Multiple Choice

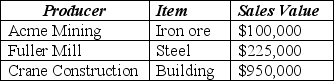

Table 6-6 shows the different stages in the production of an office building. A mining firm extracts iron from the earth. A steel mill converts the iron to steel beams for use in construction. A construction company uses the steel beams to make a building. Assume that the total product of these firms represents the only components of the building and that they will have no other uses.

Table 6-6

-Refer to Table 6-6. Suppose the value added tax is 10%. What is the amount paid by Fuller Mill to Acme Mining?

A) $100,000

B) $110,000

C) $215,000

D) $225,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Disposable personal income is calculated as personal

Q32: Double counting occurs when both intermediate and

Q33: The largest expenditure category in U.S. GDP

Q75: A measure of the degree to which

Q85: If a farmer grows crops and keeps

Q87: The purchases of U.S. products by the

Q100: The smallest component of income generated in

Q129: Which of the following items would NOT

Q159: Table 6.2 shows data on the components

Q160: Table 6-3 shows data relating to the