Essay

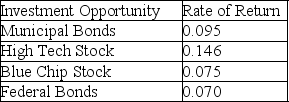

First Securities, Inc., an investment firm, has $380,000 on account.The chief investment officer would like to reinvest the $380,000 in a portfolio that would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds.The following table shows the investment opportunities and rates of return.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock.Formulate this portfolio selection problem using linear programming.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock.Formulate this portfolio selection problem using linear programming.

Correct Answer:

Verified

Let X1 = $ invested in Municipal Bonds

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: In the linear programming transportation model, the

Q72: The linear programming truck loading model always

Q73: Table 8-2<br>Diamond Jewelers is trying to determine

Q74: The following problem type is such a

Q75: In the optimal solution to this scenario,

Q77: The linear programming model of the production

Q78: The linear programming transportation model allows us

Q79: The linear programming model of the production

Q80: Since the production mix linear program applications

Q81: The following table provides shipping costs from