Multiple Choice

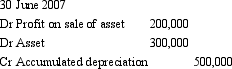

A non-current asset was sold by Subsidiary Limited to Parent Limited during the 2006-07 financial year. The carrying amount of the asset at the time of the sale was $700,000. As part of the consolidation process, the following journal entry was passed.

What (a) amount did Parent Limited pay Subsidiary Limited for the asset; (b) was the cost of the asset as shown in the books of Subsidiary Limited?

A) (a) $900,000; (b) $1,400,000

B) (a) $900,000; (b) $1,200,000.

C) (a) $700,000; (b) $1,200,000

D) (a) $900,000; (b) $800,000

E) Cannot determine from the information provided.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q7: Intragroup transactions that are to be eliminated

Q9: A non-current asset was sold by Subsidiary

Q17: Question 1: Transactions between entities that form

Q17: French Ltd purchased 100 per cent of

Q21: What is the amount of unrealised profit

Q23: The fact that consolidation worksheets start "afresh"

Q25: AASB 127 "Consolidated and Separate Financial Statements"

Q37: Alice Ltd sold inventory items to its

Q42: Aladdin Ltd sells inventory for a profit