Multiple Choice

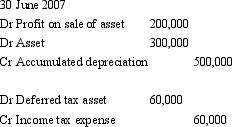

A non-current asset was sold by Subsidiary Limited to Parent Limited on 30 June 2007. The carrying amount of the asset at the time of the sale was $700,000. As part of the consolidation process, the following journal entry was passed.

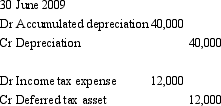

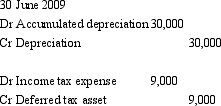

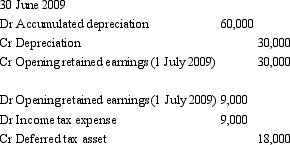

Assuming there is another ten years of useful life remaining for the asset, what are the journal entries at 30 June 2009 to adjust for depreciation?

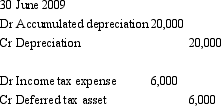

A)

B)

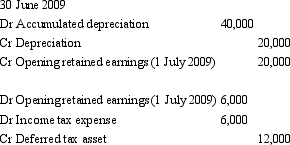

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Intragroup transactions that are to be eliminated

Q12: A non-current asset was sold by Subsidiary

Q17: Question 1: Transactions between entities that form

Q23: The fact that consolidation worksheets start "afresh"

Q25: AASB 127 "Consolidated and Separate Financial Statements"

Q37: Alice Ltd sold inventory items to its

Q38: Parent Ltd sells inventories to Child Ltd

Q42: Aladdin Ltd sells inventory for a profit

Q47: In the absence of an election to

Q58: Intragroup sales of non-current assets results in