or loss on the sale

Q18: Under the step-by-step method,the need to revalue

Q19: On 1 July 2004, Horse Ltd acquired

Q20: In calculating the profit or loss on

Q22: Dolly Ltd acquired a 60 per cent

Q22: Under the step-by-step method,the aggregate costs of

Q25: Spock Ltd acquired a 10 per cent

Q34: When a parent sells its interest in