Multiple Choice

Radio Ltd acquired all the issued capital of Wave Ltd on 1 July 2004 for cash consideration of $2 million. The fair value of the net assets of Wave Ltd at that date was $1.8 million as follows:

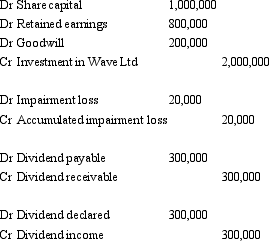

During the period ending 30 June 2005 Wave Ltd declare a dividend of $300,000 that is identified as being paid out of pre-acquisition profits. Goodwill had been determined to have impaired by $20,000 during the period. What consolidation journal entries would be required to prepare group accounts for the period ended 30 June 2005?

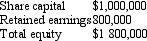

A)

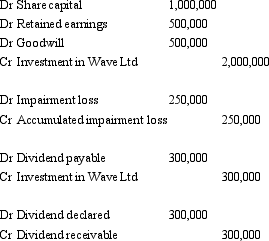

B)

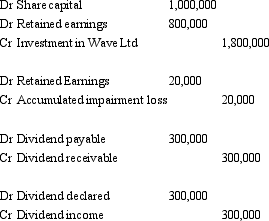

C)

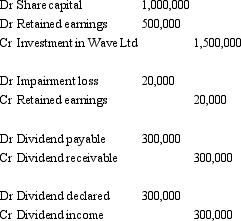

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q13: The treatment of dividends,paid by a subsidiary,that

Q14: Companies in an economic entity may increase

Q17: French Ltd purchased 100 per cent of

Q19: Stormy Ltd has purchased all the issued

Q21: What is the amount of unrealised profit

Q21: Belgium Ltd owns all the issued capital

Q30: AASB 127 "Consolidated and Separate Financial Statements"

Q32: Companies A,B and C are all part

Q43: Aladdin Ltd sold inventory items (with a