Essay

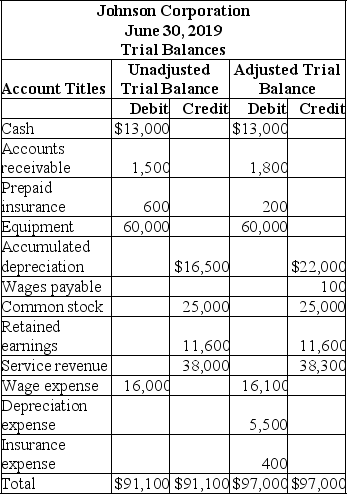

Johnson Corporation is completing the accounting information processing cycle at the end of the fiscal year,June 30,2019.Johnson has provided the following trial balances as of June 30,2019:

A.Reconstruct the adjusting entries and prepare a brief explanation of each.

A.Reconstruct the adjusting entries and prepare a brief explanation of each.

B.What is the amount of net income?

C.Calculate earnings per share (EPS)assuming 1,000 shares of common stock are outstanding.

Correct Answer:

Verified

A.

B.Net income = ...

B.Net income = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: On September 1,2019,Fast Track,Inc.was started with $30,000

Q86: Which of the following accounts would not

Q87: An accrued expense is incurred and paid

Q88: On September 1,2019,Fast Track,Inc.was started with $30,000

Q89: Depreciation expense is an estimated allocation of

Q91: Accounts that start a new accounting period

Q92: What is the effect on the financial

Q93: Which of the following journal entries is

Q94: Which of the following transactions does not

Q95: What does the total asset turnover ratio