Essay

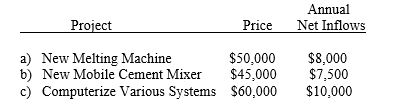

Highways, Inc. is trying to decide whether to purchase a new pavement melting machine, purchase a new mobile cement mixer or to computerize its entire estimating, ordering and inventory system. All of the alternatives are viewed as having the same ten year project life and none are expected to have any salvage value. However, different project prices are applicable to each and each has a different expected stream of annual net cash inflows. The firm's managers believe that a discount rate of 9 percent is appropriate for evaluating the alternatives. Data are as follows:

After examining the project prices, management finds it has sufficient capital budget to complete two of them. Assuming that the cash inflows from the project are independent of one another, which two projects should be undertaken?

Correct Answer:

Verified

Present value of new melting machine:

Th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: The internal rate of return IRR) for

Q63: The net present value NPV) of an

Q64: A project has an anticipated stream of

Q65: A project has an anticipated stream of

Q66: Compounding is the process of computing the

Q68: A project has an anticipated stream of

Q69: The marginal cost of capital MCC) is

Q70: The analysis of alternative investment opportunities by

Q71: The discount rate is the rate of

Q72: A project has an anticipated stream of