Multiple Choice

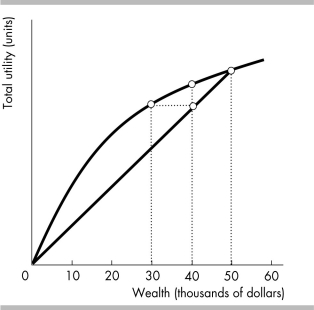

-The above figure shows the utility of wealth curve for a homeowner whose only possession is a $50,000 house. If there is a 20 percent chance that the home could be entirely destroyed, would this person buy a $20,000 insurance policy to replace the house if destroyed?

A) No, it is too expensive.

B) No, he is not risk averse.

C) Yes, the homeowner would pay even more.

D) Yes, this is the most the homeowner would pay.

Correct Answer:

Verified

Correct Answer:

Verified

Q223: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -In the figure

Q224: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Ashton has the

Q225: A major function of incentive payments, guarantees,

Q226: If you have private information that you

Q227: Moral hazard occurs because people act<br>A) in

Q228: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Ashton has the

Q230: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -The above figure

Q231: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Lucy works as

Q232: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Gunnar can work

Q233: If an individual has a 0.3 probability