Multiple Choice

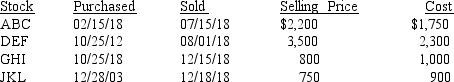

In 2018, Isabella sold several shares of different stocks held for investment. The following is a summary of her capital transactions for the year:  What is the amount of Isabella's net capital gains or losses for 2018?

What is the amount of Isabella's net capital gains or losses for 2018?

A) $1,300 long-term capital gain

B) $850 long-term capital gain and $450 short-term capital gain

C) $1,050 long-term capital loss and $250 short-term capital loss

D) $1,050 long-term capital gain and $250 short-term capital gain

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Lopez Corporation sold equipment that it had

Q15: Cliff owned investment stock purchased three years

Q20: Angel sells the following depreciable assets from

Q42: A personal residence owned by an individual

Q54: Vero Corporation owns $200,000 of equipment used

Q70: Ginger sold stock that she had purchased

Q86: Identify the type(s) of gain or loss

Q87: What are three types of dispositions other

Q90: In what order are capital gains subject

Q93: Identify the type(s) of gain or loss