Multiple Choice

In a previous period Banshee Ltd wrote-off its 'dynamic mover' equipment, but new information has shown that it is probable that the future economic benefits exceed its cost of $40 000. What is the appropriate accounting entry?

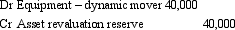

A)

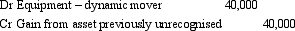

B)

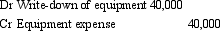

C)

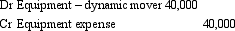

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If it is not probable that expenditure

Q15: According to the AASB Framework an asset

Q21: The cost of an asset will typically

Q32: According to AASB 136 a non-current asset

Q38: The decision to expense or capitalise an

Q39: An asset is classified as current when:<br>A)

Q45: An accountant is not sure on how

Q50: The treatment of repairs and additions to

Q52: The preserved body of famous Australian racehorse

Q56: AASB 101's definition of current assets and