Multiple Choice

Stormy Ltd has purchased all the issued capital of Cloud Ltd at the beginning of the current period. At the end of the period Cloud Ltd declares a dividend of $50,000 that is identified as being paid out of pre-acquisition profits. What entries would Stormy Ltd and Cloud Ltd make in their own books? (Assume Stormy Ltd accrues the dividends of subsidiaries when they are declared.)

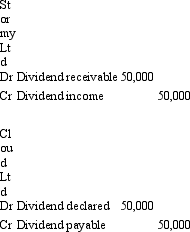

A)

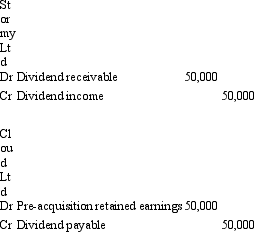

B)

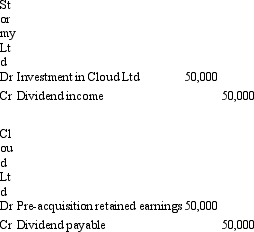

C)

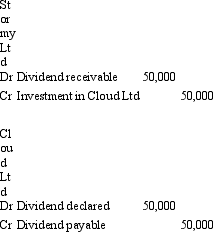

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q13: The treatment of dividends,paid by a subsidiary,that

Q14: Companies in an economic entity may increase

Q17: French Ltd purchased 100 per cent of

Q20: Radio Ltd acquired all the issued capital

Q21: What is the amount of unrealised profit

Q21: Belgium Ltd owns all the issued capital

Q25: AASB 127 "Consolidated and Separate Financial Statements"

Q30: AASB 127 "Consolidated and Separate Financial Statements"

Q32: Companies A,B and C are all part