Multiple Choice

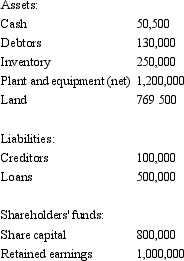

On 1 July 2004, Horse Ltd acquired 80 per cent of the issued capital of Wagon Ltd for $785,000 when the fair value of the net assets of Wagon Ltd was $950,000 (share capital $800,000 and retained earnings $150,000) . On 30 June 2007 Horse Ltd purchased the final 20 per cent of Wagon's issued capital for $380,000. The net assets of Wagon Ltd were not stated at fair value in the accounts, which are summarised as follows:

The fair value of the plant and equipment is $1,250,000 and the land was valued at $970,000 at year end. Impairment of goodwill was assessed at $7,500, the impairment having been incurred evenly across the last three years. There were no intragroup transactions during the period.

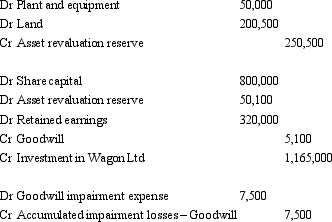

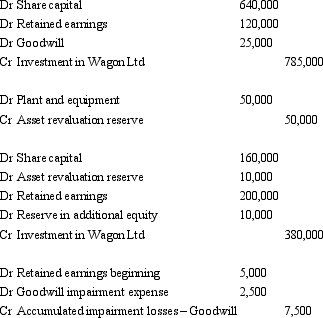

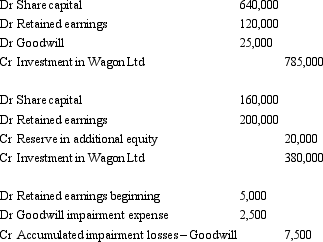

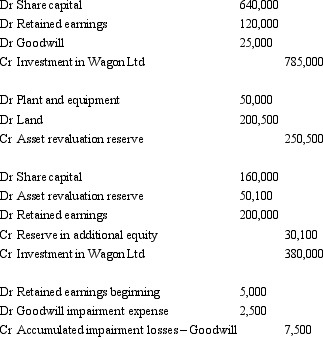

What are the consolidation journal entries required for the period ended 30 June 2007? (Ignore the tax effect of the revaluation)

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: AASB 127 "Consolidated and Separate Financial Statements"

Q15: The following consolidation adjusting journal entries appeared

Q16: Fan Ltd acquired a 60 per cent

Q17: The following consolidation adjusting journal entries appeared

Q20: In calculating the profit or loss on

Q22: Under the step-by-step method,the aggregate costs of

Q22: Dolly Ltd acquired a 60 per cent

Q23: The following consolidation adjusting journal entries appeared

Q33: When shares in a subsidiary are sold

Q34: When a parent sells its interest in