Essay

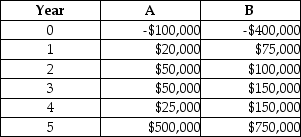

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative.Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%.Compute the payback in years and the net present value for both projects and offer advice as to the best course of action.

Correct Answer:

Verified

The NPV for project A is $264,252 and t...

The NPV for project A is $264,252 and t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Rank the problems in implementing portfolio management

Q41: A company facing an interest rate of

Q53: A project manager is using the internal

Q59: Your university is considering two projects to

Q60: The simple scoring model has this advantage

Q61: Choose any example from recent news media

Q95: The length of time it takes to

Q96: Inatech is contemplating two different projects and

Q97: _ is the systematic process of selecting,supporting,and

Q105: A project screening criterion that allows the